OIL PRICES MAXIMUM

PLATTS - ICE Brent crude futures remained at 27-month highs in mid-morning trade in Asia Monday, following the gains last week on the expectation that planned supply cuts will be extended to the end of 2018.

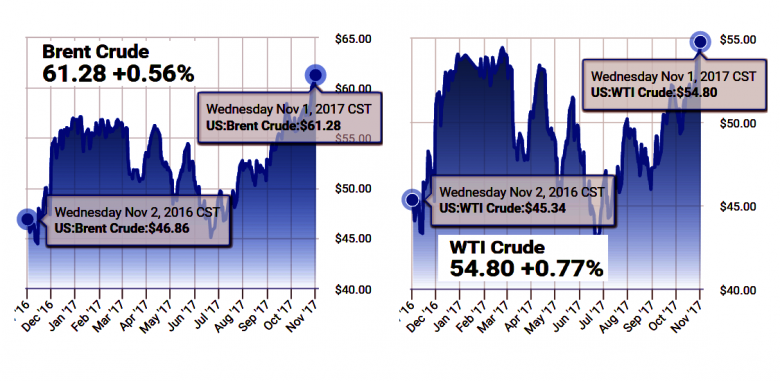

At 11:21 am Singapore time (0321 GMT), the ICE December Brent crude futures were down 6 cents/b (0.1%) from Friday's settle at $60.38/b, while the NYMEX December light sweet crude contract was up 4 cents/b (0.07%) at $53.94/b.

The expectation that output cuts by OPEC and non-OPEC producers will be extended have firmed up in recent days, amid comments by key officials that the group was inching closer to a consensus.

Over the weekend, Saudi Arabia's crown prince Muhammad bin Salman reaffirmed his backing for an extension beyond the current March 2018 deadline.

"The kingdom affirms its readiness to extend the production cut agreement, which proved its feasibility by rebalancing supply and demand," the crown prince said in a statement.

Similar remarks by him late last week sent crude prices soaring by more than 3% over October 26-27, with ICE Brent now at highs not seen since July 2015.

Nonetheless, an agreement is far from certain. Russian energy minister Alexander Novak, who is due to meet Saudi oil minister Khalid al-Falih in Riyadh this week, has said he does not see a need to announce any extension at the November 30 meeting.

With last week's gains, crude prices are now at risk of a short-term correction.

The Relative Strength Index on the four-hourly candlestick chart for front-month ICE Brent and NYMEX light sweet showed both contracts in overbought territory, a condition that has usually triggered a round of profit-taking in the past.

"We note that the RSI moving into extremely overbought territories has been an excellent advance indicator of crude oil downward corrections this year," said OANDA senior market analyst Jeffrey Halley.

The upswing in oil prices will also likely trigger greater hedging from producers, keeping future output elevated despite OPEC's efforts to curb global oversupply.

Analysts have identified the $51-$52/b region for NYMEX light sweet as a key area for hedging by US drillers.

Separately, Baker Hughes data last Friday showed the number of active US oil rigs rising by 1 in the week ended October 27 to 737.

As of 0321 GMT Monday, the US dollar index was down 0.06% at 94.67.

-----

Earlier:

October, 25, 12:40:00

OIL PRICE: ABOVE $58 AGAINBrent crude, the global benchmark, was up 8 cents at $58.41 a barrel by 0646 GMT, after settling on Tuesday up 96 cents, or 1.7 percent. U.S. West Texas Intermediate crude was trading down 9 cents at $52.38. |

October, 25, 12:35:00

OPTIMISTIC OIL PRICESFutures edged higher from the settlement in after-market trading in New York, prompted by reports that data from the American Petroleum Institute showed a 5.75 million barrel drop in gasoline last week and 4.95 million fewer barrels of distillate. Meanwhile, OPEC, set to meet next month on prolonging the cuts, are said to be planning how to prevent a new price-killing glut once they end.

|

October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

October, 25, 12:25:00

OPEC COOPERATIONCompliance among OPEC and major non-OPEC producers reached 120% in September, its highest level since the output constraint deal was launched in January, the Joint Ministerial Monitoring Committee said.

|

October, 23, 11:45:00

OIL PRICE: STILL ABOVE $57Brent crude futures were at $57.87 at 0622 GMT, up 12 cents, or 0.21 percent, from their last close. U.S. West Texas Intermediate (WTI) crude was at $52.04 per barrel, up 20 cents, or 0.39 percent. |

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|