All publications by tag «EIA»

2017, December, 15, 13:10:00

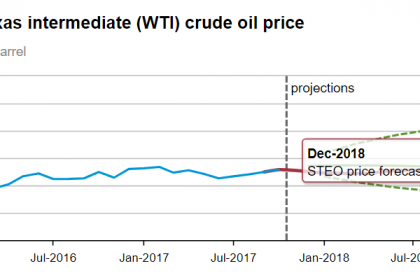

UNCERTAIN OIL PRICES

EIA - The forecast for oil prices remains highly uncertain. WTI futures contracts for March 2018 delivery, traded during the five-day period ending December 7, 2017, averaged $57/b.

2017, November, 9, 13:55:00

EIA: OIL PRICE $53 - $56

North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

2017, November, 9, 13:50:00

EIA: NUCLEAR ENERGY WILL UP

EIA projects that global nuclear capacity will grow at an average annual rate of 1.6% from 2016 through 2040, led predominantly by countries outside of the Organization for Economic Cooperation and Development (OECD). EIA expects China to continue leading world nuclear growth, followed by India. This growth is expected to offset declines in nuclear capacity in the United States, Japan, and countries in Europe.

2017, July, 14, 09:45:00

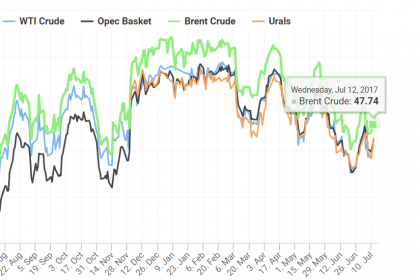

EIA OIL PRICES FORECASTS: $51 - $52

EIA now forecasts Brent crude oil spot prices to average $51 per barrel (b) in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are expected to be $2/b lower than Brent prices in 2017 and 2018.

2017, May, 22, 16:35:00

OPEC: THE LOWEST REVENUES

Members of the Organization of the Petroleum Exporting Countries (OPEC) earned about $433 billion in net oil export revenues in 2016, the lowest since 2004. In real dollar terms, the 2016 revenue represents a 15% decline from the $509 billion earned in 2015, mainly because of the fall in average annual crude oil prices and, to a lesser extent, because of decreases in OPEC net oil exports.

2017, February, 8, 19:05:00

OIL PRICES: $55 - $57

EIA forecasts Brent crude oil prices to average $55/b in 2017 and $57/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average about $1/b less than Brent prices in 2017. The NYMEX contract values for April 2017 delivery traded during the five-day period ending February 2 suggest that a range from $45/b to $65/b encompasses the market expectation of WTI prices in April 2017 at the 95% confidence level.

2017, January, 26, 19:05:00

2017: FLAT OIL PRICES

Brent crude oil spot prices are expected to remain fairly flat during 2017, in part as a result of the responsiveness of U.S. tight oil production to rising oil prices in late 2016, and they are expected to average $53/b for the year.

2016, July, 13, 14:28:00

2017: OIL MARKET BALANCE

Global consumption of petroleum and other liquid fuels is estimated to have grown by 1.4 million b/d in 2015. EIA expects global consumption of petroleum and other liquid fuels to increase by 1.4 million b/d in 2016 and by 1.5 million b/d in 2017, mostly driven by growth in countries outside of the Organization for Economic Cooperation and Development (OECD). Non-OECD consumption growth was an estimated 1.0 million b/d in 2015, and it is expected to be 1.3 million b/d in 2016 and 1.5 million b/d in 2017.

2015, April, 30, 18:50:00

U.S. INDUSTRY GROWTH

U.S. energy consumption has slowed recently and is not anticipated to return to growth levels seen in the second half of the 20th century. EIA's Reference case projections in the Annual Energy Outlook 2015 (AEO2015) show that domestic consumption is expected to grow at a modest 0.3% per year through 2040, less than half the rate of population growth. Energy used in homes is essentially flat, and transportation consumption will decline slightly, meaning that energy consumption growth will be concentrated in U.S. businesses and industries.

2015, April, 24, 22:45:00

OIL MARKET REBALANCING

Global oil demand is set to rise by 1 million or even 1.5 million barrels per day (bpd) in 2015, according to a range of forecasters.