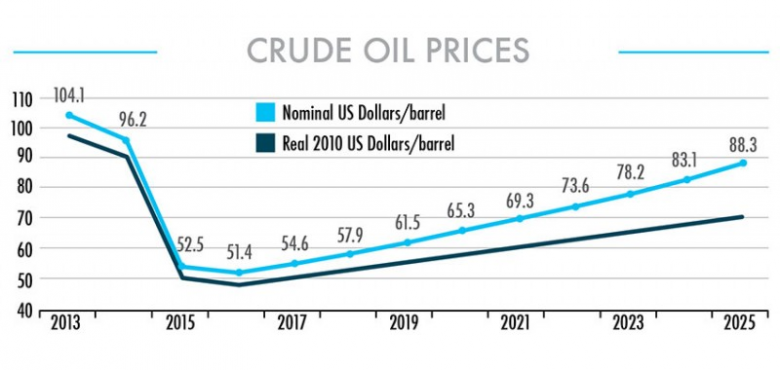

OIL PRICES 2020: $50 - $60

OGJ - Based on a "lower-for-longer" base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

The outlook is driven by a mixture of negative—supporting lower prices—and positive—supporting price recovery—market fundamentals, which are expected to impact the speed of market rebalancing and price recovery, in the medium and long terms.

Global oil demand growth will gradually slow to 1 million b/d/year in 2017-21 driven by flattened global economic growth, improved energy efficiency, and electric vehicle substitution.

MEI projects the global gross domestic product growth will slow to 2.4-2.7%/year through 2030. Oil intensity, measured by million barrels per day over GDP, will be 40% lower in 2030 compared with the level in 2000. Particularly, annualized liquids demand growth will be 400,000 b/d during 2025-30 compared with 1.2 million b/d during 2015-20.

On the supply side, MEI notes that average production costs have been dramatically reduced, thanks to lower labor costs, a stronger US dollar, decreased operation services, and less maintenance. MEI believes that the recent improvements in project costs are expected to be partially maintained, with production costs in 2030 to be 15-20% less than the costs in 2014.

In terms of production outside of the Organization of Petroleum Exporting Countries, decline rates have visibly accelerated in onshore conventional fields resulting in a 1 million b/d/year rise in production to 2021. Also, new resource types decline faster than onshore conventional fields. This results in an acceleration of average annual declines.

"The industry needs to replace 3-4 million b/d production every year due to declining production in mature basins," MEI said.

OPEC reached full level of compliance with the November production-cut deal. However, production growth in deal-exempt countries and natural gas liquids offset a large part of the cuts. MEI expects that, following historical patterns, OPEC will adhere to production cuts and then ramp up production when markets tighten again.

According to MEI, US shale oil output will keep rising despite low prices, reaching 6.6 million b/d by 2021 and 8 million b/d by 2025 because of improved breakevens and capital availability. Growth will be mostly driven by drilling in the Permian basin. Depending on oil price scenarios, production can vary by 5.5 million b/d.

However, after peak in 2026, MEI sees US shale oil production declining because of resource constraints in the Bakken and Eagle Ford areas.

In general, production from projects reaching final investment decision after 2014 is not enough to fill the supply gap, global oil markets will be tightened by 2020-21, according to MEI.

The firm also forecasts that it will take 2-3 years for stocks to go back to 5-year average levels given the current overhang.

In the long term, 2020-30, MEI estimates that exploration and production companies will need to add 35 million b/d of crude production from unsanctioned projects by 2030 to meet demand. Under these circumstances, 2025-30 marginal costs are projected to reach $60-70/bbl.

-----

Earlier:

October, 9, 21:55:00

OIL PRICE: NOT BELOW $55Global benchmark Brent crude LCOc1 was down 2 cents at $55.60 a barrel at 11:31 a.m. EDT (1531 GMT). Earlier in the session it touched a three-week low of $55.06. It ended last week 3.3 percent lower, its biggest weekly loss since June 2017. U.S. West Texas Intermediate crude futures CLc1 were trading at $49.46, up 17 cents. They came close to a four-week low when they fell to $49.13 earlier in the session. WTI’s losses last week came to 4.6 percent.

|

October, 6, 12:55:00

ДОВЕРИЕ НА РЫНКЕГоворя о результатах заключения соглашения о сокращении добычи нефти, глава Минэнерго России сообщил, что «мы достигаем целей, которые были обозначены в рамках сделки с ОПЕК». «Мы наблюдаем возврат инвестиций в отрасль, постепенно рынок балансируется. В соглашении об ограничении участвует 24 страны, на которые приходится 55 млн баррелей добычи нефти в стуки. Между нашими странами возникло доверие, и мы рады будем привлечению других участников», - сказал Александр Новак.

|

October, 6, 12:50:00

NEW OIL COALITIONAs the world's two largest oil producers, Saudi Arabia and Russia have led the 24-country OPEC/non-OPEC coalition in its 1.8 million b/d supply cut, which is scheduled to end in March.

|

October, 2, 14:45:00

OIL PRICES: $50 - $60 AGAINA snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

|

September, 29, 12:30:00

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕСегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее.

|

September, 25, 13:20:00

СОКРАЩЕНИЕ ОБЪЕМОВ ДОБЫЧИ: 116%В заявлении Министерского мониторингового комитета (ММК) стран ОПЕК и не входящих в ОПЕК государств говорится, что, согласно отчету Совместного технического комитета (СТК) стран ОПЕК и не входящих в организацию нефтедобывающих стран за август 2017 года, уровень выполнения странами ОПЕК и участвующими государствами не-ОПЕК своих добровольной корректировки объемов добычи нефти достиг исторического максимума, составив 116%.

|

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation.

|