OIL PRICE: ABOVE $63 STILL

REUTERS, BLOOMBERG - Oil prices fell on Wednesday on doubts OPEC and Russia will agree on extending a crude production cut that the market has already priced in, and after a report of an unexpected rise in U.S. crude oil inventories.

U.S. West Texas Intermediate (WTI) crude futures were at $57.67 a barrel at 0427 GMT, down 32 cents, or 0.6 percent below their last settlement.

Traders said WTI was pulled lower by a report from the American Petroleum Institute (API) late on Tuesday that showed U.S. crude inventories rose by 1.8 million barrels in the week ended Nov. 24 to 457.3 million barrels.

Official U.S. oil inventory data is due later on Wednesday.

WTI was also weighed down by the gradual restart on Tuesday of the Keystone pipeline, which supplies Canadian crude to the United States.

Brent crude futures, the international benchmark for oil prices, were at $63.14 a barrel, down 47 cents, or 0.7 percent.

Oil prices have received a broad lift this year, with Brent up by 40 percent since mid-2017, due to an effort by the Organization of the Petroleum Exporting Countries (OPEC) and a group of other producers, led by Russia, to withhold 1.8 million barrels per day (bpd) of output.

The deal expires in March 2018, but OPEC will meet on Nov. 30 and is expected to discuss ways of extending the cut.

"Market whispers suggest Saudi Arabia and Russia are not yet fully coordinated," said Stephen Innes, head of Asia-Pacific trading at futures brokerage OANDA.

OPEC and Russia are expected to extend their supply cuts for the whole of 2018 but with an option to review the deal in June, OPEC sources said on Tuesday, after Moscow expressed concerns the market could overheat.

Most analysts say an extension is needed to keep oil markets in balance, and also to keep the economies of oil exporting nations afloat.

"It is in Russia's as well as OPEC's best interest to support oil prices given their economies' dependence on oil," said Shane Chanel, equities and derivatives adviser at ASR Wealth Advisers.

Not all analysts agree. "Given the agreement doesn't expire for another four months, adding an additional nine months on that to the end of 2018 seems unnecessarily eager given the market does seem to be rebalancing," said Greg McKenna, chief market strategist at AxiTrader.

A healthy global economy has also been helping oil markets back into balance after years of oversupply.

U.S. bank Morgan Stanley said global economic growth was "likely to gain momentum and breadth in 2018".

-----

Earlier:

November, 27, 20:20:00

OIL PRICE: ABOVE $63 ANEWBLOOMBERG - West Texas Intermediate for January delivery was at $58.51 a barrel on the New York Mercantile Exchange, down 44 cents, at 10:22 a.m. London time. Total volume traded was about 24 percent above the 100-day average. Prices gained 93 cents to $58.95 on Friday, capping a 4.2 percent weekly advance. Brent for January settlement fell 21 cents to $63.65 a barrel on the London-based ICE Futures Europe exchange, after rising 1.8 percent last week. The global benchmark crude traded at a premium of $5.11 to WTI.

|

November, 27, 20:15:00

РОССИЯ ПОДДЕРЖИВАЕТ СОКРАЩЕНИЕМИНЭНЕРГО РОССИИ - «Мы видим, что с рынка ушло примерно 50% излишком запасов нефти, мы видим, что цена сбалансировалась и вышла на достаточно приемлемый уровень в районе 60 и выше долларов за баррель марки Brent, инвестиции начали уже в 17-м году расти, а до этого они 15-16-й год падали. Тем не менее, мы не достигли еще до конца цели по балансировке рынка, и сегодня практически все выступают за то, что необходимо продлить сделку дополнительно для того, чтобы достичь окончательных целей. В принципе, Россия тоже поддерживает такие предложения, рассматриваются разные варианты».

|

November, 9, 14:05:00

OIL PRICE: ABOVE $63Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015. U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

|

November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

November, 7, 12:35:00

OIL PRICE 2018: $55Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast. |

November, 3, 12:30:00

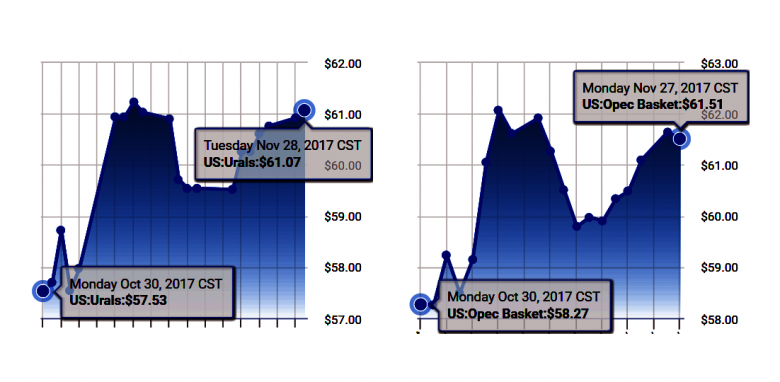

OPEC OIL PRICE: $58.49OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|