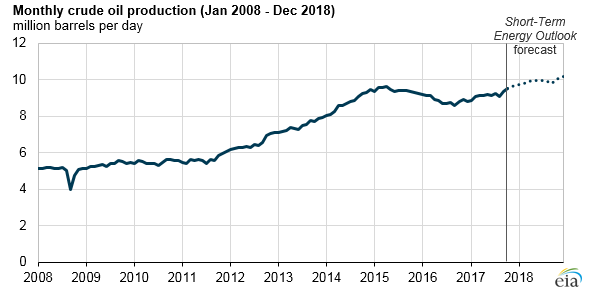

U.S. OIL PRODUCTION 9.4 MBD

EIA - EIA forecasts that U.S crude oil production will average 9.4 million barrels per day (b/d) in the second half of 2017, 340,000 b/d more than in the first half of 2017. Production in 2018 is expected to average 9.9 million b/d, surpassing the previous high of 9.6 million b/d set in 1970.

The most of the crude oil production growth in the second half of 2017 will be in the Permian region, which extends across western Texas and southeastern New Mexico and has become one of the more active drilling regions in the United States. Production in the Permian continues to increase, in part, as a result of West Texas Intermediate (WTI) crude oil average monthly prices that have remained higher than $45 per barrel since the second half of 2016.

-----

Earlier:

2017, October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

2017, October, 16, 11:55:00

U.S. ECONOMY UPEconomic activity in the United States has been growing moderately so far this year, and the labor market has continued to strengthen. The terrible hurricanes that hit Texas, Florida, Puerto Rico, and our neighbors in the Caribbean caused tremendous damage and upended many lives, and our hearts go out to those affected. While the effects of the hurricanes on the U.S. economy are quite noticeable in the short term, history suggests that the longer-term effects will be modest and that aggregate economic activity will recover quickly.

|

2017, October, 16, 11:30:00

U.S. RIGS DOWN 8 TO 928U.S. Rig Count is up 389 rigs from last year's count of 539, with oil rigs up 311, gas rigs up 80, and miscellaneous rigs down 2 to 2. Canada Rig Count is up 47 rigs from last year's count of 165, with oil rigs up 22 and gas rigs up 25.

|

2017, October, 13, 12:50:00

U.S. OIL FOR ASIAA fresh wave of North American crude cargoes could reach the Far East in the coming months, with an estimated 6 million barrels or more of light sweet US grades loading in November expected to find a home in Asia as regional end-users step up efforts to find cheaper feedstocks amid sustained strength in the Middle Eastern crude complex, Asian trade sources said.

|

2017, October, 4, 23:45:00

GAS IS ESSENTIALAPI - “The increased use of natural gas in electric power generation has not only enhanced the reliability of the overall system, but it has also provided significant environmental and consumer benefits. The abundance, affordability, low-emissions profile and flexibility of natural gas and natural gas-fired generating units make natural gas a fuel of choice. There is no question, however, that the bulk power system will continue to rely on multiple fuels, including natural gas, nuclear, coal, hydro, wind and solar, as projected by the Energy Information Administration.

|

2017, September, 29, 12:25:00

U.S. HIGHEST PELROLEUM DEMANDTotal petroleum deliveries in August moved up by 1.3 percent from August 2016 to average 20.5 million barrels per day. These were the highest August deliveries in 10 years, since 2007. Compared with July, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 0.6 percent. For year-to-date, total domestic petroleum deliveries moved up 1.3 percent compared to the same period last year.

|

2017, September, 27, 13:35:00

U.S. WANT OIL MARKETIf the US were to reimpose nuclear sanctions on Iran, the Trump administration would do so in a way that would have minimal impact on the global oil market, a senior State Department official said Tuesday. |