CHINA'S GAS MEGA-PROJECT

The efforts of China to ensure its economic development and preeminence include the creation of the "New Silk Road" - the enormous system of infrastructure mega-projects to stretch from the Pacific to the Atlantic. If completed, it will be the largest infrastructure undertaking ever built. Natural gas features prominently in the plan.

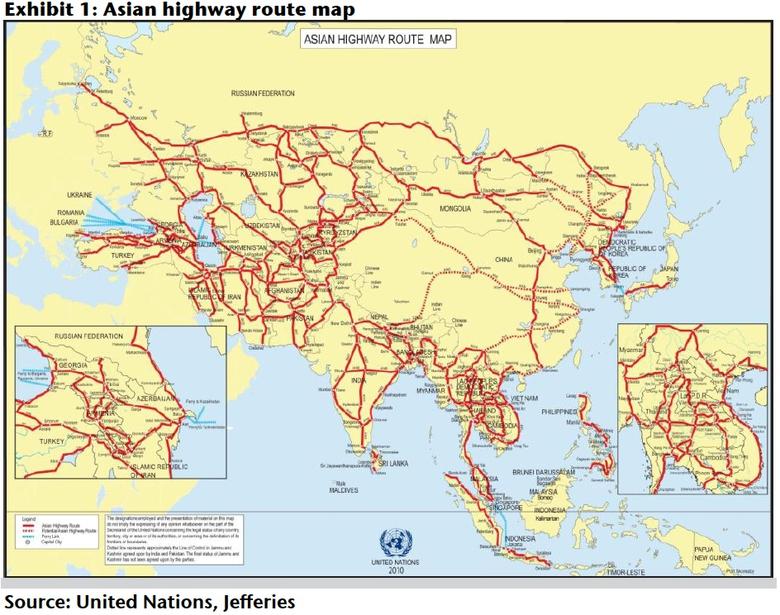

The One Belt – One Road dual pathway will stretch from the Chinese coastal production facilities and ports to Europe through Central Asia and Russia, and through the Pacific and the Indian Oceans to the Atlantic.

The critics say that the grand vision is a way to unload the excess infrastructure building capacity China has built in 30 years of its unprecedented growth, and to translate the $4 trillion astronomical cash reserves into geopolitical clout.

This is why China recently has established a $100 billion Asian Infrastructure Investment Bank, which US attempted to half-heartedly oppose, the $40 billion Eurasia Fund, and other vehicles of investment and infrastructure development.

This is a project bigger than trans-continental railroads of the nineteenth century in North America in Russia. It is bigger than the Suez and Panama Canals combined. If China persist upon its Eurasian Silk Road beyond President Xi's two terms in office, its creation will boost the economy of the transit regions significantly by providing millions of jobs and improving security in "failed" or "failing" states in Central and South Asia: Myanmar, Bangladesh, Pakistan, Afghanistan, Tajikistan, and Kyrgyzstan, to mention a few.

The talk in Beijing today is of railways, power stations, power transmission lines, oil and gas fields and pipelines, fiber optic cables, highways, ports and airports. The "One Belt—One Road" expansive vision for China's western pursuit is the signature project of President Xi Jinping.

The One Belt-One Road will stretch on land: through Mongolia, Kazakhstan and Russia, to Western Europe. There are southern branches to Burma (Myanmar), Pakistan and Iran. A look at the map discloses that China "hugs" India by building the Karakorum highway to the Pakistani port of Gwadar on the Arabian Sea. This makes the leadership in New Delhi nervous, taking into account that in 1962 the two Asian giants have fought a fierce but short war in Tibet, with India losing territory.

The Maritime Silk Road, a shipping super-highway stretching from the busy ports of Eastern China via the Straits of Malacca, along Burma, Sri Lanka and into Africa and the Persian/Arab Gulf, will be a conduit for cargo as well as for liquefied natural gas (LNG).

"One Belt-One Road" features natural gas projects prominently. First, it's backbone: the longest pipeline on earth, the Central Asia – China pipeline of 8,000 km, which goes from Turkmenistan via Uzbekistan and Azerbaijan, to China. Currently, it supplies 55 billion cubic meters of gas a year to the energy-starved and polluted Chinese cities. CNPC executives, who built this feat of engineering, pat themselves on the back. Deservedly so.

The two Russian pipelines: Power of Siberia in the East and Altay in the West, are capable of brining up to 80 bcm of gas a year to China, when fully built. The challenge is the price, the terrain, and reserves for the Altay pipeline – currently those are not confirmed.

However, Chinese appetites do not stop there. Turkmenistan and Iran have the fourth and the second largest reserves on the planet respectively. A much-discussed Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline, and the Iran-Pakistan-India (IPI) pipeline are both on the table. Beijing would like to extend a pipeline from either one of them – to China. However, the Balochi Sunni Moslem rebels who fight both the Shia Islamic Republic of Iran and the Sunni, but mostly secular regime in Islamabad, threaten IPI, while the Taliban in Afghanistan may derail TAPI. The very tough mountainous terrain and syphoning of gas by the local tribes are additional problems the pipelines will face. The security challenge for the Chinese and local operators are going to be huge.

However, if the pipelines are delayed, one can envisage the LNG tankers on the maritime Silk Road is going to bring LNG to China from Australia, East and West Africa, and the Gulf.

Speaking of energy security of the region, the implementation of this mega-project will also allow energy resources to flow to new consumers in the developing regions. Moreover, creation of unified energy systems will make the participating countries interdependent in terms of energy consumption, which will serve as a "safety net" for regional security.

Having the rules of engagement equitable and transparent will go a long way to attract stake-holders and capital to the infrastructure projects, including ports, oil and gas fields and pipelines, LNG and other port facilities, petrochemical processing, and IT.

If it does it right, China can strengthen its own security, interdependence and cooperation with the world by allowing Western, including North American and global firms, to participate in this historic undertaking.

naturalgaseurope.com