HEDGING HELPS

The decline in crude oil prices since last summer has had a direct impact on oil producers' sales revenue, but hedging strategies have lessened the effects of lower prices on some producers' total revenue. Oil producers who adopt hedging strategies can reduce their price risk and generate smoother financial outcomes in unstable markets. A common hedging practice is to sell futures and swaps to lock in desired prices for future production, a practice that can shield producers' revenue from decreasing prices.

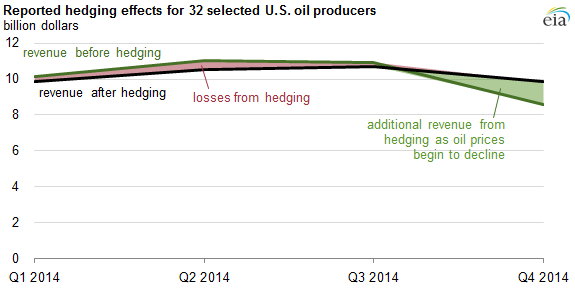

Analysis of hedging can be difficult because not all producers consistently report their hedging activity. In general, producers are not required to report hedge effectiveness in regulated financial statements. However, 32 U.S. oil producers have consistently reported their hedge results in their financial statements. The portfolio of these producers shows a 22% decline in oil sales revenue, down $2.4 billion from $10.9 billion in third-quarter 2014 to $8.6 billion in fourth-quarter 2014. But because of $1.3 billion from hedging activities, the combined sales and hedge revenue in fourth-quarter 2014 had a milder decrease of $1.1 billion.

eia.gov