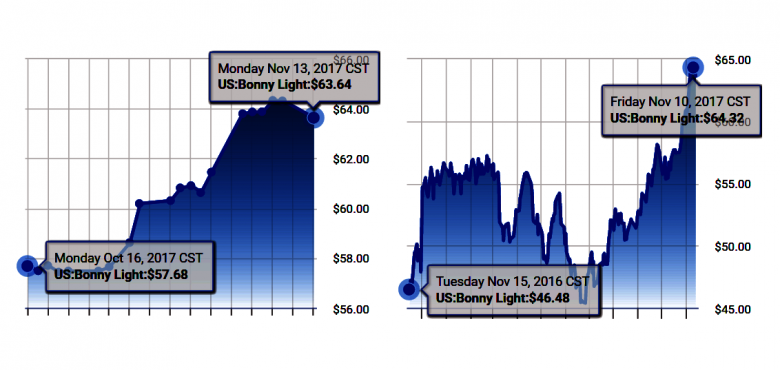

NIGERIA'S OIL PRICE UP

PLATTS - Nigeria's Bonny Light crude has seen its price rise to its highest levels since February, as the grade began to trade in a more regular fashion in the spot market following several months of disruption due to loading delays and forces majeures.

S&P Global Platts on Thursday assessed Bonny Light at a premium of 60 cents/b versus the West Africa Dated strip.

The grade last hit this value mid-August and was last higher February 21, when it was assessed at 65 cents/b.

Bonny Light differentials have been depressed compared with other Nigerian crudes over the course of 2017, which traders have attributed to the unreliability factor of the grade.

Terminal Operator Shell has declared force majeure on Bonny Light loadings three times in 2017, the most recent being between September 16-October 19.

As a result, typical buyers of Bonny Light have moved to other grades. Similar grade Qua Iboe has seen its levels versus Bonny Light widen sharply over the past few months, reaching as high as a 65 cent premium just before the last force majeure was lifted in October. Qua Iboe currently commands a 20 cents premium over Bonny Light.

Bonny Light has gained ground in recent trading sessions as its loadings have been steady since arriving out of the latest force majeure and as some cargoes have been diverted to domestic Nigerian refineries, traders have said.

The December program for Nigeria's Bonny Light crude shows average daily loadings of 212,903 b/d scheduled for the month, up 64,570 b/d from November.

Eight cargoes will load during December in varying sizes, from 300,000 barrels to 1,000,000 barrels. This compares with five cargoes scheduled for November.

-----

Earlier:

2017, September, 15, 08:50:00

NIGERIA NEEDS TIMEEmmanuel Kachikwu, Nigeria’s minister of state for petroleum resources, told the Financial Times that the west African nation’s energy sector was still suffering from years of violent disruptions and needed more “recovery time” before joining a supply deal agreed last year between some of the world’s biggest oil producers. |

2017, September, 4, 12:25:00

NIGERIA'S OIL PRODUCTION: 2.2 MBDThe figure of around 2.2 million to 2.3 million b/d includes about 300,000 to 400,000 b/d of condensates, which implies that its current crude oil production is at the coveted 1.8 million b/d mark.

|

2017, July, 24, 13:55:00

OIL OUTPUT CONSENSUSWith prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members.

|

2017, April, 12, 17:30:00

WBG - AFRICA'S ECOMOMIC DIFFICULTIESNigeria, South Africa, and Angola, the continent’s largest economies, are seeing a rebound from the sharp slowdown in 2016, but the recovery has been slow due to insufficient adjustment to low commodity prices and policy uncertainty. Furthermore, several oil exporters in the Central African Economic and Monetary Community (CEMAC) are facing economic difficulties.

|

2017, March, 31, 18:35:00

IMF HAS NIGERIAWith oil receipts dominating fiscal revenue and exports, the Nigerian economy has been hit hard by low oil prices and falling oil production. The country entered into a recession in 2016, with growth contracting by 1.5 percent. Annual inflation levels doubled to 18.6 percent, reflecting hikes in electricity and fuel tariffs, a weaker naira and accommodating monetary conditions (broad money expanding at 19 percent y-o-y). Even with a significant under-execution in capital spending, the consolidated fiscal deficit increased from 3.5 percent of GDP in 2015 to 4.7 percent of GDP in 2016, because of significant revenue shortfalls.

|

2016, November, 22, 18:40:00

NIGERIA INTO RECESSIONNigeria, which was Africa's largest oil producer until a few months ago, slipped into recession after its economy shrank by 2.06% in Q2, as the impact of militant attacks on oil facilities weighed on the country's economy.

|

2016, August, 19, 18:35:00

NIGERIA MAY LOSE $25 BLN“This period of low oil price is not a time to jeopardize Nigeria’s long term interests by showing Nigeria as a place not to be trusted, and projecting our business environment as unconducive,” |