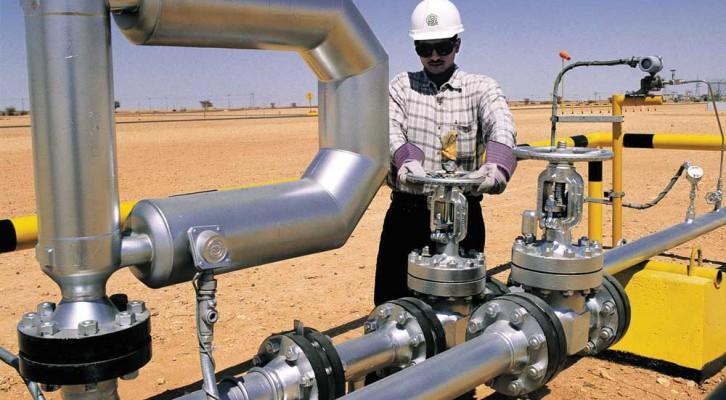

50 IRAN'S OIL&GAS PROJECTS

Iran will pitch more than 50 oil and natural gas projects to foreign investors at a two-day conference in Tehran starting Saturday as the Persian Gulf country prepares for the end of sanctions that have stifled development and production of its energy wealth.

The government hopes international companies will commit at least $100 billion that Iran says it needs to boost oil-production capacity by more than 1 million barrels a day. Oil Minister Bijan Namdar Zanganeh will introduce at the same event a new type of investor contract offering better incentives than the buy-back agreements Iran offered in the past.

Iran will offer a framework for new oil deals to be negotiated project by project, rather than a uniform contract draft for all investors, Amir Hossein Zamaninia, deputy minister for commerce & international affairs, said in Tehran on Nov. 21.

Here are five things to know about this turning point in efforts to revive Iran's energy industry:

- The new contract model gives investors a share of the oil they produce and lets them sell it on the global market, Seyed Mehdi Hosseini, chairman of the Oil Ministry's Oil Contract Restructuring Committee, said last month in Tehran. The more they pump, the more they profit. Conversely, investors will share the burden of a decrease in production. Iran's old buy-back deals paid companies a fixed fee regardless of how much oil they produced and offered them no incentive to exceed output targets. Buy-backs also paid no compensation to companies that spent more than budgeted amounts to develop a field.

- The new contracts will be valid for 20 years, with possible extensions to 25 years. Buy-back agreements were limited to seven years, which wasn't enough time for companies to make adequate returns on their investments, Total SA Chief Executive Patrick Pouyanne said last month in Abu Dhabi.

- Investors will be able to negotiate directly for contracts with Iranian authorities and won't be limited only to bidding. Iran won't allow them to escape their contractual obligations if sanctions are ever re-imposed on Iran, Hosseini said. Companies that explore for oil or gas and come up empty-handed can search for fuel in nearby areas. Under buy-backs, companies had to stick to development plans they agreed to before starting work and were barred from exploring new areas.

- International investors must team up with local partners that the Iranian government has pre-selected, and they can't own hydrocarbon deposits. Iran hasn't yet specified the stakes local companies should hold in joint-ventures that will be formed to develop fields.

- Iran is preparing to start the bidding process for oil and gas rights by the next Iranian calendar year starting March 21. It plans to sign contracts with companies to develop fields within two years after that, said Hosseini of the Oil Contract Restructuring Committee.

-----

More:

RUSSIA & IRAN: STRATEGIC PARTNERS