Analysis

2020, December, 8, 12:45:00

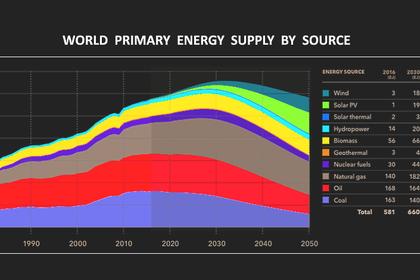

ENERGY TRANSITION EFFICIENCY

The Energy Transition (ET) efficiency for all mankind is the higher, the less its harmful impact to the environment, duration and cost, if the energy needs is satisfied.

2020, December, 8, 12:40:00

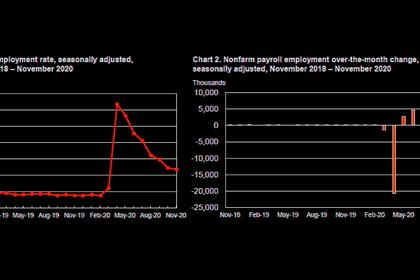

U.S. EMPLOYMENT UP BY 245,000

Total nonfarm payroll employment rose by 245,000 in November, and the unemployment rate edged down to 6.7 percent,

2020, December, 8, 12:30:00

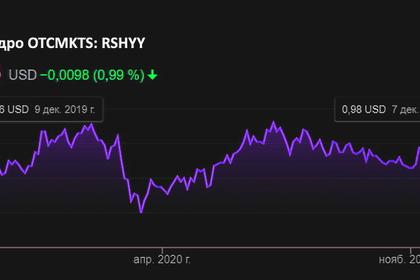

RUSHYDRO RATING 'BAA3'

Moody's Investors Service ("Moody's") has today upgraded RusHydro, PJSC's (RusHydro) Baseline Credit Assessment (BCA) to baa3 from ba1.

2020, December, 7, 13:30:00

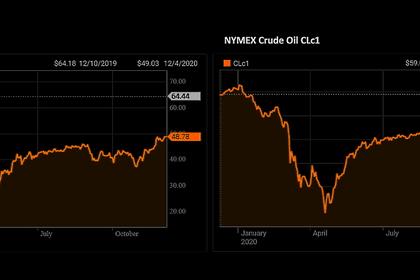

OIL PRICE: NOT ABOVE $49 AGAIN

Brent fell 76 cents, or 1.5%, to $48.49 a barrel. WTI was down 82 cents, or 1.8%, at $45.44.

2020, December, 7, 13:15:00

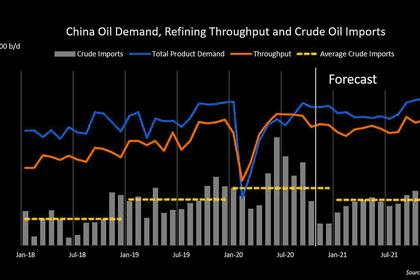

CHINA OIL IMPORTS UP

China's crude imports in the first 11 months to 11.03 million b/d, rising 9.2% year on year.

2020, December, 7, 13:10:00

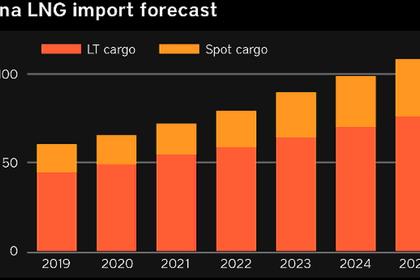

CHINA GAS IMPORTS UP

China's natural gas sales exceeded 950 million cu m/day across the nation, state-owned oil and gas infrastructure giant PipeChina said on its official WeChat on Nov. 21.

2020, December, 7, 13:05:00

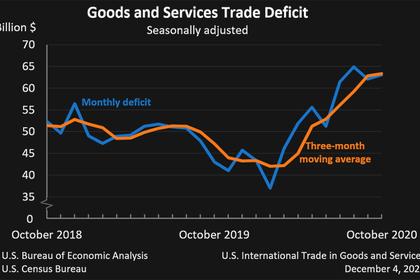

U.S. INTERNATIONAL TRADE DEFICIT UP TO $63 BLN

the U.S. goods and services deficit was $63.1 billion in October, up $1.0 billion from $62.1 billion in September

2020, December, 7, 12:55:00

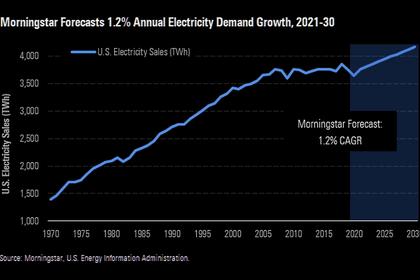

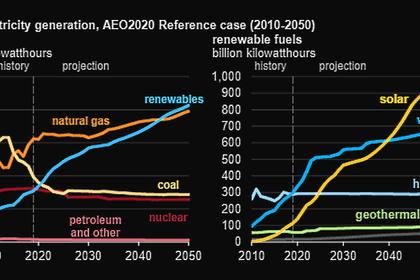

U.S. ELECTRICITY DEMAND CHANGES

In April and May, at the peak of the COVID-19 restrictions, electricity demand fell 5.8%, the largest two-month drop in 50 years of recordkeeping.

2020, December, 7, 12:50:00

U.S. RENEWABLES ELECTRICITY UP

Renewable energy sources (i.e., biomass, geothermal, hydropower, solar, wind) continued to expand their share of the nation's electricity production during the first three-quarters of 2020,

2020, December, 7, 12:45:00

HYDROGEN ENERGY LOSSES

The energy transformation requires a major shift in electricity generation from fossil fuels to renewable sources like solar and wind, greater energy efficiency and the widespread electrification of energy uses from cars to heating and cooling in buildings.

2020, December, 7, 12:40:00

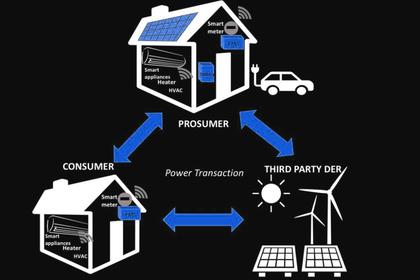

TRANSACTIVE ENERGY SYSTEM

Transactive energy is an intelligent, multi-level communications approach that coordinates the actions of energy suppliers, customers, and delivery resources

2020, December, 7, 12:35:00

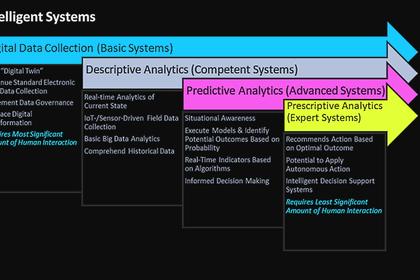

DIGITAL TRENDS FOR CLEAN ENERGY

As we move forward into a low-carbon future, disruptive innovations in information technology will help us to more intelligently integrate and transition energy systems.

2020, December, 7, 12:30:00

ROBOTIZATION FOR ENERGY CHANGES

With a rapidly changing energy landscape and rising customer expectations, businesses are being forced to shift from a highly traditional, regulation-driven marketplace to an advanced technology-driven environment to keep up with the growing customer demands,

2020, December, 7, 12:25:00

WORLDWIDE RIG COUNT UP 58 TO 1,074

The Worldwide Rig Count for November was 1,074, up 58 from the 1,016 counted in October 2020

2020, December, 7, 12:20:00

U.S. RIGS UP 3 TO 323

U.S. Rig Count is up 3 from last week to 323 , Canada Rig Count is unchanged from last week at 102