WORLD OIL DEMAND UP BY 1.5 MBD

OPEC - Monthly Oil Market Report

Crude Oil Price Movements

The OPEC Reference Basket rose to $53.44/b in September, its highest value since July 2015. Crude futures prices also saw gains, with ICE Brent averaging above the $55/b, supported by increasing evidence that the oil market is heading toward rebalancing. Geopolitical tensions and lower distillates stocks also pushed prices higher.

ICE Brent averaged $55.51/b in September, a gain of $3.64, while NYMEX WTI increased $1.82 to average $49.88/b. Hedge funds raised net long position in ICE Brent and NYMEX WTI futures and options by almost 200,000 contracts. At the end of the month, the Brent crude contract curve had flipped into backwardation through December 2021. The sweet/sour spread widened significantly in Asia and Europe.

World Economy

Growth in the world economy continues to improve, with the forecast for 2017 revised up to 3.6% from 3.5% in last month's report. Similarly, the 2018 forecast has been adjusted higher to 3.5% from 3.4%. The improving momentum is visible in all economies, particularly the OECD, which is seen growing by 2.2% in 2017 and by an upwardly revised 2.1% in 2018. US growth in 2018 has been revised up to 2.3% and the EU to 1.9% for the same year. Russia has also seen an upward revision for 2018 to now stand at 1.6%, compared to 1.4% in the previous report. Growth expectations for India and China were left unchanged for both 2017 and 2018.

World Oil Demand

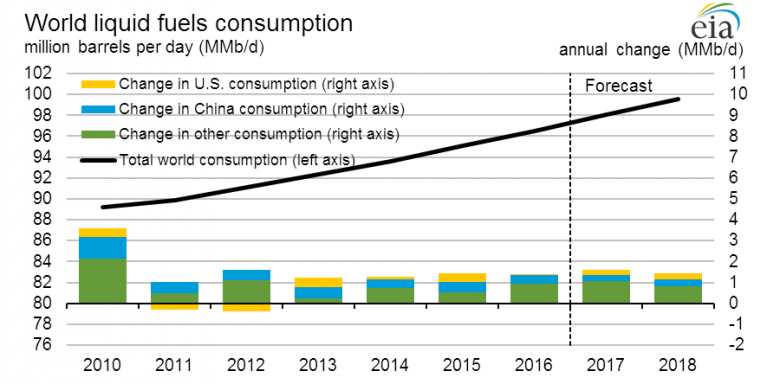

World oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

World Oil Supply

Non-OPEC oil supply is expected to grow by 0.7 mb/d in 2017, following a downward revision of 0.1 m/bd from the previous report. In 2018, the growth in non-OPEC oil supply saw a downward revision of 60 tb/d to stand at 0.9 mb/d. OPEC NGLs and non-conventional liquids production are seen averaging 6.5 mb/d in 2018, representing an increase of 0.2 mb/d, broadly in line with growth in the current year. In September, OPEC crude oil production increased by 88 tb/d, according to secondary sources, to average 32.75 mb/d.

Product Markets and Refining Operations

Product markets in the Atlantic Basin improved further in September as the top of the barrel saw support from higher gasoline demand. Middle distillate markets continue to improve globally on the back of healthy demand, depleted stocks and along with regional refinery maintenance. However, the bottom of the barrel in Asia and Europe saw some pressure on low demand and high inventory levels. Product markets are expected to see support in 4Q17 from healthy demand for winter fuels.

Tanker Market

Average dirty vessel spot freight rates rose in September, compared to the previous month, supported by enhanced activity across several trading routes. Higher Aframax rates were the main driver behind the strength in sentiment, while average VLCC and uezmax freight rates showed lesser growth. However, the tanker market still suffers from oversupply of ships which often cap rates gains. In the clean tanker market, spot freight rates showed also a positive development mostly attributed to stronger west of Suez market as tonnage demand in the Mediterranean increased. Additionally, prompt replacements gave a further support to freight rates. Spot freight rates are expected to strengthen in 4Q17 supported by winter seasonal demand.

Stock Movements

Total OECD commercial oil stocks fell in August to stand at 2,996 mb. At this level, OECD commercial oil stocks are 171 mb above the latest five-year average. Crude and products stocks indicate a surplus of around 146 mb and 25 mb above the seasonal norm, respectively. In terms of days of forward cover, OECD commercial stocks stand at 63.2 days in August, 2.6 days higher than the latest five-year average.

Balance of Supply and Demand

Based on the current global oil supply/demand balance, OPEC crude in 2017 is estimated at 32.8 mb/d, around 0.6 mb/d higher than in 2016. Similarly, OPEC crude in 2018 is projected at 33.1 mb/d, about 0.3 mb/d higher than in 2017.

-----

Earlier:

2017, October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|

2017, September, 29, 12:25:00

U.S. HIGHEST PELROLEUM DEMANDTotal petroleum deliveries in August moved up by 1.3 percent from August 2016 to average 20.5 million barrels per day. These were the highest August deliveries in 10 years, since 2007. Compared with July, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 0.6 percent. For year-to-date, total domestic petroleum deliveries moved up 1.3 percent compared to the same period last year.

|

2017, September, 15, 08:55:00

WORLD ENERGY CONSUMPTION UP TO 28%The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

|

2017, August, 16, 09:30:00

OPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBDOPEC said world oil demand in 2018 will grow 1.28 million b/d from 2017 levels, meaning that total oil consumption is expected to hit a new record high of 97.8 million b/d in 2018.

|

2017, July, 17, 14:10:00

CHINA'S ENERGY DEMAND UPCHINA will accelerate expanding oil and gas distribution in the next decade to ensure energy security and help boost industry, its top economic and energy planners said.

|

2017, June, 21, 11:25:00

BP ENERGY REVIEWBob Dudley, BP group chief executive, said: “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years."

|

2017, May, 29, 13:35:00

HARD OIL DEMANDWhile most big oil companies foresee a day when the world will need less crude, timing when that peak in oil demand will materialize is one of the hottest flashpoints for controversy within the industry. It’s tough to predict because changes to oil demand will hinge on future disruptive technologies, such as batteries in electric cars that will allow drivers to travel for hundreds of miles on a single charge.

|