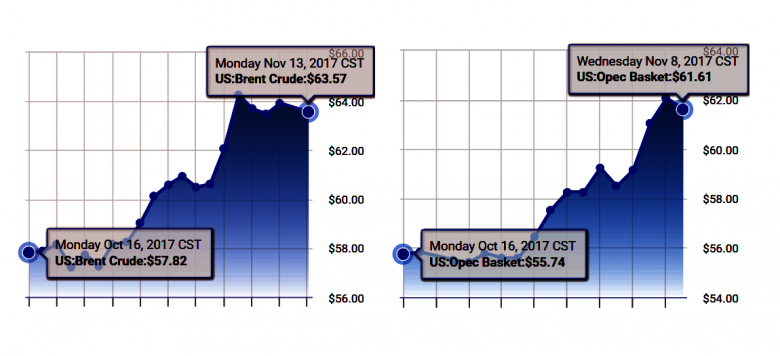

OPEC OIL PRICE: $61.72

OPEC - The price of OPEC basket of fourteen crudes stood at $61.72 a barrel on Thursday, compared with $61.61 the previous day, according to OPEC Secretariat calculations.

The OPEC Reference Basket of Crudes (ORB) is made up of the following: Saharan Blend (Algeria), Girassol (Angola), Oriente (Ecuador), Zafiro (Equatorial Guinea), Rabi Light (Gabon), Iran Heavy (Islamic Republic of Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Qatar Marine (Qatar), Arab Light (Saudi Arabia), Murban (UAE) and Merey (Venezuela).

-----

Earlier:

November, 9, 14:05:00

OIL PRICE: ABOVE $63Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015. U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

|

November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

November, 7, 12:35:00

OIL PRICE 2018: $55Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast. |

November, 3, 12:35:00

OIL PRICE: ABOVE $61 YETBrent futures LCOc1 were at $60.75 per barrel at 0739 GMT, up 13 cents, or 0.2 percent, from their last close. Brent has risen by around 37 percent since its low in 2017 reached last June. U.S. West Texas Intermediate (WTI) crude CLc1 was at $54.70 a barrel, up 16 cents, or 0.3 percent, from the last close. WTI is around 30 percent above its 2017-low in June. |

November, 3, 12:30:00

OPEC OIL PRICE: $58.49OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

|

November, 3, 12:25:00

ЦЕНА URALS: $51,15Средняя цена нефти марки Urals по итогам января – октября 2017 года составила $ 51,15 за баррель.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|