Analysis

2022, October, 4, 14:40:00

OPEC+ OUTPUT CUT

Russia currently forecasts a further drop in Urals oil price over the next three years – to $70.1/b in 2023, $67.5/b in 2024, and $65/b in 2025. Its 2022 forecast is $80/b.

2022, October, 4, 14:30:00

GLOBAL GAS UNCERTAINTY

The current gas crisis also casts longer-term uncertainty on the prospects for natural gas, especially in developing markets where its use was expected to rise at least in the medium term as it replaced other higher-emission fossil fuels.

2022, October, 4, 14:25:00

NO RUSSIAN GAS TO ITALY

The halt in deliveries to Italy is the latest disruption to Russian gas flows to Europe after supplies were already halted via the Yamal-Europe and Nord Stream pipelines earlier this year and deliveries via Ukraine sharply curtailed.

2022, October, 4, 14:20:00

GAZPROM PRODUCTION DOWN BY 17%

According to preliminary data, Gazprom produced 313.3 billion cubic meters of gas from January through September 2022. This is a decrease of 17.1 per cent (or 64.8 billion cubic meters) versus the same period of last year.

2022, October, 4, 14:15:00

ЦЕНА URALS: $80,58

Средняя цена на нефть марки Urals в январе-сентябре 2022 года сложилась в размере $80,58 за баррель, в январе-сентябре 2021 года – $65,96 за баррель.

2022, October, 3, 12:30:00

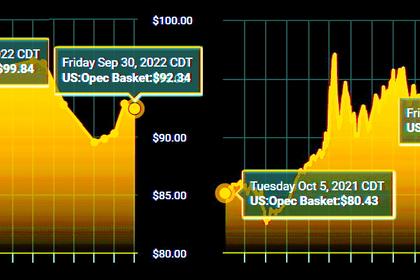

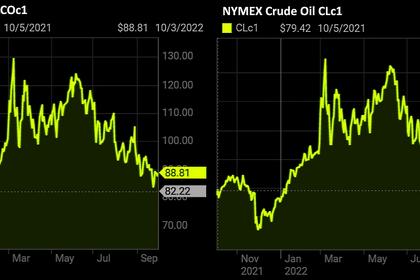

OIL PRICE: BRENT ABOVE $87, WTI ABOVE $81

Brent rebounded $2.36, or 2.8%, to $87.50 a barrel, WTI was up 2.9%, or $2.27, at $81.76 a barrel.

2022, October, 3, 12:20:00

THE NEW EUROPEAN GAS WINTER

In a spokesman for the Kremlin last week where Europe was threatened about how difficult it would be to face the coming winter.

2022, October, 3, 12:10:00

EUROPE LIMITS ENERGY

The cap must cover all market revenues of producers and intermediaries participating in electricity wholesale markets, "regardless of the market timeframe in which the transaction takes place and of whether the electricity is traded bilaterally or in a centralized marketplace," the text said.

2022, October, 3, 11:50:00

U.S. RIGS UP 1 TO 765

U.S. Rig Count is up 1 from last week to 765, Canada Rig Count is down 2 from last week to 213.

2022, September, 30, 10:05:00

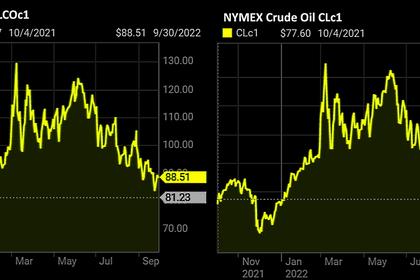

OIL PRICE: BRENT ABOVE $88, WTI ABOVE $81

Brent inched down 10 cents or 0.1% to $88.39 a barrel, WTI rose 0.1% or by 9 cents to $81.32 a barrel.

2022, September, 30, 09:45:00

EUROPEAN ENERGY CRISIS: DEEPER

The 27-nation bloc has already agreed on a voluntary target to cut gas consumption by 15% after Russia, its biggest supplier, cut shipments following the invasion of Ukraine. Still, more action is needed to contain the energy crunch that’s fueling inflation and risks recession.

2022, September, 30, 09:40:00

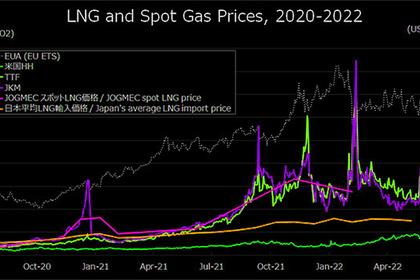

JAPAN NEED LNG

Japan wants to avoid an energy crunch by offering financial support before winter, when heating demand is expected to increase. Spot LNG prices remain at high levels amid a risk of supply disruption from Russia given its war with Ukraine.

2022, September, 29, 14:10:00

OIL PRICE: BRENT ABOVE $89, WTI ABOVE $82

Brent rose 52 cents, or 0.6%, to $89.84 a barrel, WTI rose by 52 cents, or 0.6%, to $82.67.

2022, September, 29, 13:55:00

EUROPEAN GAS PRICES DOWN AGAIN

Benchmark prices declined as much as 6.4%, after rising 19% over the previous two days.

2022, September, 29, 13:50:00

EUROPE NEED ENERGY SECURITY

Despite the fact neither Nord Stream nor Nord Stream 2 were flowing gas to Europe at the time of the incidents, gas prices rose as much as 9% in early trading Sept. 27.