Analysis

2021, May, 26, 13:00:00

INDIA'S COAL IMPORTS UP

Thermal coal imports in April were at 16.239 million t, a growth of 40.10% over the 11.591 million t imported last April 2020 and a 26.31% growth over the 12.856 million t imported in March 2021.

2021, May, 25, 12:40:00

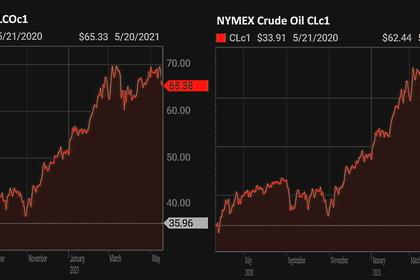

OIL PRICE: NOT ABOVE $69 ANEW

Brent were down 1 cent at $68.45 a barrel. WTI were off 8 cents at $65.97 a barrel.

2021, May, 24, 13:05:00

OIL PRICE: NOT ABOVE $68 ANEW

Brent rose $1.25, or 1.9%, to $67.69. WTI was at $64.73 a barrel, up $1.15, or 1.8%.

2021, May, 24, 13:00:00

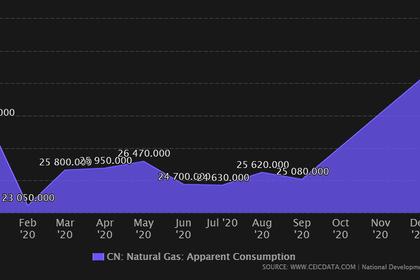

CHINA LNG DEMAND WILL UP

This will inevitably increase China's demand for natural gas, including LNG, and boost prices for spot LNG cargoes, similar to the demand surge seen in the winter of 2020-21.

2021, May, 24, 12:50:00

GERMANY'S COAL REFUSAL

The German federal government published its updated Climate Protection Act on May 12, 2021.

2021, May, 24, 12:20:00

U.S. RIGS UP 2 TO 455

U.S. Rig Count is up 2 from last week to 455, Canada Rig Count is down 1 from last week to 58.

2021, May, 21, 10:10:00

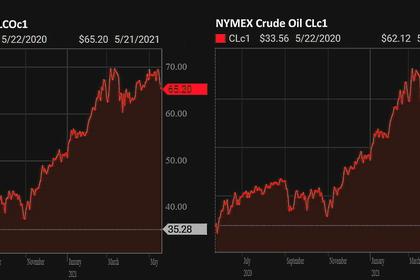

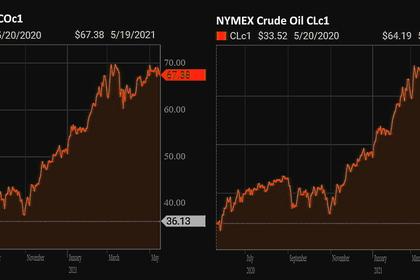

OIL PRICE: NEAR $65

Brent fell $1.55, or 2.3%, to settle at $65.11 a barrel. WTI crudeended $1.31, or 2.1%, lower at $62.05 a barrel.

2021, May, 21, 10:00:00

ЦЕНА URALS: $ 65,45667

Средняя цена на нефть Urals за период мониторинга с 15 апреля 2021 года по 14 мая 2021 года составила $ 65,45667 за баррель, или $ 477,8 за тонну.

2021, May, 21, 09:55:00

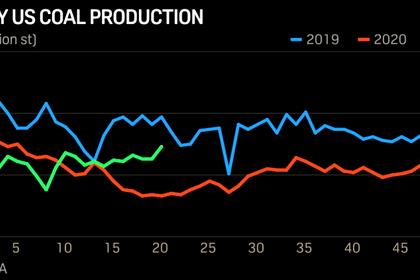

U.S. COAL PRODUCTION UP

The five-year average for week 19 is about flat with the most recent week at about 12.3 million st. Over 19 weeks, production was about 207 million st, up 3.3% from the year-ago period.

2021, May, 21, 09:35:00

NORWAY OIL, GAS PRODUCTION 2.008 MBD

Preliminary production figures for March 2021 show an average daily production of 2 094 000 barrels of oil, NGL and condensate.

2021, May, 20, 14:10:00

OIL PRICE: ABOVE $65

Brent was down $1.40, or 2.1%, at $65.26 a barrel. WTI lost $1.12, or 1.7%, to $62.24 a barrel.

2021, May, 20, 13:55:00

FUSION WILL BE READY

The Russian physicist Lev Artsimovich once said, “Fusion will be ready when society needs it.” Ideally, we would have solved fusion 30 years ago and today it would be ready to roll out. But conditions in the past weren’t right for fusion, and there wasn’t the right kind of drive or possibility for it.

2021, May, 20, 13:30:00

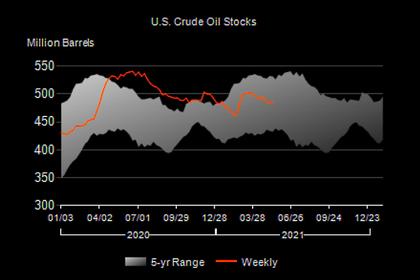

U.S. OIL INVENTORIES UP 1.3 MB TO 486.0 MB

U.S. commercial crude oil inventories increased by 1.3 million barrels from the previous week to 486.0 million barrels.

2021, May, 19, 14:55:00

OIL PRICE: NEAR $68 YET

Brent fell $1.08, or 1.5%, to $67.63 a barrel. WTI dropped $1.05 cents, or 1.6%, to $64.44 a barrel.

2021, May, 19, 14:50:00

IMPRACTICAL CLEAN ENERGY

The International Energy Agency's Net Zero Emissions (NZE) scenario puts too much faith in technologies that are "uncertain, untested or unreliable" and fails to reflect both the size and scope of the contribution that nuclear technologies could make, World Nuclear Association said