All publications by tag «WELL»

2019, May, 6, 11:35:00

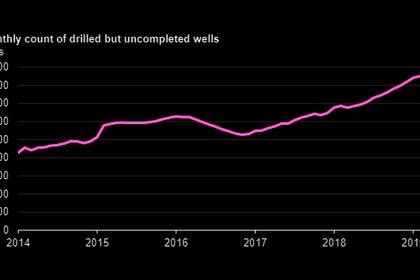

U.S. UNCOMPLETED WELLS UP

The number of drilled but uncompleted wells in seven key oil and natural gas production regions in the United States has increased over the last two years, reaching a high of 8,504 wells in February 2019,

2017, December, 25, 20:20:00

ROSNEFT'S ULTRA-DEEPWATER WELL

ROSNEFT - Rosneft has spudded the Maria-1 exploration well offshore in the Black Sea. Forecasted oil in place for Zapadno-Chernomorskaya licence area is estimated to exceed 570 million tons.

2017, October, 11, 12:45:00

U.S. OIL WELLS UP 84%

API announced that estimated wells completed in the third quarter of 2017 increased 63 percent compared to the third quarter of 2016. This includes a dramatic 84 percent increase for all oil wells completed from year-ago levels.

2017, May, 1, 12:05:00

CANADIAN WELLS UP TO 6,680

The Petroleum Services Association of Canada (PSAC), in its second update to the 2017 Canadian Drilling Activity Forecast, announced its revision of the forecasted number of wells drilled (rig released) across Canada for 2017 to 6,680 wells. This represents an increase of 2,505 wells and a 60 per cent increase from PSAC’s original 2017 Drilling Activity Forecast released in early November 2016 of 4,175 wells rig released. PSAC based its updated 2017 forecast on average natural gas prices of $3.00 CDN/mcf (AECO), crude oil prices of US$52.50/barrel (WTI) and the Canada-US exchange rate averaging $0.74.

2016, October, 27, 18:35:00

NOV VARCO NET LOSS $1.7 BLN

Revenues for the third quarter of 2016 were $1.65 billion, a decrease of five percent compared to the second quarter of 2016 and a decrease of 50 percent from the third quarter of 2015. Operating loss for the third quarter was $1.19 billion, or 72.1 percent of sales. Excluding other items, operating loss was $108 million, or 6.6 percent of sales. Adjusted EBITDA (operating profit excluding other items before depreciation and amortization) for the third quarter was $68 million, or 4.1 percent of sales, an increase of $43 million from the second quarter of 2016.

2016, October, 14, 18:35:00

U.S. OIL WELLS UNCHANGED

API announced today that estimated oil wells drilled and completed in the third quarter of 2016 remained relatively unchanged from the previous quarter at 2,285. That is a decline of 3.7%, which follows an average of 17.3% in quarterly declines for the past year and a half.

2016, July, 28, 18:35:00

NOV VARCO NET LOSS $336 MLN

National Oilwell Varco, Inc. (NYSE:NOV) reported a second quarter 2016 net loss of $217 million, or $0.58 per share. Excluding other items, net loss for the quarter was $114 million, or $0.30 per share. Other items included $143 million in pre-tax charges ($103 million net of tax) primarily associated with severance, facility closure costs, and write-off of certain fixed assets.

2016, July, 8, 18:00:00

U.S. OIL WELL COMPLETIONS DOWN 69%

Estimated U.S. oil well completions decreased by 69 percent in the second quarter of 2016 compared to year-ago levels, according to API's 2016 Quarterly Well Completion Report, Second Quarter.

2016, April, 28, 19:35:00

VARCO NET LOSS $119 MLN

National Oilwell Varco, Inc. (NYSE:NOV) reported a first quarter 2016 net loss of $21 million, or $0.06 per share, excluding other items. Other items included $147 million in pre-tax charges primarily associated with severance and facility closure costs. GAAP net loss for the quarter was $119 million, or $0.32 per share.

2016, March, 31, 19:10:00

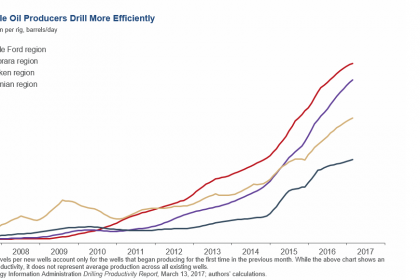

U.S. DECLINE COSTS

The drilling cost per foot, based on total depth, and the completion cost per foot, based on lateral length, are both projected to maintain these lower cost trends through 2018. Sustained lower upstream costs may affect near-term oil and natural gas markets, and ultimately, the prices of these fuels.