SAUDIS SUPPORTS THE REDUCTION

BLOOMBERG - Oil closed at its highest in more than two years in London, nearing $60 a barrel, as Saudi Crown Prince Mohammed bin Salman backed the extension of OPEC output cuts.

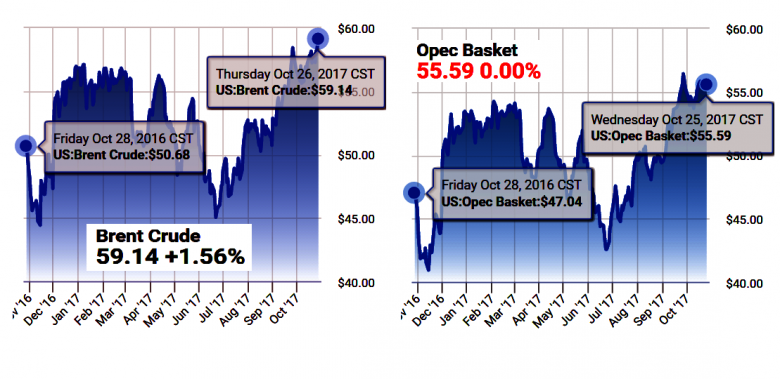

Brent, the global crude benchmark, rose 1.6 percent. Prince Mohammed said in an interview that "of course" he wanted to extend OPEC's production cuts beyond March 2018. His comments follow President Vladimir Putin saying Russia is open to extending the deal to the end of next year.

"Saudi has stayed consistent with its desire to extend the production cuts, and continue the gradual erosion of global crude inventory," Michael Hiley, head of over-the-counter energy trading at New York-based LPS Partners, said.

Mounting signs that the Organization of Petroleum Exporting Countries and its allies may agree to extend the output-reduction deal at a meeting in Vienna later next month have helped U.S. oil hold above $50 and Brent above $55 for most of this month.

"The OPEC story is definitely supportive. You've got to say they have earned back the market's respect. They have gained credibility by compliance," Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago, said by telephone. Yet the bearish argument is that the "shale oil producers are going to raise production. There are still some doubts in the market."

Brent for December settlement rose 86 cents to end the session at $59.30 a barrel, the highest since June 2015, on the London-based ICE Futures Europe exchange. The global benchmark traded at a premium of $6.66 to WTI.

West Texas Intermediate for December delivery added 46 cents to settle at $52.64 a barrel, the highest since April, on the New York Mercantile Exchange. Total volume traded was about 18 percent below the 100-day average.

Tighter Supplies

In a sign that international supplies are tightening with OPEC's cuts, the front-month Brent contract has traded higher than futures for any other month, a structure known as backwardation that signals rising demand for prompt deliveries.

"The forward structure of the market, with increasing backwardation, illustrates that the plan is working.," Hiley said.

In the U.S., on the other hand, crude output rose by the most since 2012 last week as shale producers reap the results of a drilling ramp-up that started in May of last year. While they've started to reduce the number of oil rigs lately, many drilled wells are yet to be fracked and start producing, meaning output is still set to rise. That may limit the scope of oil's rally in New York.

"We're stuck in the $50-$55 range," Jay Hatfield, a New York-based portfolio manager at the InfraCap MLP exchange-traded fund, said by telephone. Next year, prices may break above $55 a barrel, but "we see it as a running game, not a passing game. It's going to slowly grind higher."

Oil-market news:

Iraq resumed exports of crude from the disputed Kirkuk province through a Kurdish-operated pipeline to Turkish port of Ceyhan.

ConocoPhillips helped kick off earnings season for the world's biggest oil companies with a bang, more than tripling analyst profit estimates on the strength of higher crude prices and a crash diet of asset sales.

Oil will stabilize $55 to $60 a barrel in the near term, according to Apollo Global Management LLC Chief Executive Officer Leon Black.

-----

Earlier:

October, 25, 12:40:00

OIL PRICE: ABOVE $58 AGAINBrent crude, the global benchmark, was up 8 cents at $58.41 a barrel by 0646 GMT, after settling on Tuesday up 96 cents, or 1.7 percent. U.S. West Texas Intermediate crude was trading down 9 cents at $52.38. |

October, 25, 12:35:00

OPTIMISTIC OIL PRICESFutures edged higher from the settlement in after-market trading in New York, prompted by reports that data from the American Petroleum Institute showed a 5.75 million barrel drop in gasoline last week and 4.95 million fewer barrels of distillate. Meanwhile, OPEC, set to meet next month on prolonging the cuts, are said to be planning how to prevent a new price-killing glut once they end.

|

October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

October, 25, 12:25:00

OPEC COOPERATIONCompliance among OPEC and major non-OPEC producers reached 120% in September, its highest level since the output constraint deal was launched in January, the Joint Ministerial Monitoring Committee said.

|

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|