Analysis

2022, October, 17, 12:35:00

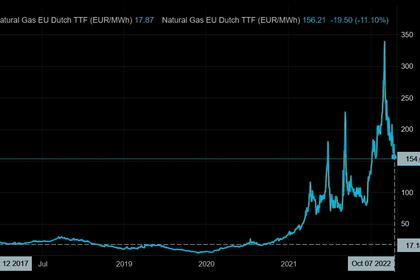

EUROPEAN GAS PRICES DOWN AGAIN

The EU has already asked members to voluntarily reduce gas demand by 15%, and Energy Commissioner Kadri Simson has said a plan is under consideration to make the cut mandatory.

2022, October, 17, 12:25:00

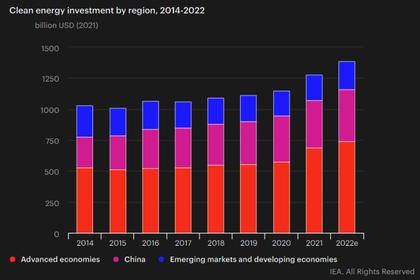

GLOBAL CLEAN ENERGY: SLOWLY AND EXPENSIVE

Progress on the world’s rising climate action ambitions could be undermined by a shortage of some of the critical minerals used in clean-energy technologies including wind turbines, solar farms and electric vehicles (EVs),

2022, October, 17, 12:20:00

DIGITAL CLEAN ENERGY TRANSITION

With AI, utilities can forecast more accurately to predict how much actual power their installations will generate in any situation.

2022, October, 17, 12:15:00

U.S. RIGS DOWN 7 TO 769

U.S. Rig Count is up 7 from last week to 769, Canada Rig Count is up 1 from last week to 216.

2022, October, 17, 12:10:00

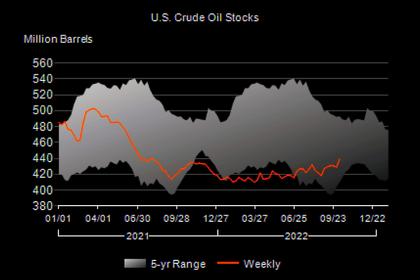

U.S. OIL INVENTORIES UP BY 9.9 MB TO 439.1 MB

U.S. commercial crude oil inventories increased by 9.9 million barrels to 439.1 million barrels.

2022, October, 13, 13:20:00

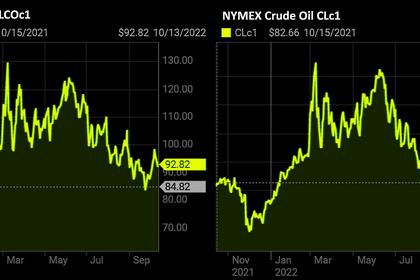

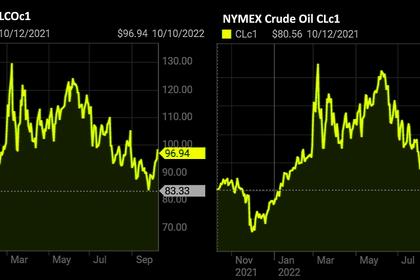

OIL PRICE: BRENT BELOW $93, WTI BELOW $88

Brent rose 49 cents, or 0.5%, to $92.94 a barrel , WTI was up 37 cents, or 0.4%, at $87.64 a barrel.

2022, October, 13, 12:55:00

GLOBAL OIL DEMAND +2.6 MBD

Global oil demand for 2022 is now expected to grow by about 2.6 mb/d.

2022, October, 13, 12:50:00

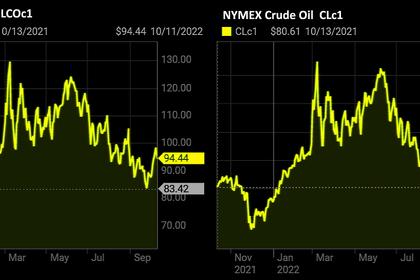

OIL PRICES 2022-23: $93 - $95

The Brent crude oil spot price averages $93 per barrel (b) in the fourth quarter of 2022 (4Q22) and $95/b in 2023.

2022, October, 12, 12:30:00

OIL PRICE: BRENT BELOW $95, WTI BELOW $90

Brent were down 2 cents, or 0.02%, to $94.27 a barrel, WTI was at $89.14 a barrel, down 21 cents, or 0.24%.

2022, October, 11, 17:45:00

OIL PRICE: BRENT ABOVE $94, WTI ABOVE $89

Brent was down $1.63, or 1.7%, to $94.56 a barrel, WTI dropped $1.82, or 2%, to $89.31.

2022, October, 11, 17:30:00

OPEC+ STABILIZE MARKETS

The OPEC+ alliance, co-chaired by Russia and Saudi Arabia, last week agreed to cut its production by 2 million barrels a day, the biggest reduction since 2020.

2022, October, 10, 12:55:00

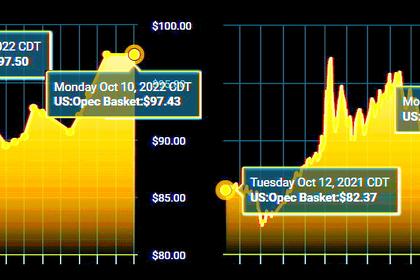

OIL PRICE: BRENT NEAR $97, WTI NEAR $92

Brent was down 77 cents, or 0.8%, at $97.15 a barrel, WTI was at $92 a barrel, down 64 cents, or 0.7%.

2022, October, 10, 12:50:00

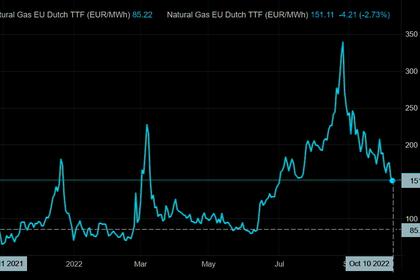

EUROPEAN GAS PRICES DOWN ANEW

Benchmark Dutch front-month futures dropped as much as 7.8% to 144 euros per megawatt-hour, the lowest intraday since July 1.

2022, October, 10, 12:45:00

EUROPEAN GAS PRICES LIMITS

Europe's gas price benchmark, the TTF month-ahead contract, traded Oct. 7 below Eur160/MWh, more than 50% lower than peaks seen in late August.

2022, October, 10, 12:40:00

GLOBAL CLIMATE WITHOUT CRISIS

The nations which are home to more than half of the world’s population are not treating climate change as a crisis.