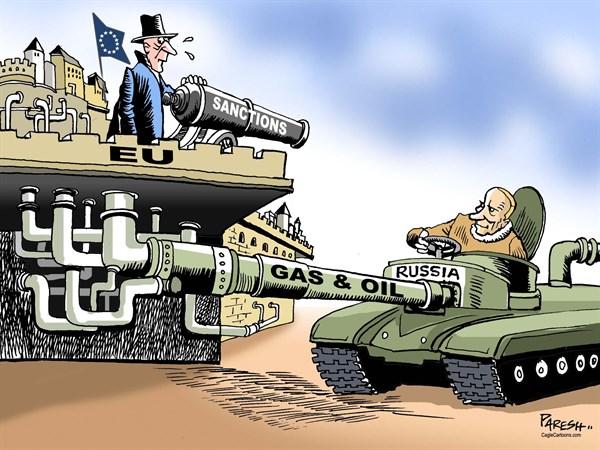

RUSSIA SANCTIONS: NO AFFECT

Figures showing that Russian oil and gas production hasn't been affected by Western sanctions underpins the oversupply in global oil markets, keeping prices under pressure.

"The continued high level of oil production in Russia is playing its part in the oversupply on the world-wide oil market," Commerzbank said.

Commerzbank reported that, according to the Russian Ministry of Energy, Russia produced 10.6 million barrels a day of crude oil and condensates in October, only slightly down from September and only just short of the record post-Soviet Union era high.

The oversupply continues to put pressure on the Organisation of the Petroleum Exporting Countries, which has so far confounded the market by refusing to rein in production. Many had expected OPEC members to slash production to shore up prices.

On Friday, OPEC Secretary-General Abdalla Salem el-Badri said the group's production volumes are likely to be similar in 2015 to what they were this year.

"A lack of a cut in November doesn't preclude a cut in 2015, and stricter enforcement of the quota is always possible. In fact, we see some signs of a modest decrease through year-end," said analysts at Morgan Stanley.

Some see some hope in lower oil prices. Consumers may start to use more fuel.

"The outlook [for oil prices] is gloomy but we may not be far away from price levels that will stop the oil demand decline and even reverse it," Tamas Varga of research firm PVM, said.

Crude oil prices diverged in London trading Monday morning. Brent crude for December delivery fell 15 cents to $US85.72 a barrel on ICE Futures Europe. West Texas Intermediate crude for delivery in December was up 7c to $US80.61 a barrel on the New York Mercantile Exchange.

ICE gasoil for delivery in November was up $US8.75 at $US750.50 a metric ton, while gasoline was down 48 points at $US2.1430 a gallon.

theaustralian.com.au