CHINA'S LNG UP

PLATTS - Asia LNG spot prices surged to a near three-year high Monday as surging Chinese demand and robust oil prices coincided with persistent supply anxieties.

The Platts JKM for January was assessed at $9.85/MMBtu Monday, the highest price since January 9, 2015, and up about 8% since the start of the month.

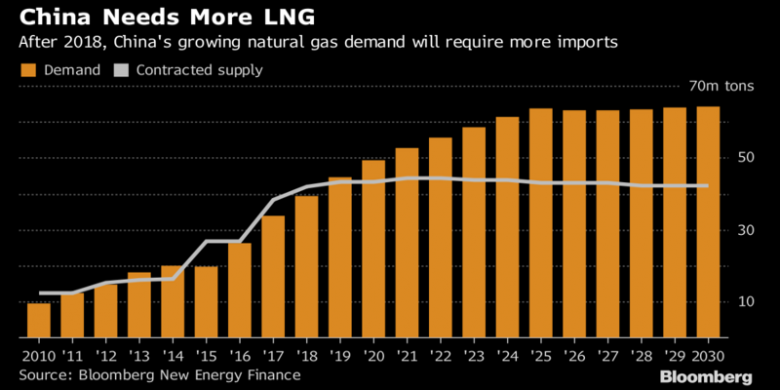

China imported 28 million mt of LNG in January-October 2017, up 47% from 19 million mt in the same period last year, closing the gap to the world's second-largest importing nation, South Korea.

The country's policy directives encouraging coal-to-gas switching to combat air pollution mean that LNG imports were increasingly needed to feed the country's enormous energy appetite.

The replacement of coal-fired heating with gas-fired boilers at millions of Chinese households this year also boosted winter LNG purchases.

This additional demand was satisfied through spot procurement largely through majors CNOOC and PetroChina. Both companies were active in spot dealmaking, either via bilateral transactions or participating in sell-tenders, sources said.

In particular, CNOOC awarded a rare tender for up to seven December deliveries in late-September, sources said. Other importers like Guanghui Energy opted to do short-term strip deals, while others like Sinopec and Jovo relied on long-term contracted volumes.

"China's activity on the spot market this year really took out a lot of excess supply, especially for leaner cargoes," an international trader said.

Market participants also attributed this year's spot price rally to higher oil prices which boosted the price attractiveness of spot cargoes.

Dated Brent prices have been trading in the $60-64/MMBtu range since the end of October, levels unseen since June 2015.

Asian buyers of long-term volumes fixed on an oil-linked basis could still be incentivized towards spot procurement especially during peak-winter demand. On the other hand, spot trading activity in the weaker demand periods of spring and autumn were boosted by traders and portfolio players optimizing oil-linked positions.

However, supply concerns also accelerated the spot price jumps this year.

Spot prices had surged almost 60% since the start of September, with the rally ignited by the disruption of US Sabine Pass output due due to Hurricane Harvey. This mean offtakers had to source spot LNG cargoes from elsewhere, as well as optimize their Pacific positions.

The continued delay of Wheatstone LNG's start-up in Australia also meant that supply was unexpectedly constrained at the start of the fourth quarter. The facility shipped its first export cargo to Japan's JERA at the end of October.

-----

Earlier:

2017, November, 9, 13:35:00

U.S. - CHINA LNGChina’s top state oil major Sinopec, one of the country’s top banks and its sovereign wealth fund have agreed to help develop Alaska’s liquefied natural gas sector as part of U.S. President Donald Trump’s visit, the U.S. government said on Thursday. The agreement will involve investment of up to $43 billion, create up to 12,000 U.S. jobs during construction, reduce the trade deficit between the United States and Asia by $10 billion a year, and give China clean energy.

|

2017, November, 3, 12:15:00

SOUTH CHINA SEA LNGThe South China Sea is a major route for liquefied natural gas (LNG) trade, and in 2016, almost 40% of global LNG trade, or about 4.7 trillion cubic feet (Tcf), passed through the South China Sea.

|

2017, October, 23, 11:25:00

AUSTRALIAN LNG UP ANEWAustralia became the world’s second-largest exporter of liquefied natural gas (LNG) in 2015 and is likely to overtake Qatar as the world’s largest LNG exporter by 2019. As Australia’s LNG exports have increased, primarily from LNG projects in eastern Australia, the country has had natural gas supply shortages in eastern and southeastern Australia and an increase in domestic natural gas prices.

|

2017, October, 18, 18:40:00

U.S. LNG RISKThere are more than a dozen LNG export projects currently being proposed to US regulators, though across the industry almost no final investment decisions have been announced over the last 18 months and some developers have delayed their decisions into 2018 or beyond. Few firm supply purchase agreements have been announced for the projects that have yet to commit to moving forward.

|

2017, October, 16, 12:10:00

CHINA LNG UP 44%China bought 22.1 million tonnes, equivalent to 30 bcm, of foreign LNG in the first eight months of the year, up 44 percent from a year ago. Almost half of that came from Australia followed by Qatar.

|

2017, October, 16, 11:35:00

JAPAN LNG INVESTMENTThe Japanese government will offer $10 billion to support firms bidding to build liquefied natural gas (LNG) infrastructure around Asia, the Nikkei business daily said on Monday.

|

2017, October, 13, 12:45:00

JAPAN - INDIAN LNGIndia will work with Japan to make long-term liquefied natural gas (LNG) import deals more affordable for its price-sensitive consumers, it said on Wednesday, as these two big importers try to secure better prices and concessions from suppliers. |