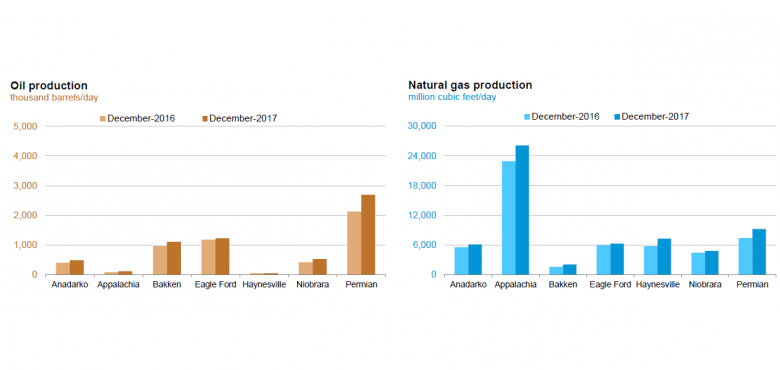

U.S. OIL + 80 TBD, GAS + 779 MCFD

EIA published their Drilling Productivity Report for November.

-----

Earlier:

2017, November, 13, 10:00:00

U.S. RIGS UP 9 TO 907U.S. Rig Count is up 339 rigs from last year's count of 568, with oil rigs up 286, gas rigs up 54, and miscellaneous rigs down 1 to 1. Canada Rig Count is up 27 rigs from last year's count of 176, with oil rigs up 19 and gas rigs up 8.

|

2017, October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

2017, October, 18, 18:55:00

U.S. OIL + 81 TBD, GAS + 827 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 81,000 b/d month-over-month in November to 6.12 million b/d.

|

2017, October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

2017, October, 4, 23:45:00

GAS IS ESSENTIALAPI - “The increased use of natural gas in electric power generation has not only enhanced the reliability of the overall system, but it has also provided significant environmental and consumer benefits. The abundance, affordability, low-emissions profile and flexibility of natural gas and natural gas-fired generating units make natural gas a fuel of choice. There is no question, however, that the bulk power system will continue to rely on multiple fuels, including natural gas, nuclear, coal, hydro, wind and solar, as projected by the Energy Information Administration.

|

2017, September, 29, 12:25:00

U.S. HIGHEST PELROLEUM DEMANDTotal petroleum deliveries in August moved up by 1.3 percent from August 2016 to average 20.5 million barrels per day. These were the highest August deliveries in 10 years, since 2007. Compared with July, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 0.6 percent. For year-to-date, total domestic petroleum deliveries moved up 1.3 percent compared to the same period last year.

|

2017, September, 8, 09:00:00

U.S. ENERGY INVESTMENT: $1.3 TLN“We welcome the President’s commitment to pro-growth tax reform, and look forward to working with the administration and Congress on continuing our nation’s energy leadership. Pro-growth tax reform and economic policies can further strengthen our energy infrastructure and benefit consumers. As an industry that invests billions in the U.S. economy each year, pro-growth policies would allow us to accelerate these economic investments while keeping energy affordable. Private investment in our nation’s energy infrastructure could exceed $1.3 trillion and support 1 million jobs annually through 2035.” |