CANADA'S HOPE PRICE: $2 BLN

According to EnergyNow, a flurry of stock sale financings by oil and gas producers in Canada has sparked optimism among investors that the stalled drilling industry will soon go back to work.

But analysts warn that's not likely to happen this year, dashing faint hopes of thousands of Western Canadian oilfield workers who have been laid off since benchmark oil prices peaked at over US$107 US per barrel two years ago in June 2014.

Since January, nearly $2 billion has been raised by Canadian non-oilsands producers on equity markets, but most of it has been geared to paying down debt or funding acquisitions, not for drilling new wells, according to a recent report from AltaCorp Capital.

Analyst Aaron MacNeil said he wrote the report to temper expectations of investors who are watching the recent rise in oilfield service companies' share prices. Prices for Canada's two largest drillers, Precision Drilling (TSX:PD) and Ensign Energy Services (TSX:ESI), for example, have risen by more than 30 per cent since March 1.

"You're at a seasonal trough in Canada right now but I think, in terms of sentiment, you're probably at a trough, too," said MacNeil. "Pricing is obviously still a really tough, tough part of the business for drillers."

In April, natural gas producer Tourmaline Oil Corp. (TSX:TOU) raised $282 million by selling shares. The producer announced it would use the funds to pay down debt — including $183 million racked up earlier in the year to buy assets near its northwestern Alberta production base.

Despite the new opportunities provided by the purchase, however, the Calgary-based intermediate said last month it had reduced its development spending budget for the first half of 2016 from $350 million to $310 million, preferring to avoid spending in view of low natural gas price forecasts.

On Wednesday, it said it would cap the wells it drills over this summer and fall until at least the fourth quarter to avoid selling initial flush natural gas production into a down price market.

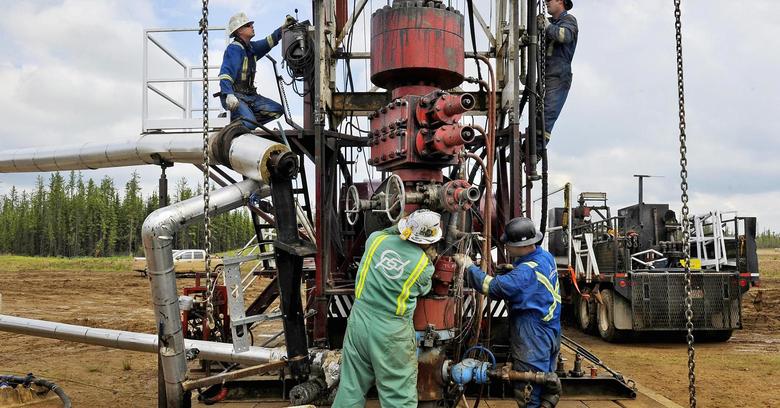

John Bayko, vice-president of communications for the Canadian Association of Oilwell Drilling Contractors, said only 68 rigs were working in Canada last week, down from about 125 at the same time in 2015 and 280 two years ago.

That indicates there are roughly 29,000 fewer jobs now than two years ago, Bayko said, using the CAODC formula of 20 direct jobs and 115 indirect jobs created per active rig.

"This downturn has gone on for so long, cash flows have been down for so long, people have left the sector and we don't know if they are going to be coming back," he said.

"It's going to take a much longer period of higher commodity price to sort of recover from where companies are at among our membership."

The Canadian Association of Petroleum Producers estimated in April that 110,000 direct and indirect jobs have been lost in the energy industry in the past two years.

The AltaCorp report points out it is often cheaper now to buy existing producing wells than to drill new ones.

"The predominant use of proceeds in 2015 and 2016 has been balance sheet repair," it says.

Analyst Justin Bouchard of Desjardins Capital Markets said in a recent report that he believes the North American drilling sector has entered a recovery mode after hitting rock bottom in recent weeks.

"However, we still expect the pace of ramp-up to remain measured," he wrote. "While the fundamentals are clearly improving, it will be a long road back for drilling activity, with many producers looking to use a period of higher prices to nurse balance sheets back to health."

Analyst Jeff Fetterly of Peters and Co. said the current quarter could be the weakest on record for Western Canadian oilfield activity and the outlook for the second half of this year is "cautious."

Stronger commodity prices, however, suggest that producers will spend more in 2017, he said in a report, adding that a forecast 50 per cent increase in oilfield activity versus 2016 will still leave the sector at a lower level than in 2015.

Benchmark oil prices have risen almost 90 per cent to about US$50 per barrel since January when they touched a 13-year low.

But while U.S. natural gas prices have strengthened recently, prices at the Alberta trading hub have not as Canadian storage levels remain close to capacity, FirstEnergy Capital analyst Martin King pointed out in a report last week.

-----

Earlier:

CANADA'S GAS PRODUCTION WILL UP

CANADA'S LONG-TERM EFFECTIVENESS