Analysis

2024, February, 26, 07:00:00

OIL PRICE: BRENT ABOVE $81, WTI ABOVE $76

Brent fell 35 cents, or 0.4%, to $81.27 a barrel, WTI declined 35 cents, or 0.5%, to $76.14 a barrel.

2024, February, 26, 06:45:00

CHINA'S COAL ELECTRICITY

China saw a robust increase in its peak power demand in 2021-2022 due to an increase in the prevalence of air conditioners amid exceptionally intense heat waves. This prompted an enhancement of more coal-based power generation capacity as a "costly and suboptimal solution,"

2024, February, 26, 06:25:00

GLOBAL MARKETS(2024) : A GOOD OLD SWITCHEROO

At the start of the month,we saw #Crudeoil longs data jump 17%, partly offsetting wrong-footed sales the previous week.Russia stated that the cut of 500k b/d to meet the quota expectations for the month of February as part of a package of cuts promised by the OPEC+.

2024, February, 21, 07:00:00

OIL PRICE: BRENT ABOVE $82, WTI ABOVE $77

Brent rose 30 cents or 0.36% to $82.64 a barrel, WTI were up 26 cents or 0.34% at $77.30.

2024, February, 21, 06:55:00

EUROPEAN INDUSTRY RISKS

Europe risks losing out to China and the US in the race to supply the technologies needed to roll out renewables and slash industrial emissions.

2024, February, 21, 06:50:00

EUROPEAN CARBON RISKS

“The European Commission’s carbon capture ambition is significant at ~450 million tonnes of CO2 by 2050, of which around 40% will come from direct air capture (DAC) alone, the most expensive carbon capture process.

2024, February, 21, 06:40:00

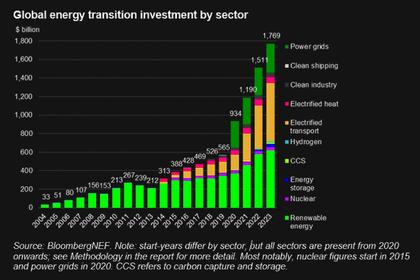

GLOBAL ENERGY INDUSTRY OPPORTUNITIES 2024

The year 2024 is projected to be a potential turning point for the power industry, as it could witness a significant shift towards renewable energy.

2024, February, 21, 06:35:00

GLOBAL ENERGY INDUSTRY DEVELOPMENT 2024

In 2024, Energy consumers have more questions about the state of the Energy Industry's current initiatives than answers. Some areas to focus on include decarbonization, technology implementation, energy storage, and emergency responses.

2024, February, 21, 06:10:00

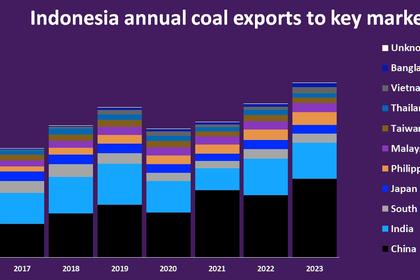

INDONESIAN COAL EXPORTS UP

For 2023 as a whole, Indonesian exports scaled a new high of 504.6 million tons, so if the blistering pace of exports seen so far this year is sustained, 2024 will mark a new high for Indonesian exports of the power fuel.

2024, February, 20, 07:00:00

OIL PRICE: BRENT ABOVE $83, WTI NEAR $80

Brent ticked down 11 cents to $83.45 a barrel, WTI rose 36 cents to $79.55 a barrel.

2024, February, 20, 06:50:00

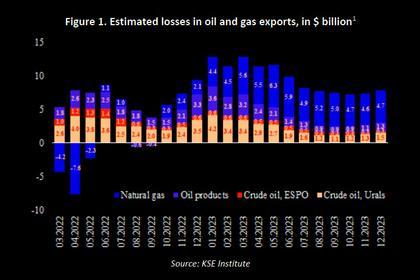

RUSSIAN ENERGY SANCTIONS 2024

The International Working Group on Russian Sanctions aims to provide expertise and experience to governments and companies around the world by assisting with the formulation of sanctions proposals that will increase the cost to Russia of invading Ukraine

2024, February, 20, 06:45:00

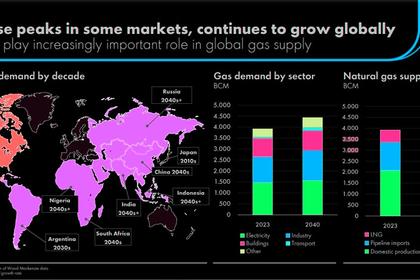

INDIA NEED GAS

India's natural gas consumption in 2024 will likely grow 5%-6% corresponding to an estimated economic growth of 6%-7%,

2024, February, 20, 06:35:00

GLOBAL LNG DEMAND WILL UP

Demand for natural gas globally will then peak after 2040, although appetite for LNG will continue growing as China and developing Asian nations switch from dirtier coal to the comparatively cleaner fuel.

2024, February, 20, 06:30:00

EUROPE NEED SMR NUCLEAR

"Compared to the larger, conventional nuclear power plants, SMRs have several advantages — such as shorter construction time schedules, enhanced safety features and a sounder appeal to private investors thanks to their lower initial costs and shorter development timelines," the commission added.

2024, February, 16, 07:00:00

OIL PRICE: BRENT NEAR $83, WTI NEAR $78

Brent were down 9 cents, or 0.1%, to $82.77 a barrel, WTI rose 4 cent to $78.07 a barrel.