U.S. IMPORT ELIMINATION

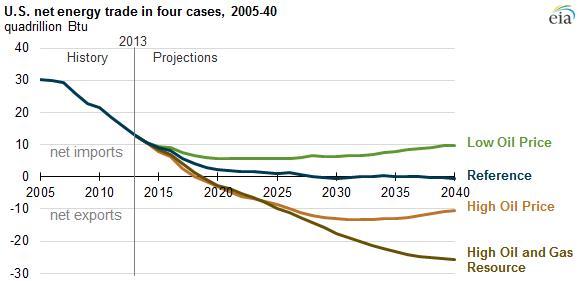

U.S. show the potential to eliminate net energy imports sometime between 2020 and 2030. This reflects changes in both supply and demand, as continued growth in oil and natural gas production and the use of renewables combine with demand-side efficiencies to moderate demand growth. The United States has been a net importer of energy since the 1950s.

The United States is currently an exporter of petroleum products and coal, but an importer of natural gas and crude oil. When the energy content of these fuels is combined, the United States in 2014 imported 23.3 quadrillion British thermal units (Btu) of energy and exported 12.2 quadrillion Btu. Projections in EIA's recently released AEO2015 show that, on an energy content basis, U.S. energy imports and exports could come into balance in coming years.

The timing of the projected end to U.S. net energy imports depends on assumptions about oil prices, energy resources, and economic growth. In the AEO2015 Reference case, imports and exports are balanced starting in 2028. In other cases, such as the High Oil Price and High Oil and Gas Resource cases, the United States becomes a net exporter of energy in 2019. However, in the Low Oil Price case, the United States remains a net energy importer through 2040.

In most of these cases, natural gas is the dominant U.S. energy export, while crude oil and liquid fuels continue to be imported. In all cases, the United States transitions from a net importer of natural gas to a net exporter in 2017. These natural gas exports are mostly sent by pipeline to Mexico or in the form of liquefied natural gas (LNG) to other countries.

The United States continues to be a net importer of crude oil and liquid fuels in most cases, despite increases in exports of petroleum products. Net trade in coal and other energy commodities is relatively unchanged.

These changes in energy trade are anticipated based on both increases in domestic production—especially crude oil and natural gas—and more moderate expectations of demand growth. Subsequent articles will provide more information on these supply and demand projections.

eia.gov