ROSNEFT SELLS SIBERIA: $1.27 BLN

OAO Rosneft will sell a stake in one of its largest oil-producing projects to ONGC Videsh Ltd., the overseas-investment arm of India's biggest explorer, for $1.27 billion, people familiar with the plan said.

The unit of state-owned Oil & Natural Gas Corp. will take a 15 percent share in Vankorneft, Russia's second-largest oil producing development, the companies said at a signing ceremony Friday in Vladivostok, in Russia's Far East. ONGC Videsh is studying financing options for Vankor and will spend an additional $500 million on the project, one person said, asking not to be identified because of internal policy.

State-run Rosneft, impeded by Western sanctions on Russia, is looking for investments from its Asian neighbors to cut mounting debt and fund expansion. ONGC, which is tasked with meeting India's energy security, is tying up new sources of crude oil from Latin America to Russia to ensure steady supplies.

"The deal clearly shows ONGC is pushing forward to build a global portfolio in oil," Neil Beveridge, a Hong Kong-based analyst at Sanford C. Bernstein & Co., said in a phone interview on Friday. Acquiring assets "will be critical as India's demand continues to grow and oil imports accelerate."

ONGC shares fell 1.6 percent to 225.55 rupees at the close in Mumbai, tracking the benchmark S&P BSE Sensex's 2.2 percent decline. Rosneft dropped as much as 1 percent to 246.70 rubles and traded at 247.40 rubles as of 2:22 p.m. in Moscow.

Talks Continue

Russia's biggest crude producer will continue talks for selling more stakes in Vankor to other companies, including China National Petroleum Corp., Igor Sechin, chief executive officer of Rosneft, told reporters after the deal was announced early Friday. The deal sets "a market price" for the asset, he said.

ONGC Videsh expects to close the deal by March, Managing Director Narendra Kumar Verma said in a phone interview from Russia. Output from Vankor is expected to account for about one-third of ONGC's overseas oil production, he said. ONGC Videsh's share will be about 66,000 barrels a day, according to a company statement.

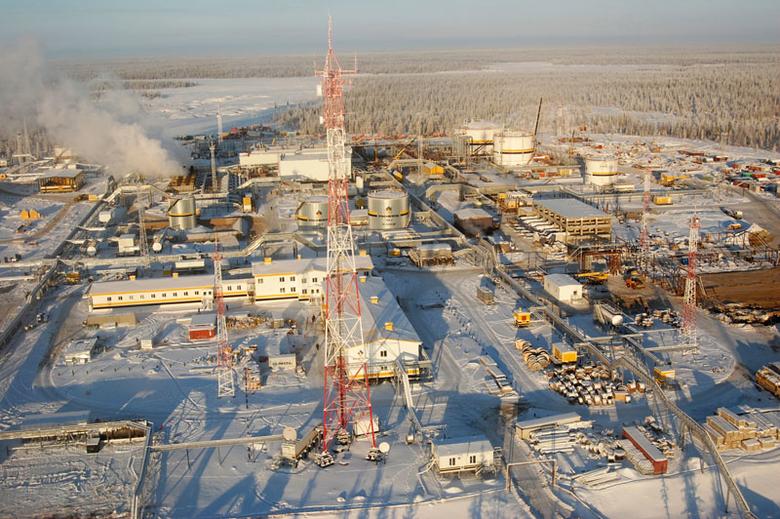

The Vankor field, which started production in 2009, is one of the largest in Russia, with recoverable reserves estimated at about 500 million tons. Vankor pumped about 80.9 million barrels of oil in the first six months of the year, according to the company. The field produces more than 60,000 tons (about 440,000 barrels) a day and is one of the main sources of supply for the Eastern Siberia-Pacific Ocean pipeline, Rosneft said on Friday.

'Strategic Cooperation'

"This will give an impulse to development of our partnership, probably in the other large-scale oil and gas upstream projects in the region," Sechin said in a statement. The agreement will allow a "brand new level of strategic cooperation between Rosneft and ONGC," he said.

ONGC Videsh also owns 20 percent in the Sakhalin-1 project off Russia's far eastern coast, which it acquired in 2001. The project produces oil and gas; ONGC Videsh gets a share of the output or equivalent revenue. While ONGC spent $2.1 billion to buy Imperial Energy Corp. in Russia in 2009, output from the field witnessed a decline.

"They have had a mixed record in Russia so far," Beveridge said. "Sakhalin was a great project, but Imperial turned out to be very disappointing. Vankor is one of Russia's largest fields and there may be an oil off-take agreement with Rosneft as part of this."

-----

More: