OIL PRICES UP

WSJ, BLOOMBERG - Oil prices gained Friday after a week of losses, on fresh signs that Saudi Arabia plans to back an extension of OPEC's deal to curb global production.

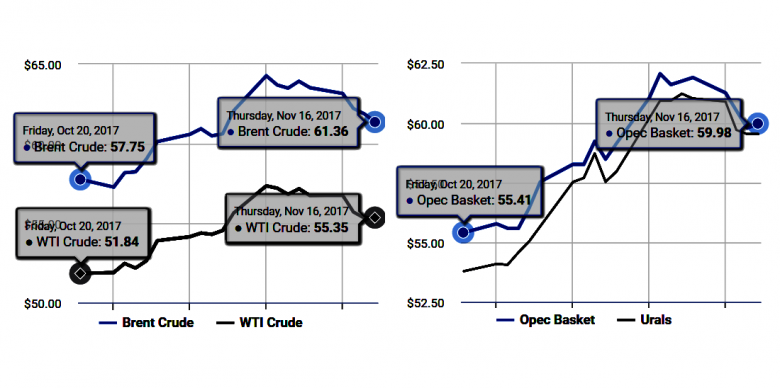

Light, sweet crude for December delivery rose $1.41, or 2.6%, to $56.55 a barrel on the New York Mercantile Exchange, snapping a three-session losing streak. Brent, the global benchmark, advanced $1.36, or 2.2%, to $62.72 a barrel.

On Thursday, Saudi Arabia's energy minister Khalid al-Falih reiterated the country's commitment to the deal, saying that further production cuts are necessary to continue rebalancing the market.

"This isn't a parsed statement, this is clear-cut and pretty unequivocal, " said John Saucer, vice president of research and analysis at Mobius Risk Group. "It wiped away doubts."

Many traders are anticipating that the Organization of the Petroleum Exporting Countries and other major producers will announce a decision to extend supply cuts past March 2018 after their meeting in Vienna on Nov. 30.

Following the meeting last year, OPEC agreed to reduce its crude output in an effort to rein in the supply glut and boost prices, later bringing in Russia and several other producers outside the cartel. The deal, which was extended in May, is set to expire in March. Russia has also indicated a willingness to lengthen the cuts and is set to participate in the OPEC meeting at the end of the month.

"It's going to be an OPEC-headline type market for the next two weeks here," said Bob Yawger, director of the futures division of Mizuho Securities USA.

Still, some doubts linger over some producers' commitment to the deal. The high level of speculative long positions in the market may also put increased pressure on OPEC to come out of the meeting with an extension agreement, Mr. Yawger said.

"Anything apart from an extension to the end of 2018 is likely to send the oil price into an immediate tailspin," Commerzbank analysts wrote.

Despite Friday's gains, oil prices closed down for the week after five straight weeks of gains. Concerns over increasing output from U.S. shale producers resurfaced this week, raising questions on whether they will continue to flood the market as other countries pull back.

On Wednesday, the U.S. Energy Information Administration said U.S. production rose last week to a record weekly high of 9.645 million barrels, while crude stockpiles climbed by 1.9 million barrels.

That report came a day after the International Energy Agency revised downwards its global oil demand forecasts for this year and next.

Gasoline futures rose 1.8% to $1.7447 a gallon and diesel futures gained 2.3% to $1.9466 a gallon.

-----

Earlier:

November, 17, 19:55:00

OIL PRICE: ABOVE $62REUTERS - Benchmark Brent crude oil LCOc1 was up 66 cents at $62.04 a barrel by 1400 GMT, recovering some ground after five sessions of losses. U.S. light crude hit a three-day high, rising more than $1 before easing back to $56.08, 94 cents up on the day. |

November, 17, 19:50:00

RUSSIA'S OIL PAUSEFT - The original deal with Opec’s de facto leader Saudi Arabia, brokered by Mr Novak and Russian president Vladimir Putin, reduced oil production from participating countries by 1.8m barrels a day and helped push the price of benchmark Brent Crude above $60 a barrel this week for the first time in more than two years. |

November, 15, 15:20:00

IEA COOLS THE MARKETBLOOMBERG - Prices dropped during the session as the International Energy Agency said the recent recovery in oil prices, coupled with milder-than-normal winter weather, is slowing demand growth. The worsening outlook for consumption dampened some of the enthusiasm that OPEC and its allies will extend supply curbs.

|

November, 13, 10:50:00

OIL PRICE: ABOVE $63 YETBrent crude futures LCOc1 were at $63.55 per barrel at 0614 GMT, up 3 cents from their last close. U.S. West Texas Intermediate (WTI) crude CLc1 was at $56.79 per barrel, up 5 cents.

|

November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

October, 30, 11:45:00

OIL PRICES WILL UP TO $56WBG - Oil prices are forecast to rise to $56 a barrel in 2018 from $53 this year as a result of steadily growing demand, agreed production cuts among oil exporters and stabilizing U.S. shale oil production, while the surge in metals prices is expected to level off next year, the World Bank said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|