IEA COOLS THE MARKET

BLOOMBERG - An unexpected increase in U.S. crude stockpiles further depressed the price of oil on Tuesday.

Futures slipped from the settlement in after-market trading in New York, spurred by data from the American Petroleum Institute that was said to show a 6.51 million barrel increase in U.S. crude stockpiles last week. That would be the largest build since March if Energy Information Administration data confirms it on Wednesday.

It "would put a little bit of a damper on the bullish outlook," Kyle Cooper, director of research at IAF Advisors in Houston, said by telephone. "I am assuming that crude exports remained very low for a second week in a row. After multiple weeks of near-record levels, maybe there is just a little bit of lull before those exports resume."

Prices dropped during the session as the International Energy Agency said the recent recovery in oil prices, coupled with milder-than-normal winter weather, is slowing demand growth. The worsening outlook for consumption dampened some of the enthusiasm that OPEC and its allies will extend supply curbs.

"Global demand growth, with the extension of the production cut, were the two primary factors behind the significant increase we've seen, particularly in the last six months," Gene McGillian, a market research manager at Tradition Energy in Stamford, Connecticut, said by telephone. The dour growth forecast is "taking a little bit of the bloom off the rose."

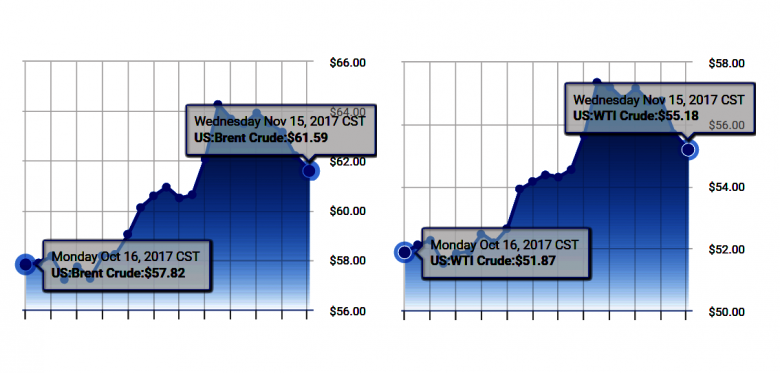

Crude rallied above $57 a barrel in New York last week to the highest level since June 2015 as tensions in the Middle East raised concerns about the potential for supply disruptions. Prices also found support from expectations that the Organization of Petroleum Exporting Countries will extend output cuts scheduled to expire in March. That was before the IEA warned that the supply surge from U.S. shale fields will be bigger than anything the oil and natural gas industry has ever seen.

"It's pretty clear that some of the fears that were priced in over the last month will start to slowly come out," McGillian said.

By 2025, the growth in American oil production will be on par with that achieved by Saudi Arabia at the height of its expansion, according to the IEA.

"Some of the investors are getting a little bit skittish in terms of the impact on supply, particularly in North America, if we stay in this mid-$50 range," Michael Loewen, a commodities strategist at Scotiabank in Toronto, said by telephone.

West Texas Intermediate for December delivery traded at $55.14 a barrel at 4:38 p.m. after settling at $55.70 a barrel on the New York Mercantile Exchange.

Dip in Demand

Brent for January settlement dropped 95 cents to end the session at $62.21 on the London-based ICE Futures Europe exchange. The global benchmark traded at a premium of $6.32 to January WTI.

The IEA reduced its demand estimate for next year by 200,000 barrels a day to 98.9 million a day, according to projections in its report. Forecasts for demand growth next year fell by 100,000 barrels a day to 1.3 million a day. "The market balance in 2018 does not look as tight as some would like, and there is not in fact a new normal" that would buoy prices above $60, said the Paris-based agency.

"If you put two and two together, it shows that we are going to be a little bit oversupplied" in the first quarter, Loewen, said. "Traders in the market are focusing on that right now. We rallied too far, too quick."

U.S. crude inventories probably slid by 2.4 million barrels last week, according to the median estimate in a Bloomberg survey. Stockpiles at Cushing, Oklahoma, the delivery point for New York-traded futures contracts, probably dropped by 50,000 barrels, according to a separate forecast compiled by Bloomberg.

The API report also is said to show gasoline stockpiles increased by 2.4 million barrels last week, while Cushing supplies dropped by 1.8 million barrels. A cushing draw of that magnitude would be the largest since July if EIA data confirms it.

-----

Earlier:

November, 14, 18:10:00

OIL PRICE: ABOVE $62Brent crude futures LCOc1 were at $63.55 per barrel at 0614 GMT, up 3 cents from their last close. U.S. West Texas Intermediate (WTI) crude CLc1 was at $56.79 per barrel, up 5 cents. |

November, 7, 12:40:00

OIL PRICES MAXIMUM ANEWWest Texas Intermediate for December delivery rose 23 cents to $55.87 a barrel at 10:04 a.m. on the New York Mercantile Exchange after earlier rising to $56.28, the highest intraday price since July 2015. Brent for January settlement climbed 46 cents to $62.53 on the London-based ICE Futures Europe exchange, and traded at a $6.41 premium to WTI for the same month.

|

October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|

July, 21, 09:15:00

U.S. OIL PRICE: $45Fitch Ratings anticipates most investment-grade and 'BB' category U.S. E&P companies will see minimal ratings changes in a steady $45 per barrel environment as the realization of further production efficiency gains and lower costs per barrel of oil equivalent (boe) should contribute to resilient margins and cash flow.

|

June, 8, 17:35:00

OIL PRODUCTION DOWNThe Organization of the Petroleum Exporting Countries (OPEC) met on May 25, 2017, and announced an extension to production cuts that were originally set to end this month. The agreed-upon OPEC crude oil production target remains at 32.5 million barrels per day (b/d) through the end of the first quarter of 2018. EIA now forecasts OPEC members’ crude oil production to average 32.3 million b/d in 2017 and 32.8 million b/d in 2018, about 0.2 million b/d and 0.4 million b/d, respectively, lower than previously forecast. However, continuing production growth in many non-OPEC countries is expected to moderate the pace of global liquid fuels inventory draws in 2017 and lead to a small inventory build in 2018.

|

June, 5, 15:10:00

BAD NEWS FOR OPECAs oil prices sag despite OPEC’s renewed efforts to shore up world crude markets, Wall Street banks have more bad news for the producer group: the outlook for next year isn’t great either. |