OIL PRICE EXPECTATIONS

December was the sixth consecutive month in which monthly average Brent crude oil prices decreased, falling $17/barrel (bbl) from November to a monthly average of $62/bbl, the lowest since May 2009. The December price decline, and its continuation into early January, reflects continued growth in U.S. tight oil production, strong global supply, and weakening outlooks for the global economy and oil demand growth.

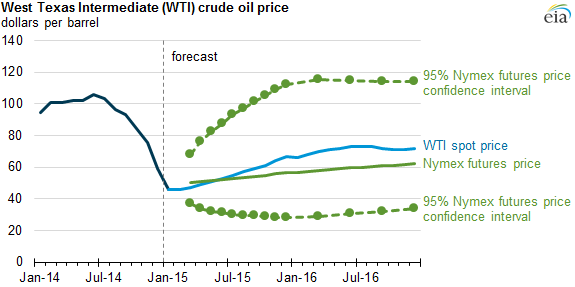

As oil prices have sharply declined, market expectations of uncertainty in the price outlook have increased as reflected in the current values of futures and options contracts. West Texas Intermediate (WTI) futures contracts for April 2015 delivery, traded during the five-day period ending January 8, averaged $51/bbl, with the value of options contracts establishing the lower and upper limits of the 95% confidence interval for the market's expectations of monthly average WTI prices that month at $34/bbl and $76/bbl, respectively. The 95% confidence interval for market expectations widens considerably over time, with lower and upper limits of $28/bbl and $112/bbl for prices in December 2015.

The growing uncertainty surrounding oil prices presents a major challenge to all price forecasts. EIA's January Short-Term Energy Outlook (STEO), released yesterday, forecasts Brent crude oil prices averaging $58/bbl in 2015 and $75/bbl in 2016, with annual average WTI prices expected to be $3/bbl to $4/bbl below Brent.

These price projections reflect a scenario in which supply is expected to continue to exceed demand, leading to inventory builds through the first three quarters of 2015. With increased demand and weakening supply, the market becomes more balanced beyond mid-2015, and prices begin to rise.

Recent global economic data outside the United States has generally been below expectations. With most of the projected increases in future global petroleum consumption expected in developing countries, disappointing international economic news had more downward influence on crude oil prices than positive U.S. economic data.

EIA expects global petroleum and other liquids demand to grow by 1.0 million bbl/d in both 2015 and 2016 from an average of 91.4 million bbl/d in 2014. Nearly all the forecast demand growth comes from non-OECD (Organization for Economic Cooperation and Development) countries. The biggest reduction in forecast non-OECD consumption growth in 2015 comes from a 0.2 million bbl/d decline in Russia's consumption because of its economic downturn. Russia's consumption is expected to decline by a similar amount in 2016. China is the leading contributor to projected global consumption growth, with consumption expected to increase by an annual average of 0.3 million bbl/d over the next two years.

EIA estimates that non-OPEC (Organization of the Petroleum Exporting Countries) production grew by 2.0 million bbl/d in 2014, averaging 56.2 million bbl/d for the year. Growth of non-OPEC supply is expected to slow over the next two years mostly because of lower projected oil prices. EIA expects non-OPEC production to grow by 0.7 million bbl/d in 2015 and by 0.5 million bbl/d in 2016, with the United States as the leading contributor. Given the rapid growth in oil production throughout 2014, the year-over-year comparisons between 2015 and 2014 oil production overstates projected growth in 2015 relative to levels at the end of 2014. For example, U.S. oil production in December 2014 is estimated at 9.2 million barrels per day, only slightly below the average daily 2015 production level in EIA's STEO forecast.

Oil prices could deviate significantly from current projections under different supply and demand conditions. Weaker-than-expected global demand growth would increase the supply overhang and would require larger production cuts to bring the market into balance. Producers' responsiveness to lower prices will determine how soon production is cut. The price decline and lag time required to cause a reduction in forecast non-OPEC supply growth, particularly U.S. tight oil, vary by producer and are also difficult to gauge.

eia.gov