CHINA'S INVESTMENT TO U.S.

REUTERS - President Donald Trump can return to the United States claiming to have snagged over $250 billion in deals from his maiden trip to Beijing. Whether those deals live up to the lofty price tag is another question altogether.

Watched by Trump and China's President Xi Jinping at a signing ceremony in Beijing, U.S. planemaker Boeing Co, General Electric Co and chip giant Qualcomm Inc sealed lucrative multi-billion dollar deals.

"This is truly a miracle," China's Commerce Minister Zhong Shan said at a briefing in Beijing.

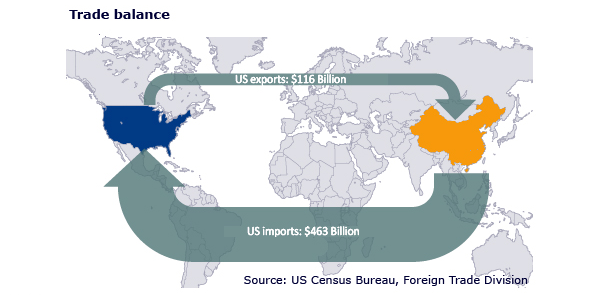

The quarter of a trillion dollar haul underscores how Trump is keen to be seen to address a trade deficit with the world's second-largest economy that he has long railed against and called "shockingly high" on Thursday.

But U.S. businesses still have many long-standing concerns to complain about, including unfettered access to the China market, cybersecurity and the growing presence of China's ruling Communist Party inside foreign firms.

William Zarit, chairman of the American Chamber of Commerce in China, said the deals pointed to "a strong, vibrant bilateral economic relationship" between the two countries.

"Yet we still need to focus on leveling the playing field, because U.S. companies continue to be disadvantaged doing business in China."

U.S. tech companies like Facebook Inc and Google are mostly blocked in China. Automakers Ford Motor Co and General Motors must operate through joint ventures, while Hollywood movies face a strict quota system.

"(These deals) allow Trump to portray himself as a master dealmaker, while distracting from a lack of progress on structural reforms to the bilateral trade relationship," Hugo Brennan, Asia analyst at risk consultancy Verisk Maplecroft, said in a note.

PUMP IT UP

Some huge deals were announced. Among them is a 20-year $83.7 billion investment by China Energy Investment Corp in shale gas developments and chemical manufacturing projects in West Virginia, a major energy producing state that voted heavily for Trump in the 2016 election.

"The massive size of this energy undertaking and level of collaboration between our two countries is unprecedented," West Virginia Secretary of Commerce H. Wood Thrasher said in a statement.

It marks the first major overseas investment for the newly founded China Energy, which formed from the merger of China Shenhua Group, the country's largest coal producer and China Guodian Corp, one of China's top five utilities.

However, as is often the case during state visits, many of the deals were packaged as "non-binding" agreements, gave scant details or rolled over existing tie-ups, helping pump up the headline figure.

"I am somewhat skeptical of such a large number," Alex Wolf, senior emerging markets economist at Aberdeen Standard Investments, told the Reuters Global Markets Forum, adding that the overall tone of the visit so far had been "positive".

"I suspect they might be primarily MOUs (memorandum of understandings) instead of actual contracts and the actual contract amount may be substantially less."

Qualcomm signed non-binding agreements worth $12 billion with Xiaomi, OPPO and Vivo, three Chinese handset makers that the firm said it had "longstanding relationships" with. Qualcomm already earns more than half of its revenues in China.

Boeing announced a deal with state-run China Aviation Suppliers Holding Co to sell 300 Boeing jets with a valuation of $37 billion at list prices, though analysts said it was unclear how many of these were new orders.

"Interesting to see how many of those are past agreements/purchase orders repackaged. Beijing is a master of selling the same agreement 10 times," former Mexican ambassador to China Jorge Guajardo posted on Twitter.

XI VOWS TRANSPARENCY

Speaking alongside Trump in Beijing as they announced the deals, Xi said the Chinese economy would become increasingly open and transparent to foreign firms, including those from the United States, and welcomed U.S. companies to participate in his ambitious "Belt and Road" infrastructure-led initiative.

Trump made clear he blamed his predecessors, not China, for allowing the U.s. trade deficit to get "out of kilter", and repeatedly praised Xi, calling him "a very special man".

-----

Earlier:

2017, November, 7, 12:20:00

U.S. DEFICIT $43.5 BLNThe U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.5 billion in September, up $0.7 billion from $42.8 billion in August, revised. September exports were $196.8 billion, $2.1 billion more than August exports. September imports were $240.3 billion, $2.8 billion more than August imports. |

2017, October, 23, 11:20:00

U.S. DEFICIT - 2017: $666 BLNU.S. Treasury Secretary Steven T. Mnuchin and Office of Management and Budget (OMB) Director Mick Mulvaney today released details of the fiscal year (FY) 2017 final budget results. The deficit in FY 2017 was $666 billion, $80 billion more than in the prior fiscal year, but $36 billion less than forecast in the FY 2018 Mid-Session Review (MSR). As a percentage of Gross Domestic Product (GDP), the deficit was 3.5 percent, 0.3 percentage point higher than the previous year.

|

2017, October, 20, 12:25:00

U.S. FOREIGN ACQUISITIONS UP $125 BLNThe sum total in August of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a monthly net TIC inflow of $125.0 billion. Of this, net foreign private inflows were $131.5 billion, and net foreign official outflows were $6.5 billion.

|

2017, September, 8, 08:45:00

CHINA'S LNG IMPORTS UP 45%Over the first seven months of 2017, China's imports of liquefied natural gas (LNG) averaged 4.3 billion cubic feet per day (Bcf/d), or 45% higher than during the same period in 2016. With the exception of a slight decline in 2015, LNG import into China have grown steadily over the last decade, increasing by 33% between 2015 and 2016. LNG imports growth has been supported by both government policies to replace some coal and oil use with natural gas as well as lower natural gas import prices.

|

2017, July, 28, 10:00:00

U.S. - CHINA OIL RECORDChina's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.

|

2017, June, 21, 20:40:00

CHINA'S RENEWABLE INVESTMENT: $368 BLNChina plans to invest 2.5 trillion yuan (US$368 billion) into renewable energy projects during the 2016-2020 period, creating more than 13 million jobs in the sector, according to the National Energy Administration.

|

2017, June, 5, 14:40:00

U.S. - CHINA TRADE DEFICIT: +13.8%“While the overall trade deficit continues to grow, it is too soon for the numbers to reflect the recent deal with China and other actions of this Administration is taking to level the balance of trade,” said Secretary Ross. “We look forward to the July 16 deadline which will open up the Chinese market to American beef, liquefied natural gas and other products.” |