Analysis

2022, September, 29, 13:35:00

INDONESIA NEED RUSSIAN OIL

Although Pertamina remains cautious and the company declined to make official comments on any concrete plans to purchase Russian crude going forward, Ambara Jaya said that the state-run refiner finds several Russian crude grades to be suitable feedstocks.

2022, September, 29, 13:30:00

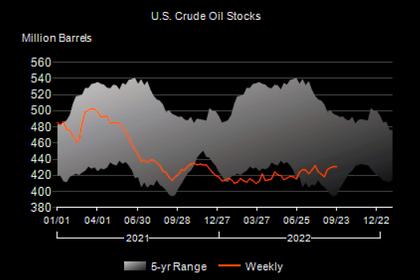

U.S. OIL INVENTORIES DOWN BY 0.2 MB TO 430.6 MB

U.S. commercial crude oil inventories decreased by 0.2 million barrels to 430.6 million barrels.

2022, September, 28, 12:40:00

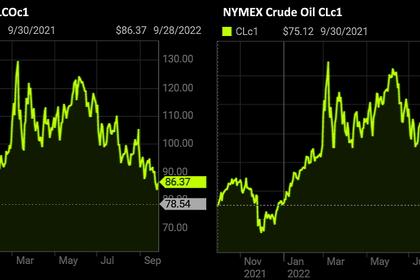

OIL PRICE: BRENT ABOVE $86, WTI ABOVE $78

Brent fell $1.02, or 1.2%, to $85.25 per barrel , WTI were down 97 cents, or 1.2%, at $77.53 per barrel.

2022, September, 28, 12:35:00

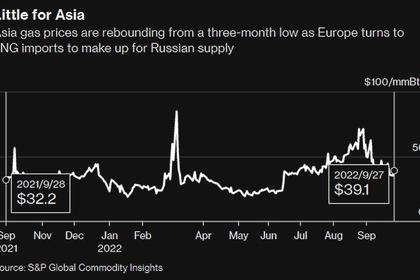

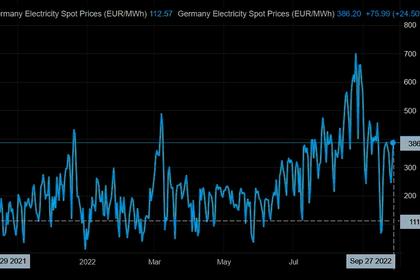

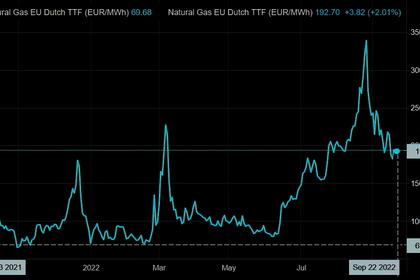

EUROPEAN GAS PRICES UP AGAIN

Dutch front-month gas, the European benchmark, rose 11% to 206 euros per megawatt-hour at 8:47 a.m. in Amsterdam. Price increased 7.1% on Tuesday.

2022, September, 28, 12:30:00

NORD STREAM WAS DAMAGED

The currently out-of-action Nord Stream pipeline system was damaged, with Germany saying it suspected it was an act of sabotage.

2022, September, 28, 12:25:00

RUSSIA, UKRAINE SANCTIONS

Naftogaz and Gazprom signed in December 2019 a gas transit agreement under ship-or-pay terms, meaning Gazprom is obliged to pay for transit whether it uses it or not.

2022, September, 28, 12:20:00

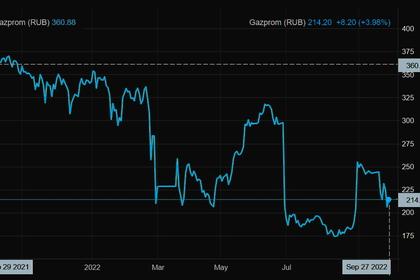

GAZPROM'S FINANCIAL GROWTH

The net profit amounted to RUB 2.514 trillion, which not only marks a 2.6-fold increase against the amount recorded in the first half of 2021 but also exceeds the total profit of the Gazprom Group for the two previous calendar years!

2022, September, 28, 12:10:00

NORWAY OIL, GAS PRODUCTION 1.998 MBD

Preliminary production figures for August 2022 show an average daily production of 1 998 000 barrels of oil, NGL and condensate.

2022, September, 28, 09:00:00

GLOBAL RENEWABLE ENERGY JOBS 12.7 MLN

The ninth edition of IRENA’s series, Renewable energy and jobs: Annual review 2022, produced in collaboration with the International Labour Organization (ILO), provides the latest estimates of renewable energy employment globally.

2022, September, 27, 16:55:00

OIL PRICE: BRENT ABOVE $85, WTI NEAR $78

Brent was up $1.49, or 1.8%, to $85.55 a barrel, WTI was up $1.37, or 1.8%, at $78.08.

2022, September, 27, 16:40:00

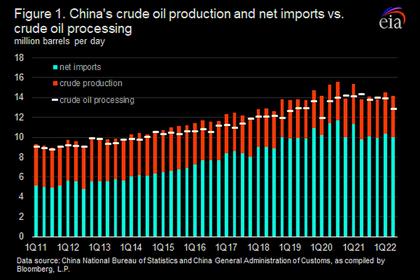

RUSSIAN OIL FOR CHINA UP

The share of imports from Russia has likely risen because of lower imports into China and shifting trade patterns following Russia’s full-scale invasion of Ukraine. Western economic sanctions have reduced demand for Russian crude oil, and as a result, have left Russia to look for alternative export destinations.

2022, September, 27, 16:25:00

ARTIFICIAL INTELLIGENCE FOR ENERGY TRANSITION

Smart energy systems are the future of clean energy. Apart from AI, technologies such as ML and blockchain in the energy sector also significantly impact the shift toward sustainable energy.

2022, September, 27, 16:20:00

U.S. RIGS UP 1 TO 764

U.S. Rig Count is up 1 from last week to 764, Canada Rig Count is up 4 from last week to 215

2022, September, 22, 16:35:00

OIL PRICE: BRENT NEAR $92, WTI NEAR $85

Brent were up 70 cents, or 0.78%, to $90.53, WTI was up 71 cents, or 86%, at $83.65.

2022, September, 22, 16:30:00

EUROPEAN ENERGY CRISIS PLAN

The European Commission aims to publish Sept. 28 a document detailing future steps to ease volatility and increase trading volume in energy markets after surging prices led to ballooning margin calls