2018 OIL MARKET FORECAST

IEA - Falling global crude oil stockpiles in 2017 will help put the market "roughly" into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn't stick to its agreement to curb output.

Recent upward momentum in crude prices was provided by uncertainty with suppliers such as Libya, Venezuela, Iran, and northern Iraq, signs of possibly slower-than-expected growth in US shale production, and strong oil demand, IEA explained.

Meanwhile, OPEC crude output was virtually unchanged in September at 32.65 million b/d, down 400,000 b/d year-over-year, as slightly higher supply from Libya and Iraq offset lower supply from Venezuela. Year-to-date compliance with the group's agreement to curtail output by 1.2 million b/d is 86%.

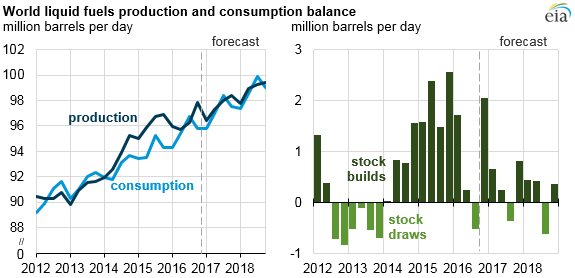

Assuming OPEC production remains at that level, global crude stockpiles are slated to fall 300,000 b/d in 2017. While the data is subject to revision, IEA said it can "now clearly see a major reduction in floating storage, oil in transit, and stocks held in some independent areas."

In the Organization for Economic Cooperation and Development, the 5-year average stock overhang is down to 170 million bbl from 318 million bbl at the end of January. Stocks have fallen in months when they normally increase, offsetting net builds in China, where crude imports have fallen every month since June, and the implied net build for stocks in September was relatively small at 100,000 b/d.

Based on unchanged OPEC output and normal weather conditions, IEA expects three of four quarters in 2018 to be "roughly balanced," with a first-quarter stock build of 800,000 b/d.

But IEA projects oil demand and non-OPEC production in 2018 will grow by about the same volume, which could act as a ceiling for oil prices. Non-OPEC output is expected to increase 700,000 b/d in 2017 and 1.5 million b/d in 2018. Projected global demand growth remains at 1.6 million b/d in 2017 and 1.4 million b/d in 2018.

With OPEC members scheduled to meet in Vienna on Nov. 30, IEA notes the next few weeks "will be crucial in shaping their decision on output." It added, "A lot has been achieved towards stabilizing the market, but to build on this success in 2018 will require continued discipline."

-----

Earlier:

October, 11, 12:55:00

РЫНОК БУДЕТ СБАЛАНСИРОВАН"Ключевую роль играли две стороны — Россия и Саудовская Аравия как крупнейшие производители нефти в мире. Примерно 11 млн баррелей в сутки добывает Саудовская Аравия, Российская Федерация — чуть больше, мы занимаем первое место.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|

October, 2, 14:45:00

OIL PRICES: $50 - $60 AGAINA snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

|

September, 29, 12:30:00

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕСегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее.

|

September, 25, 13:20:00

СОКРАЩЕНИЕ ОБЪЕМОВ ДОБЫЧИ: 116%В заявлении Министерского мониторингового комитета (ММК) стран ОПЕК и не входящих в ОПЕК государств говорится, что, согласно отчету Совместного технического комитета (СТК) стран ОПЕК и не входящих в организацию нефтедобывающих стран за август 2017 года, уровень выполнения странами ОПЕК и участвующими государствами не-ОПЕК своих добровольной корректировки объемов добычи нефти достиг исторического максимума, составив 116%.

|

September, 15, 09:00:00

OIL PRICES: $50 - $60Oil prices are expected to hold between $50 and $60 a barrel as bloated global stocks fall after a deal between OPEC and other producers to trim output, BP Chief Executive Bob Dudley said on Thursday.

|

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation. |