U.S. SHALE REVOLUTION DOWN

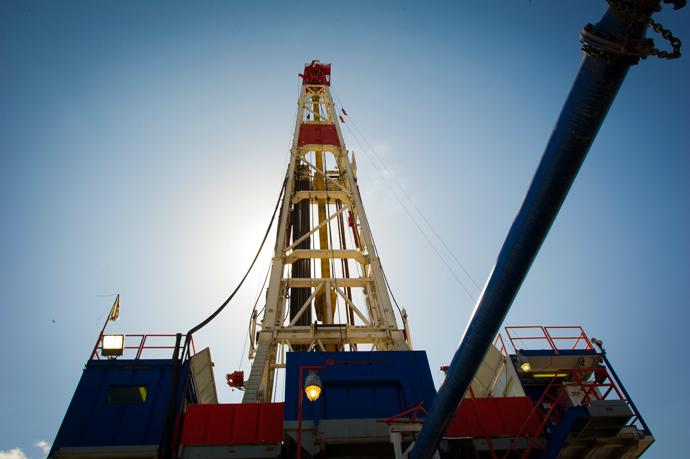

OPEC members (predominately Saudi Arabia) have traditionally been the only countries with the ability to ramp-up production through spare oil supply capacity. Nowadays, however, following the shale revolution, the US onshore market is widely being touted as the industry's new 'swing' producer.

DW expects significantly reduced OFS activity in the US in 2015, with 30% fewer wells drilled, and expenditure down 36% relative to 2014. In the current low price environment, there is a growing trend amongst operators to drill wells, but defer completion. Motivation for these wells – commonly referred to as 'WOCs' (waiting on completion) or 'DUCs' (drilled but uncompleted) – is multi-faceted, but fundamentally producers are holding out for a commodity price recovery, or an OFS cost reduction (or a combination of both). Whilst sinking capital in uncompleted wells is not a sustainable long-term strategy, the growing backlog of DUCs demonstrates an acknowledgement amongst US shale players of the importance of being 'first past the post' upon price recovery. EOG Resources, Apache and Chesapeake Energy are among those that have chosen to widely adopt this strategy.

As the proportion of DUCs grows, the resilience shown by US production may falter sooner than expected. When it does, and the underlying commodity recovers, the extent to which the nascent and fragmented US onshore industry can provide the sort of coordinated 'swing' response required to stabilise price, remains to be seen.

Whilst the oil industry has always been intrinsically cyclical, the control dials are now in the hands of a new market player. The rapid introduction of new supply in the volumes seen from the US onshore industry is unprecedented. Whilst DW believes that prices must recover in the long-term to support required activity, the market is still calibrating. Forecasting prices is more difficult than ever, but continued short-term volatility seems very likely as the market struggles to find balance.

oilandgaseurasia.com