OIL PRICE: ABOVE $63 TOO

BLOOMBERG - Oil headed for its best weekly advance in a month after an outage on the Keystone pipeline added to speculation crude supply could tighten and as investors await OPEC's decision on extending output curbs.

Futures gained as much as 1 percent in New York. News that TransCanada Corp. was said to have cut 85 percent of Keystone's November shipments because of last week's spill in South Dakota has helped West Texas Intermediate prices head toward a 3.4 percent gain this week. Meanwhile, Brent crude has climbed just 1.1 percent, leading to the narrowest spread on a closing basis between the grades since early September.

The U.S. benchmark settled above $58 a barrel for the first time since mid-2015 this week on heightened optimism the Organization of Petroleum Exporting Countries and its allies will agree to prolong cuts at a Nov. 30 meeting in Vienna. Prices are up more than 7 percent in November, heading for a third monthly gain in what would be their longest winning streak since May last year.

"The Keystone outage is putting upward pressure on oil prices," Kim Yumi, a Seoul-based market strategist at Kiwoom Securities Co., said by phone. "While expectations over OPEC's supply-curb extension has already been reflected in prices, there's a high chance we may lose a clear price direction next week as the market may take a wait-and-see stance close to the meeting."

WTI for January delivery was at $58.43 a barrel on the New York Mercantile Exchange at 1:25 p.m. in Singapore, up 41 cents. The contract added $1.19 to $58.02 on Wednesday. There was no settlement Thursday because of the Thanksgiving holiday in the U.S. and all transactions will be booked Friday.

Brent for January settlement lost 14 cents, or 0.2 percent, to $63.41 a barrel on the London-based ICE Futures Europe exchange. Prices rose 23 cents to $63.55 on Thursday. The global benchmark crude traded at a premium of $4.98 to WTI.

This week, the front-month contract for WTI on Nymex turned more expensive than the second-month contract, a structure known as backwardation, driven by the Nov. 16 shutdown of the Keystone pipeline after a spill.

Also aiding prices this week is data showing U.S. crude inventories declined to about 457.1 million in the week ended Nov. 17, according to the Energy Information Administration. Stockpiles at Cushing, Oklahoma, dropped by 1.83 million barrels to 61.2 million, the largest draw since July. Meanwhile, American production gained for a fifth week to 9.66 million barrels a day.

-----

Earlier:

November, 22, 11:35:00

OIL PRICE: ABOVE $63 AGAINBLOOMBERG - West Texas Intermediate for January delivery gained as much as 97 cents to $57.80 a barrel on the New York Mercantile Exchange and was at $57.72 at 1 p.m. in Hong Kong. The contract added 41 cents to $56.83 on Tuesday. Brent for January settlement added 44 cents, or 0.7 percent, to $63.01 a barrel on the London-based ICE Futures Europe exchange after climbing 0.6 percent on Tuesday. The global benchmark traded at a premium of $5.31 to WTI.

|

November, 20, 09:35:00

OIL PRICE: ABOVE $62 YETREUTERS - Brent crude futures LCOc1, the international benchmark for oil prices, were at $62.56 per barrel at 0439 GMT, down 16 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $56.59 a barrel, up 4 cents, or 0.1 percent, from their last settlement.

|

November, 20, 09:25:00

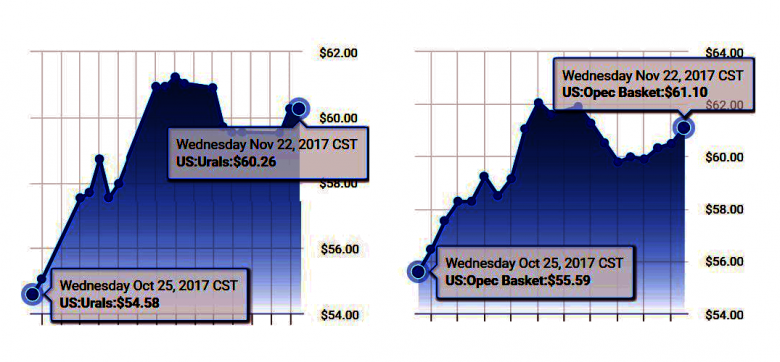

ЦЕНА URALS: $59,62182Средняя цена на нефть Urals за период мониторинга с 15 октября по 14 ноября 2017 года составила $59,62182 за баррель, или $435,2 за тонну.

|

November, 20, 08:55:00

OIL PRICES UPWSJ - Light, sweet crude for December delivery rose $1.41, or 2.6%, to $56.55 a barrel on the New York Mercantile Exchange, snapping a three-session losing streak. Brent, the global benchmark, advanced $1.36, or 2.2%, to $62.72 a barrel.

|

November, 1, 13:40:00

OIL PRICE: ABOVE $61Brent crude futures LCOc1 were up 59 cents at $61.53 per barrel at 0905 GMT, having hit a session peak of $61.70 earlier, the highest since July 2015. U.S. West Texas Intermediate (WTI) crude CLc1 was at $55.12 a barrel, up 74 cents. |

November, 1, 13:35:00

OIL PRICES MAXIMUMICE Brent crude futures remained at 27-month highs in mid-morning trade in Asia Monday, following the gains last week on the expectation that planned supply cuts will be extended to the end of 2018.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI). |