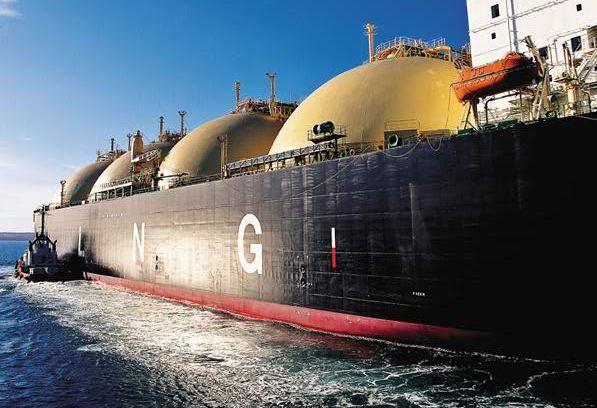

AUSTRALIAN LNG DOWN

Australia's $170-billion liquefied natural gas (LNG) construction boom is winding down, and the hunt for new work is picking up.

As plants owned by companies including ConocoPhillips and Chevron prepare to start production, workers and engineering firms that helped build them, including San Francisco-based Bechtel, are looking for new contracts. That's proving tough at a time when commodity prices are putting future energy and mining developments in doubt.

The decline in investment highlights the challenge facing resources-driven economies from Brazil to Russia that are adjusting to the end of a decade-long bonanza. Australia has seen a "dramatic collapse" in engineering activity as gas-export plants finish, according to consultant Deloitte Access Economics.

"That's the trend I'm seeing, guys ringing me up and saying 'there's nothing happening in Australia for the foreseeable future, is there anything else going on?'" said Tom Michael, a consultant at recruiting specialist EarthStream Global in Singapore. Some managers are moving to the Philippines and China to help manufacture parts for the Yamal LNG project in the Russian Arctic, he said.

'Anxiously Awaiting'

Australia, which rode a natural resources wave to a record 25 years of growth, is now facing downward pressure on prices for its commodity exports and counting on other sectors to cushion the blow.

The expected start this month of a A$24.7 billion ($18 billion) project led by ConocoPhillips and Origin Energy is a sign LNG construction on the east coast is nearing an end. It's the last of the three projects on Curtis Island, near the port town of Gladstone, where BG Group and Santos are already producing the fuel.

Contractors are shifting focus. Bechtel, the company that built $60 billion of LNG plants on the island, said it will bid for work on infrastructure projects in the country, targeting several billion dollars worth of planned rail lines, highways, tunnels, ports and airport expansions.

Moving On

"While we see the downturn in the commodities market, we see an awful lot of interest in building infrastructure projects" in Australia, Kevin Berg, Bechtel's general manager at Gladstone, said in a phone interview. "We're anxiously awaiting the request for proposals or tenders to go out. Then we'll be bidding."

The workforce on Curtis Island has halved from a peak of 14,500 at the end of last year and will keep falling into 2016 as the facilities move into operation, according to Bechtel. That work represents the largest concentration of new projects in the company's 117-year history, Berg said.

The plants have employed more than 26,000 people over the last five years, everyone from welders to crane operators and boilermakers. About 2,000 workers have gone from the island to Chevron's A$29 billion Wheatstone project in Western Australia, which is still under construction, Berg said. Wheatstone is due to start in late 2016, according to Chevron.

1 in 20

Almost half the Curtis Island workers have taken jobs in the local workforce around Gladstone, Berg said. About 20% plan to use the Queensland town as a base for fly-in, fly-out work elsewhere, while smaller numbers are taking time off to rest and travel or retiring, he said.

Elsewhere in the country, which is forecast to overtake Qatar as the world's largest LNG exporter, Inpex Corp.'s Ichthys project in northern Australia is expected to start production in the third quarter of 2017, it said in September. The venture's $34 billion budget may rise by about 10%, Inpex said.

That comes as the price of LNG shipped to Asia has tumbled about 60% from a peak last year amid a global glut.

Only one in every 20 proposed projects are actually necessary by 2025 as weakening Asian economies, cheap coal and the return of nuclear power in Japan temper demand for the power-plant fuel, according to consulting firm IHS.

Difficult Phase

Chevron's $54-billion Gorgon project off northwest Australia, which has employed more than 10,000 people, is due to begin shipments in the first quarter of next year. The US oil producer said in October that it will eliminate 6,000 to 7,000 jobs, the deepest cuts since its 2001 merger with Texaco.

While job losses in Australia's other commodity sectors including iron ore are further along, Reserve Bank of Australia Governor Glenn Stevens said some LNG projects in Western Australia are still only in the investment phase.

"Over the next few years some labor presumably will be released from these projects," Stevens said, speaking in Perth on Wednesday. "So it will be a while yet before we will be able to say that the difficult phase is completed."

-----

More: