Analysis

2022, August, 26, 12:15:00

OIL PRICE: BRENT NEAR $100, WTI ABOVE $93 AGAIN

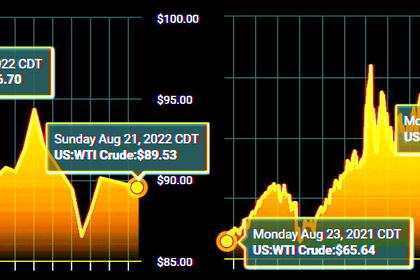

Brent climbed 73 cents, or 0.73%, to $100.07 a barrel, WTI rose 78 cents, or 0.84%, to $92.93.

2022, August, 26, 12:10:00

EUROPE CUT ENERGY

While some countries like Germany, where nearly half the homes rely on gas for heating, are more exposed than others, the European Union is seeking to band together.

2022, August, 26, 12:05:00

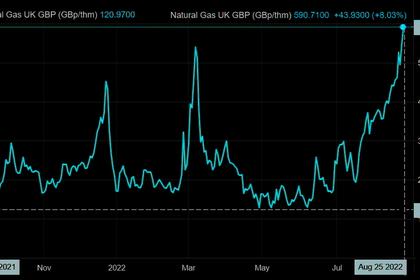

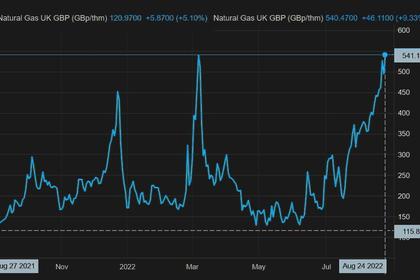

BRITISH COLD WINTER

UK households will pay almost triple the price to heat their homes this winter compared with a year ago, a jarring increase for millions of people already struggling to afford everyday essentials.

2022, August, 26, 12:00:00

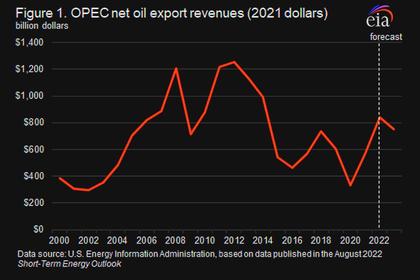

OPEC EARNINGS $842 BLN

OPEC will earn about $842 billion in oil export revenue in 2022, the most inflation-adjusted net oil export revenue for the group since 2014, when they collectively earned nearly $992 billion.

2022, August, 26, 11:50:00

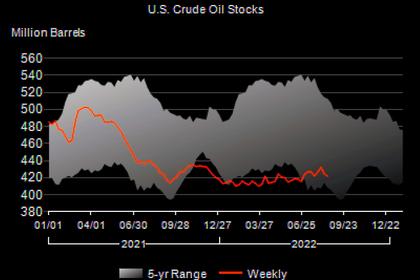

U.S. OIL INVENTORIES DOWN BY 3.3 MB TO 421.7 MB

U.S. commercial crude oil inventories decreased by 3.3 million barrels to 421.7 million barrels.

2022, August, 25, 10:25:00

OIL PRICE: BRENT ABOVE $101, WTI ABOVE $95

Brent rose 45 cents, or 0.4%, to $101.67 a barrel, WTI was up 32 cents, or 0.3%, at $95.21 a barrel.

2022, August, 25, 10:20:00

RUSSIAN OIL DISCOUNTS

The EU’s sixth round of sanctions over the invasion of Ukraine includes a ban on Russian oil, as well as the use by third countries of the bloc’s companies for insurance and financial services.

2022, August, 25, 10:15:00

BRITAIN'S ENERGY PROTECTION £100 BLN

UK was facing a “catastrophic winter”, telling the BBC that half of all households could fall into fuel poverty without intervention.

2022, August, 23, 11:00:00

OIL PRICE: NEAR $97, WTI NEAR $91

Brent gained 42 cents, or 0.4%, to $96.90 a barrel, WTI rose 40 cents, or 0.4%, to $90.76 a barrel.

2022, August, 23, 10:55:00

OPEC OIL PRICE: $99.66

The price of OPEC basket of thirteen crudes stood at $99.66 a barrel

2022, August, 23, 10:50:00

EUROPEAN GAS PRICES GROW AGAIN

Russia’s Gazprom will halt flows on its key Nord Stream gas pipeline for three days of repairs on Aug. 31, again raising concerns it won’t return after the work.

2022, August, 23, 10:40:00

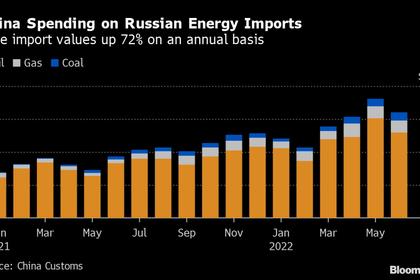

RUSSIAN ENERGY FOR CHINA UP

Russia is now China’s top supplier of the fuel, supplanting Indonesia after the Southeast Asian nation deterred buyers by raising prices.

2022, August, 22, 13:35:00

OIL PRICE: BRENT NEAR $96, WTI NEAR $90 ANEW

Brent fell $1.60, or 1.6%, to $95.12 a barrel, WTI were down $1.56, or 1.7%, at $89.21 a barrel.

2022, August, 22, 13:30:00

EUROPEAN GAS PRICES UP ANEW

Benchmark futures rose as much as 16%, also driving up electricity prices to fresh records. The key Nord Stream pipeline will stop for three days of maintenance on Aug. 31, again raising concerns that the link won’t return to service as planned after the works.

2022, August, 22, 13:25:00

U.S. OIL INDUSTRY LIQUIDATION

There is no indication that such orderly liquidations would be offset by orderly installation of replacement facilities,