OIL PRICE: NOT BELOW $55

REUTERS, BLOOMBERG, OILPRICE - Oil prices stabilized on Monday after one of the most bearish weeks in months, propped up by OPEC comments signaling the possibility of continued action to restore market balance in the long term.

Oil production platforms in the Gulf of Mexico started returning to service after Hurricane Nate forced the shutdown of more than 90 percent of crude output in the area. The prospective restarts kept price gains in check.

Former hurricane Nate has become a post-tropical cyclone that continues to pack heavy rain and gusty winds, the U.S. National Hurricane Center (NHC) said on Monday.

"Quiet market overall this morning though (refined) products are weaker as it looks like Nate was a non-event for refining," said Scott Shelton, broker at ICAP in Durham, North Carolina.

"I think that without the support of products and Brent, the market may get dragged lower in the near term as its apparent that the market doesn't care much about OPEC already jawboning about an extension of the deal."

The Organization of the Petroleum Exporting Countries is due to meet in Vienna on Nov. 30, when it will discuss its pact to reduce output in order to prop up the market.

OPEC Secretary-General Mohammad Barkindo said on Sunday that consultations were under way for an extension of the agreement beyond March 2018 and that more oil-producing nations may join the pact, possibly at the November meeting.

He also said OPEC members and other producers may have to take some "extraordinary measures" to ensure the market is in balance in the long term.

In a speech to the Reuters Global Commodities Summit on Monday, Barkindo said he saw clear evidence the oil market was rebalancing.

Global benchmark Brent crude LCOc1 was down 2 cents at $55.60 a barrel at 11:31 a.m. EDT (1531 GMT). Earlier in the session it touched a three-week low of $55.06. It ended last week 3.3 percent lower, its biggest weekly loss since June 2017.

U.S. West Texas Intermediate crude futures CLc1 were trading at $49.46, up 17 cents. They came close to a four-week low when they fell to $49.13 earlier in the session. WTI's losses last week came to 4.6 percent.

In further signs that OPEC members are sticking to agreed cuts, Saudi Arabia said it had curtailed crude allocations for November by 560,000 barrels per day and Iraq's oil minister said the country was fully committed to its OPEC production target.

Among other bullish news for oil, Morgan Stanley cut its forecast for U.S. crude output growth, citing a range of operational headwinds including limited availability of fracking crews.

Money managers raised their bullish bets on U.S. crude futures for the third week in a row, the U.S. Commodity Futures Trading Commission reported on Friday.

However, data published by InterContinental Exchange showed investors had slightly reduced their bets on rising Brent prices in the week ending Oct. 3.

-----

Earlier:

October, 6, 13:00:00

OIL PRICE: ABOVE $56 YETGlobal benchmark Brent crude futures were up 7 cents at $57.07 a barrel at 0848 GMT. Week on week, the contract was set for a near 1 percent loss, snapping a five-week winning streak that was the longest since June 2016. U.S. West Texas Intermediate (WTI) crude was at $50.59, down 20 cents. It was set to close the week down more than 2 percent, the biggest weekly loss in three months.

|

October, 6, 12:50:00

NEW OIL COALITIONAs the world's two largest oil producers, Saudi Arabia and Russia have led the 24-country OPEC/non-OPEC coalition in its 1.8 million b/d supply cut, which is scheduled to end in March.

|

October, 4, 23:59:00

OIL PRICE: ABOVE $55U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $50.16 per barrel at 0648 GMT, down 26 cents, or 0.5 percent, from their last close. They fell below $50 per barrel earlier in the session. Brent crude futures LCOc1 were down 22 cents, or 0.4 percent, at $55.78 a barrel.

|

October, 4, 23:30:00

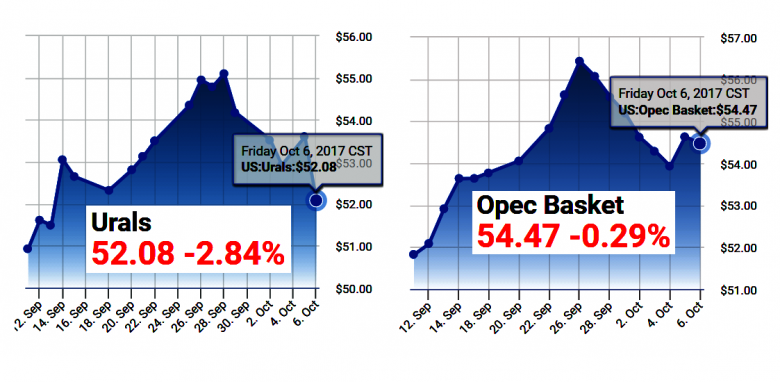

ЦЕНА URALS: $ 50,55Средняя цена нефти марки Urals по итогам января - сентября 2017 года составила $ 50,55 за баррель.

|

October, 2, 15:00:00

OIL PRICE: ABOVE $56Brent crude, the global benchmark, was down 12 cents at $56.67 a barrel at 0846 GMT. It notched up a third-quarter gain of around 20 percent, the biggest third-quarter increase since 2004 and traded as high as $59.49 last week. U.S. crude was down 17 cents at $51.50. The U.S. benchmark posted its strongest quarterly gain since the second quarter of 2016.

|

October, 2, 14:45:00

OIL PRICES: $50 - $60 AGAINA snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

|

September, 29, 12:35:00

OIL PRICE: ABOVE $57U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month. Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September.

|