JAPAN: MORE GAS

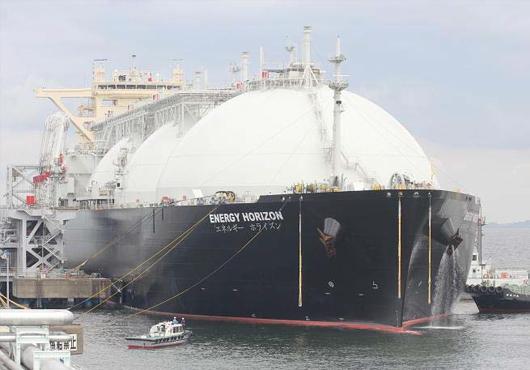

Japan's imports of liquefied natural gas (LNG) remained at a near-record average of 11.85 billion cubic feet a day (Bcf/d) in the first eight months of 2014, according to recently released trade statistics from Japan's Ministry of Finance. Increased LNG imports are occurring amid continued shutdowns of nuclear power plants following the March 2011 disaster at the Fukushima Daiichi nuclear power plant and the subsequent increased use of fossil fuels in power generation. Higher levels of LNG imports in 2014 are underpinned by continuous growth in gas-fired power generation, the ready availability of spot LNG supply because of weak demand in Europe and Asia (particularly in South Korea) and lower short-term prices.

Higher consumption of fossil fuels for power generation following the nuclear meltdown contributed to already high energy costs and led to record trade deficits. Japanese utilities have been reducing the share of crude oil and heavy fuel oil in the power generation mix, while increasing coal consumption with the start-up of new coal-fired plants. In 2013, coal consumption for power generation increased by 16% over 2012, and reached a record 40 million tons in the first eight months of 2014. LNG consumption also remains at near-record levels, supported by more than 2.5 GW of new gas-fired power generating capacity commissioned in 2014 and a growing demand in the industrial sector driven by oil-to-gas substitution.

At present, all of Japan's 48 nuclear reactors (which generated 34% of the country's power in 2010) remain offline, and the timeline for their restarts remains uncertain. Last month, Japan's Nuclear Regulation Authority approved a safety report of two reactors—Kyushu Electric Power Company's Sendai reactors No. 1 and 2—bringing them a step closer to a restart in the next few months. However, strict safety standards for nuclear plant restarts combined with strong public opposition to nuclear power may delay the restarts of the plants.

Since 2012, the increase in Japan's LNG consumption has averaged around 2.3 Bcf/d compared with 2010. That increase is nearly equal to the total LNG import volume of the world's third-largest LNG importer, China, which imported 2.5 Bcf/d in 2013. The incremental supply to accommodate Japan's increase was diverted primarily from Europe, where LNG consumption declined by 4.1 Bcf/d (48%) in 2013 compared with 2010. Increased use of existing liquefaction capacity, particularly in Qatar and Australia, also contributed to the incremental supply.

Additionally, the commissioning of the Papua New Guinea liquefaction plant in May, which coincided with lower demand in Europe, contributed to more spot supply available to Asian buyers.

In South Korea, warmer-than-average winter temperatures and near-full storage levels going into summer prompted the Korean Gas Corporation to seek buyers or swap partners for 20-40 cargos to manage lower-than-expected demand. Reduced competition from South Korea increased supply and reduced prices in Asia Pacific markets.

These factors contributed to lower average LNG import prices in Japan in the second half of the year, and were coupled with higher LNG import volumes. Japan's spot LNG prices averaged $13.77/MMBtu in June-August and declined to $11.30/MMBtu in September. While Japanese spot prices have been trending lower in the second half of 2014, they still remain significantly above natural gas prices in other regions.

eia.gov