TRANSCANADA'S CAPITAL PROGRAM: $24 BLN

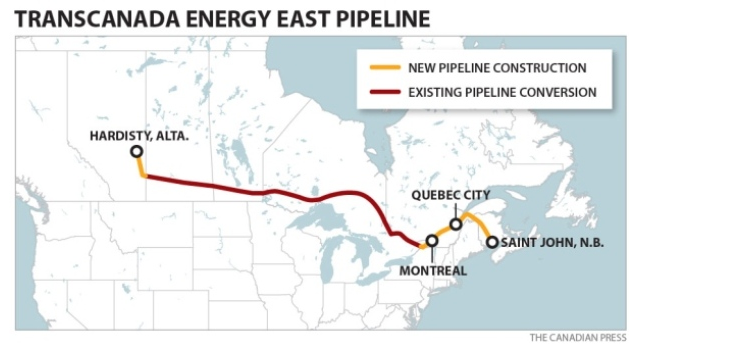

TRANSCANADA - TransCanada Corporation (TSX, NYSE: TRP) (TransCanada) announced today it will no longer be proceeding with its proposed Energy East Pipeline and Eastern Mainline projects.

Following is a statement from TransCanada President and Chief Executive Officer Russ Girling:

After careful review of changed circumstances, we will be informing the National Energy Board that we will no longer be proceeding with our Energy East and Eastern Mainline applications. TransCanada will also notify Quebec's Ministère du Developpement durable, de l'Environnement, et Lutte contre les changements climatiques that it is withdrawing the Energy East project from the environmental review process.

We appreciate and are thankful for the support of labour, business and manufacturing organizations, industry, our customers, Irving Oil, various governments, and the approximately 200 municipalities who passed resolutions in favour of the projects. Most of all, we thank Canadians across the country who contributed towards the development of these initiatives.

We will continue to focus on our $24 billion near-term capital program which is expected to generate growth in earnings and cash flow to support an expected annual dividend growth rate at the upper end of an eight to 10 per cent range through 2020.

As a result of its decision not to proceed with the proposed projects, TransCanada is reviewing its approximate $1.3 billion carrying value, including allowance for funds used during construction (AFUDC) capitalized since inception and expects an estimated $1 billion after-tax non-cash charge will be recorded in the company's fourth quarter results. TransCanada stopped capitalizing AFUDC on the project effective August 23, 2017, as disclosed on September 7, 2017. In light of the project's inability to reach a regulatory decision, no recoveries of costs from third parties are expected.

With more than 65 years' experience, TransCanada is a leader in the responsible development and reliable operation of North American energy infrastructure including natural gas and liquids pipelines, power generation and gas storage facilities. TransCanada operates one of the largest natural gas transmission networks that extends more than 91,500 kilometres (56,900 miles), tapping into virtually all major gas supply basins in North America. TransCanada is the continent's leading provider of gas storage and related services with 653 billion cubic feet of storage capacity. A large independent power producer, TransCanada currently owns or has interests in approximately 6,200 megawatts of power generation in Canada and the United States. TransCanada is also the developer and operator of one of North America's leading liquids pipeline systems that extends over 4,300 kilometres (2,700 miles), connecting growing continental oil supplies to key markets and refineries. TransCanada's common shares trade on the Toronto and New York stock exchanges under the symbol TRP.

-----

Earlier:

August, 1, 12:20:00

TRANSCANADA'S NET INCOME $881 MLNTransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for second quarter 2017 of $881 million or $1.01 per share compared to net income of $365 million or $0.52 per share for the same period in 2016. Comparable earnings for second quarter 2017 were $659 million or $0.76 per share compared to $366 million or $0.52 per share for the same period in 2016. TransCanada's Board of Directors also declared a quarterly dividend of $0.625 per common share for the quarter ending September 30, 2017, equivalent to $2.50 per common share on an annualized basis.

|

March, 27, 18:45:00

TRANSCANADA'S CONSTRUCTION"This is a significant milestone for the Keystone XL project," said Russ Girling, TransCanada's president and chief executive officer. "We greatly appreciate President Trump's Administration for reviewing and approving this important initiative and we look forward to working with them as we continue to invest in and strengthen North America's energy infrastructure."

|

January, 30, 18:45:00

TRANSCANADA'S APPLICATION“Today’s action to reapply for the Keystone XL Pipeline’s cross-border permit is an important step forward to building a 21st Century energy infrastructure system across our nation,” said Gerard. “The Keystone XL Pipeline would support tens of thousands of jobs, contribute billions of dollars to our economy, and deliver energy efficiently and safely to consumers.

|

June, 27, 18:15:00

TRANSCANADA WANTS $15 BLNThe Calgary-based pipeline operator filed papers late Friday seeking arbitration under the North American Free Trade Agreement, arguing that TransCanada had every reason to believe it would win approval to build Keystone XL.

|

May, 19, 20:20:00

TRANSCANADA & CPG: $13 BLNIncluding the assumption of CPG debt, the total enterprise value of the transaction is approximately $13 billion.

|