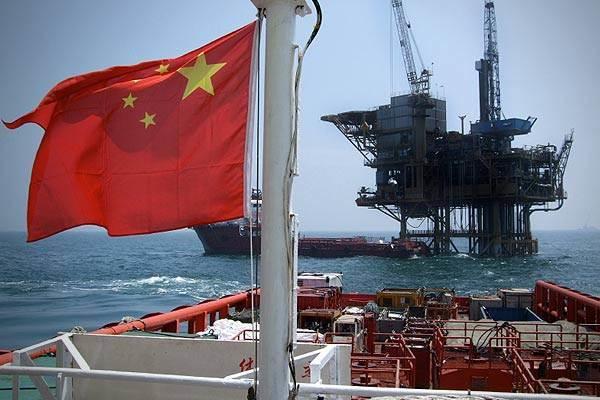

OIL: SOUTH CHINA SEA

China has sent four more oil rigs into the South China Sea in a sign that Beijing is stepping up its exploration for oil and gas in the tense region, less than two months after it positioned a giant drilling platform in waters claimed by Vietnam.

The announcement comes at a time when many countries in Asia are nervous at Beijing's increasing assertiveness in the potentially energy-rich waters, where sovereignty over countless islands and reefs is in dispute.

Coordinates posted on the website of China's Maritime Safety Administration showed the Nanhai number 2 and 5 rigs had been deployed roughly between China's southern Guangdong province and the Pratas Islands, which are occupied by Taiwan. The Nanhai 4 rig was towed to waters close to the Chinese coast.

Earlier this week, the maritime body gave coordinates for a fourth rig, the Nanhai 9, which would be positioned just outside Vietnam's exclusive economic zone by Friday.

Wang Ching-hsiu, deputy director of Taiwan's Land Administration Department, said Taipei claimed an exclusive economic zone around the Pratas Islands, but declined to comment on the rig deployments.

China, which regards Taiwan as a renegade province and claims about 90 percent of the South China Sea, said the rigs were in waters close to Guangdong province and Hainan island. The Philippines, Vietnam, Malaysia, Brunei and Taiwan also have claims to parts of the sea.

"For these normal activities there is no need for over-reading or to make any particular links," Chinese Foreign Ministry spokeswoman Hua Chunying told a daily briefing in Beijing. "Please don't worry, there won't be any problem."

In Washington, the U.S. State Department said it did not have enough information about the placement of the rigs and so would withhold judgment but repeated its long-standing view that it would be troubled if they were in disputed waters.

"If a rig were placed in disputed waters, that would be a concern," State Department spokeswoman Jen Psaki told reporters in Washington. "We certainly have a national interest in the maintenance of peace and stability in the region."

All four rigs are listed as being operated by China Oilfield Services Ltd (COSL), the oil service arm of state-run China National Offshore Oil Company (CNOOC) Group, according to COSL's 2013 annual report.

Three are deepwater platforms and one is a jackup rig used in shallow water.

Reached by telephone, COSL Chief Executive Li Yong said he had seen the maritime announcement but declined to comment. A CNOOC spokesman also declined to comment.

The Global Times, a popular tabloid published by the Communist Party's official People's Daily, quoted Zhuang Guotu, director of the Center for Southeast Asian Studies at Xiamen University, as calling the rig deployment a "strategic move".

"The increase in oil rigs will inevitably jab a sensitive nerve for Vietnam and the Philippines," Zhuang said.

CNOOC HAS LONG EYED DEEPWATER

State oil behemoth CNOOC Ltd, a subsidiary of CNOOC Group, has said it had four new projects scheduled to come on stream in the western and eastern South China Sea in the second half of 2014.

It was unclear if the four rigs were part of those projects, but the company has long said that in a bid to boost production it wanted to explore in deeper waters off China.

CNOOC has said it would increase by up to a third its annual capital spending for 2014, to almost $20 billion. That, combined with output declines at major offshore fields in Bohai Bay in eastern China, made it inevitable that Chinese state oil firms would push into the South China Sea, analysts said.

"It does not surprise us that more rigs are being deployed into the South China Sea - especially over the summer, which is a high-drilling-activity period," said Scott Darling, head of Asia Oil and Gas Research with JPMorgan in Hong Kong.

Roughly 60 percent of CNOOC Ltd's existing production in China comes from its ageing fields in Bohai Bay.

Anti-Chinese violence flared in Vietnam last month after a $1-billion deepwater rig owned by CNOOC Group was parked 240 km (150 miles) off the coast of Vietnam.

Hanoi says the rig is in its 200-nautical-mile exclusive economic zone and on its continental shelf. China has said the rig was operating completely within its waters.

reuters.com