Analysis

2021, January, 20, 14:35:00

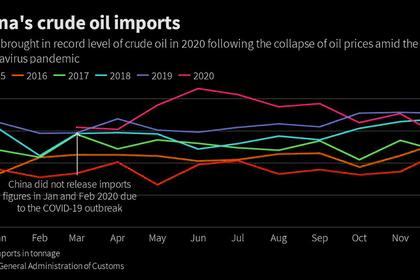

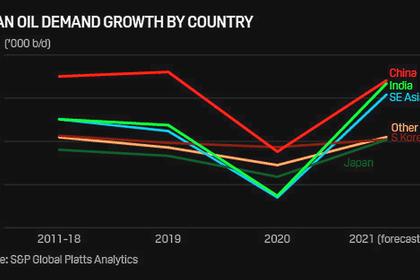

U.S. OIL FOR CHINA UP

China had suspended crude imports from the US over December 2019-April 2020 due to the trade tensions between Beijing and Washington.

2021, January, 20, 14:30:00

TURKEY GAS CONSUMPTION RECORD

Natural gas consumption countrywide increased both due to the rapidly falling temperatures and a rise in household gas consumption with time spent at home increased due to COVID-19 pandemic restrictions and lockdowns.

2021, January, 19, 14:00:00

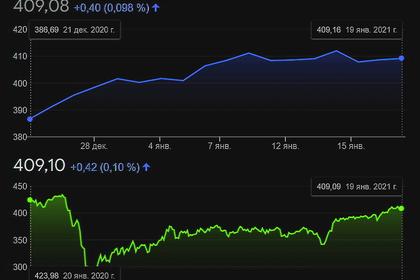

OIL PRICE: ABOVE $55 YET

Brent rose 46 cents to $55.21 a barrel. WTI was at $52.40 a barrel, up 4 cents.

2021, January, 19, 13:55:00

GLOBAL INDEXES UP ANEW

S&P 500 futures rising 0.6% and Nasdaq futures up 0.9% after the long holiday weekend.

2021, January, 19, 13:50:00

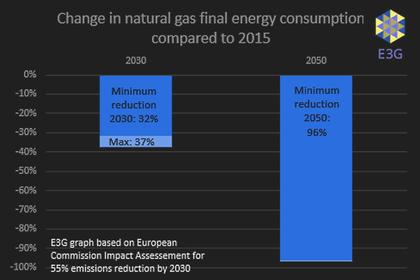

EU GAS MARKETS ARE CHANGING

The European Commission is planning to issue new proposals for gas legislation in the last quarter of 2021. EU gas markets are on the cusp of dramatic changes.

2021, January, 19, 13:45:00

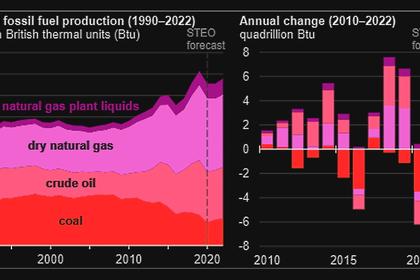

U.S. FOSSIL FUEL WILL UP

U.S. production of all fossil fuels—crude oil, coal, dry natural gas, and natural gas plant liquids (NGPL)—to increase in 2022, but forecast fossil fuel production will remain lower than the 2019 peak.

2021, January, 18, 13:15:00

OIL PRICE: NEAR $55 AGAIN

Brent fell 20 cents, or 0.4%, to $54.90 a barrel. WTI fell 20 cents, or 0.4%, to $54.90 a barrel.

2021, January, 18, 13:05:00

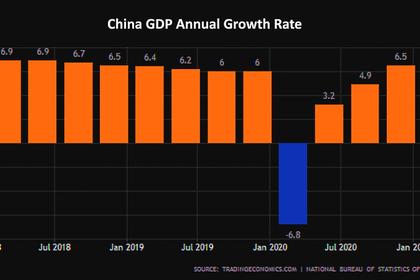

CHINA INDEXES UP

The blue-chip CSI300 index rose 1.1% to close at 5,518.52, while the Shanghai Composite Index gained 0.8% to 3,596.22.

2021, January, 18, 13:00:00

CHINA OIL THROUGHPUT UP

On a metric tons basis, the December throughput went up 2.8% from November and 2.1% from a year ago to 60 million mt.

2021, January, 18, 12:55:00

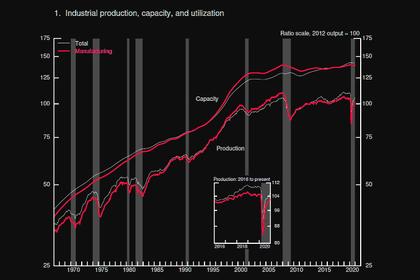

U.S. INDUSTRIAL PRODUCTION UP 1.6%

U.S. industrial production advanced 1.6 percent in December, with gains of 0.9 percent for manufacturing, 1.6 percent for mining, and 6.2 percent for utilities.

2021, January, 18, 12:45:00

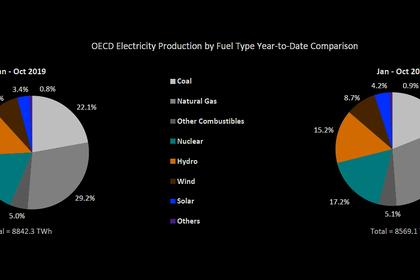

OECD RENEWABLE ELECTRICITY UP 12%

Renewable electricity production was 262.8 TWh, up by 12.4% compared to October 2019 and by8.7 % compared to September 2020.

2021, January, 18, 12:30:00

NOVATEK PRODUCTION +3%

In 2020, NOVATEK’s hydrocarbon production totaled 608.2 million barrels of oil equivalent (boe),

2021, January, 18, 12:25:00

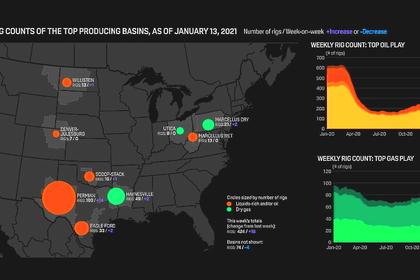

U.S. RIGS UP 13 TO 373

U.S. Rig Count is up 13 from last week to 373, Canada Rig Count is up 44 from last week to 161.

2021, January, 15, 12:05:00

OIL PRICE: BELOW $56 ANEW

Brent was down 71 cents, or 1.2%, at $55.71 a barrel. WTI was 46 cents, or 0.9%, lower at $53.11 a barrel.