OIL PRICES 2015 - 16

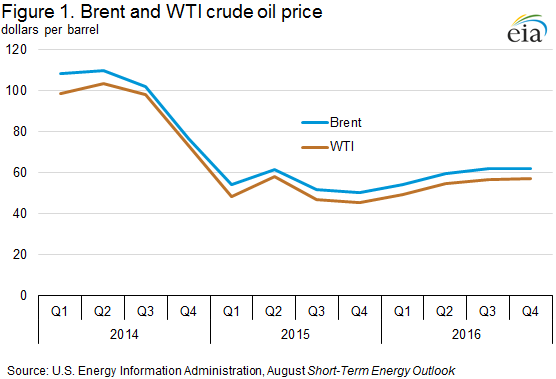

North Sea Brent crude oil prices will average $54 per barrel (b) in 2015 and $59/b in 2016.

The price decline reflects concerns about lower economic growth in emerging markets, expectations of higher oil exports from Iran, and continuing growth in global inventories. WTI prices are expected to average $5/b below Brent in both 2015 and 2016.

The oil market faces a host of uncertainties heading into 2016 including the pace and volume at which Iranian oil reenters the market, the strength of oil consumption growth, and the responsiveness of non-OPEC production to low oil prices. In the more immediate future, there is potential downward price pressure heading into the fourth quarter if refinery runs drop by more than expected during the fall maintenance season.

The current values of futures and options contracts continue to suggest high uncertainty in the price outlook (Market Prices and Uncertainty Report). WTI futures contracts for November 2015 delivery, traded during the five-day period ending August 6, averaged $47/b, while implied volatility averaged 37%. These levels established the lower and upper limits of the 95% confidence interval for the market's expectations of monthly average WTI prices in November 2015 at $34/b and $64/b, respectively. The 95% confidence interval for market expectations widens over time, with lower and upper limits of $27/b and $103/b for prices in December 2016.

OPEC crude oil production to increase by 0.8 million b/d in 2015 and remain relatively flat in 2016. Iraq is expected to be the largest contributor to OPEC production growth in 2015. However, there is considerable uncertainty regarding Iraq's ability to sustain the higher production and export levels, particularly in light of the infrastructure constraints in the southern terminals.

OPEC member Iran is another source of uncertainty regarding production. On July 14, the P5+1 (the five permanent members of the United Nations Security Council and Germany) and Iran reached an agreement that could result in relief from United States and European Union nuclear-related sanctions (which include some oil-related sanctions). If sanctions relief occurs, it will put additional Iranian oil supplies on a global market that has already seen oil inventories rise significantly above historical levels over the past year. This forecast assumes sanctions relief occurs in 2016, contributing to an annual average increase in Iranian crude oil production of 0.3 million b/d from 2015 to 2016, with most of the increase coming in the second half of the year.

U.S. crude oil production will average 9.4 million b/d in 2015 and 9.0 million b/d in 2016, 0.1 million b/d and 0.4 million b/d lower, respectively, than in July's STEO. Total U.S. crude oil production declined by 100,000 barrels per day (b/d) in July and will generally continue to decrease through mid-2016 before growth resumes late in 2016. The decrease in the crude oil production forecast reflects a lower oil price outlook that will reduce expected oil-directed rig counts and drilling and well-completion activities throughout the forecast period.

Expected crude oil production declines are largely attributable to unattractive economic returns in some areas of both emerging and mature onshore oil production regions, as well as seasonal factors such as anticipated hurricane-related production disruptions in the Gulf of Mexico. Reductions in 2015 cash flows and capital expenditures have prompted companies to defer or redirect investment away from marginal exploration and research drilling to focus on core areas of major tight oil plays. Reduced investment has resulted in the lowest count of oil-directed rigs in nearly five years and well completions that are almost half of 2014 levels. Further, the reversal in June and July of the short-lived recovery in crude oil prices and lowered outlook for oil prices over the forecast period are expected to prolong and deepen onshore production declines.

Despite the downward revision to U.S. crude production growth, total non-OPEC supply is expected to increase by 1.4 million b/d in 2015 and remain flat in 2016. This output, combined with OPEC supply increases, will exceed demand in both 2015 and 2016, resulting in continued large inventory builds. World inventory builds of 2.0 million b/d and 0.9 million b/d in 2015 and 2016, respectively.

-----

More: