Analysis

2022, August, 31, 11:30:00

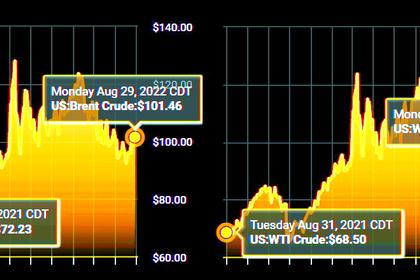

OIL PRICE: BRENT NEAR $99, WTI NEAR $91

Brent climbed 89 cents, or 0.9%, to $100.20 a barrel, WTI jumped 82 cents, or 0.9%, to $92.46 a barrel

2022, August, 31, 11:25:00

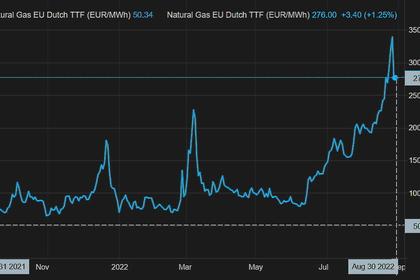

EUROPEAN CRAZY GAS PRICES

Asked if there are guarantees that Gazprom will restart gas flows via Nord Stream 1, the Kremlin's Peskov said: "There are guarantees that, apart from technological problems caused by sanctions, nothing hinders the supplies."

2022, August, 31, 11:20:00

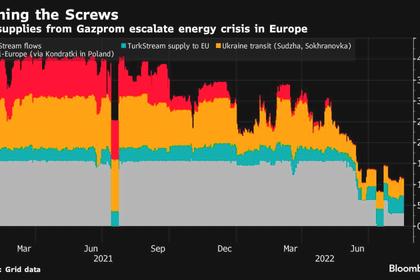

EUROPEAN GAS BLOCKOUTS

A three-day halt of the Nord Stream pipeline -- a key source of natural gas for the European Union -- starts on Wednesday, and concerns are widespread that Moscow will find another excuse to clamp down on supplies, putting the region at the mercy of the weather.

2022, August, 30, 11:25:00

OIL PRICE: BRENT NEAR $105, WTI NEAR $97

Brent dropped 56 cents, or 0.5%, to $104.53 a barrel, WTI was at $96.86 a barrel, down 14 cents,

2022, August, 30, 11:20:00

OIL PRICES RECORD

West Texas Intermediate was steady near $97 a barrel after jumping 4.2% in the week’s opening session amid concerns about the potential for supply interruptions in Libya

2022, August, 30, 11:15:00

EUROPEAN GAS PRICES DOWN ANEW

European natural gas prices on Monday plunged the most since March after Germany said its gas stores are filling up faster than planned.

2022, August, 30, 11:10:00

EUROPEAN ENERGY CRISIS: NO MEASURES

Europe’s benchmark electricity price has risen to 10 times its decade-long average, in line with a 14-fold increase in the cost of gas, amid fears of shortages this winter.

2022, August, 30, 11:05:00

EUROPEAN UNBEARABLE WINTER

With Russia squeezing gas deliveries and power-plant outages further sapping supply, pressure is growing on EU leaders to act quickly or risk social unrest and political upheaval.

2022, August, 30, 11:00:00

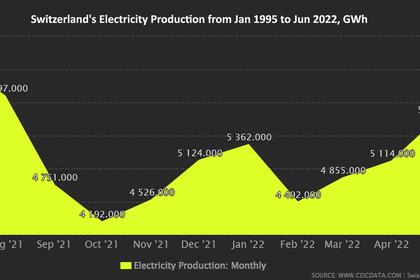

SWISS COLD WINTER

Bern has been working to build up Switzerland's energy production and storage systems, but even the grand opening next month of a new, powerful pumped-storage hydroelectric plant is unlikely to help avoid problems this winter.

2022, August, 29, 12:30:00

OIL PRICE: BRENT ABOVE $101, WTI ABOVE $94

Brent rose 65 cents, or 0.6%, to $101.64 a barrel, WTI was up $1.22, or 1.3%, at $94.28

2022, August, 29, 12:25:00

EUROPEAN GAS PRICES DOWN

Benchmark Dutch front-month futures fell as much as 16%, partly reversing last week’s jump of almost 40%.

2022, August, 29, 12:20:00

GLOBAL 3D ENERGY MEGATRENDS

The transformation of the electricity system is buoyed by three key megatrends: decarbonization, decentralization, and digitalization. Together, these primary trends, the so-called ‘3Ds’, are ushering in a new era of the electricity system by converging to produce game-changing disruptions and fundamentally reshaping the electricity system.

2022, August, 29, 11:50:00

U.S. RIGS UP 3 TO 765

U.S. Rig Count is up 3 from last week to 765 , Canada Rig Count is unchanged from last week at 201

2022, August, 26, 12:15:00

OIL PRICE: BRENT NEAR $100, WTI ABOVE $93 AGAIN

Brent climbed 73 cents, or 0.73%, to $100.07 a barrel, WTI rose 78 cents, or 0.84%, to $92.93.

2022, August, 26, 12:10:00

EUROPE CUT ENERGY

While some countries like Germany, where nearly half the homes rely on gas for heating, are more exposed than others, the European Union is seeking to band together.