VERY IMPORTANT VENEZUELA

BLOOMBERG - Venezuela's sudden demand to renegotiate its billions in debt could complicate life for its two biggest oil patrons, China and Russia.

President Nicolas Maduro caught bondholders off guard on Thursday with a vow to wring debt relief from Venezuela's creditors, sending the country's bonds tumbling. But the move may also have been calculated to reassure the countries that are among Maduro's biggest lenders, and the most vital customers of his nation's crown-jewel oil industry.

State-owned Petroleos de Venezuela SA, keeper of the world's largest oil reserves, has seen output drop to a 14-year low, beset by the country's economic collapse, a global plunge in crude prices and U.S. sanctions. As American refineries, once PDVSA's top customers, have bought less, China and Russia have stepped in. The two countries have loaned more than $60 billion to boost production there, prepaying for more than a billion barrels.

"Venezuela is too important for the likes of China and Russia to let it fail," said Thomas Onley, an analyst at consultant Facts Global Energy, in a phone interview Friday. "Things are getting tough, no question about that, but China and Russia are the backstop."

At a rally in Caracas, Maduro said his cash-strapped country would seek talks with creditors, including for PDVSA's outstanding debt. He blamed American sanctions for drying up the well for new financing.

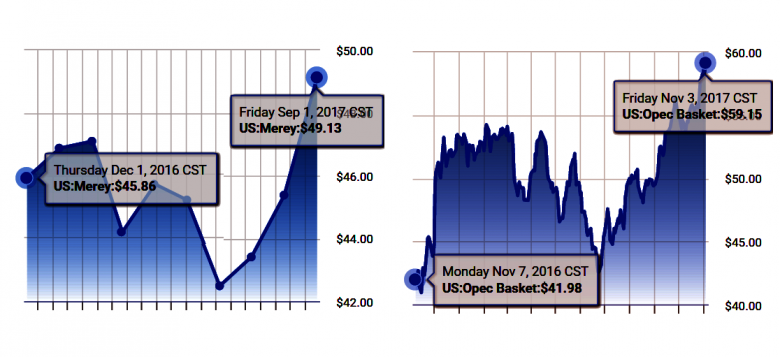

The step to restructure debt comes as Venezuela stands to receive more revenue for its oil. The country's crude oil basket price rose to CNY350.75 ($52.90) a barrel Friday, the highest since July 2015. And Venezuela did approve a $1.1 billion principal payment on a PDVSA bond on Thursday.

However, that came with the country holding just $10 billion left in hard-currency reserves, a sign, perhaps, of how wary Maduro might be of getting the oil company embroiled in a messy default. That he immediately followed that with a demand for relief is an indication he sees the situation as unsustainable.

In 2001, Venezuela was pumping more than 3 million barrels a day. Last month, national crude production fell to 1.95 million barrels a day and Venezuelan rig counts are at their lowest level since June 2012.

With output tanking, PDVSA has been forced to buy more cargoes from abroad to blend with its own, tar-like low-quality oil. Meanwhile, many of its refineries have shut because of recurring breakdowns or a lack of domestic supplies to process.

Sanctions imposed by U.S. President Donald Trump, meant to punish Maduro's crackdown on his political opposition, helped drive down exports to the U.S. by 35 percent from August to October. Over the same period, daily shipments to China doubled while cargoes to Russia's state-owned oil company Rosneft PJSC more than tripled, according to U.S. Customs data and a shipping report compiled by Bloomberg. But income from those sales are limited because they're repayments for previous loans.

Price Paid

Turning to the risky process of renegotiation may be the price paid by Venezuela to preserve that lifeline, said Francisco Monaldi, a fellow in Latin American energy policy at Rice University in Houston.

"Russia and China have incentives to provide financing just for oil investment, so that they are able to get the oil repayments," Monaldi said in an email. "If Venezuela was able to successfully restructure the debt with bond holders that would make it more attractive for Russia and China to help, but giving them more money just to pay bond holders is unlikely to happen."

Rosneft said in August it isn't planning any further advance payments to PDVSA after providing about $6 billion in loans, including interest.

Seeking more help, PDVSA in recent weeks turned to oil trading houses in search of more prepayment deals. The company held talks with Trafigura Group over a proposal that envisaged the Singapore-based merchant house paying as much as 80 percent of a $700 million oil contract upfront, according to emails and PowerPoint presentations reviewed by Bloomberg News.

PDVSA approached at least one other trading house with a similar deal, according to a person familiar with the matter who asked not to be named because the discussions were private. Neither deal was consummated.

PDVSA has refineries overseas and oil receivables that could become a target in any debt fight. The company's U.S. refining arm, Citgo Holding Inc., has already been used as collateral to back some bonds. If creditors start going after the assets, buyers are apt to turn to other sources of crude, depressing not only demand but the price of Venezuela's main treasure.

An actual default at PDVSA would create "significant downside risks to both oil production and exports," Luisa Palacios, senior managing director at Medley Global Advisors, said in an email. She'll be watching to see whether the oil producer makes its bond coupon payments next week, she said. "We will know by Nov. 10."

-----

Earlier:

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program. |

2017, September, 11, 12:25:00

VENEZUELA'S RESTRUCTURING“There was a request from our colleagues in Venezuela to carry out a restructuring,” Russian finance minister Anton Siluanov said. “There are difficulties in fulfilling the debt.”

|

2017, September, 4, 12:10:00

U.S. - RUSSIA BLOCK IN VENEZUELAThe Trump administration is ready to block a Russian state-owned oil giant from gaining control of critical energy assets in the U.S. owned by Venezuela, senior American officials say, a move that likely would feed tensions between Washington and Moscow.

|

2016, November, 18, 18:35:00

VENEZUELA & CHINA: $50 BLNVenezuela has borrowed over $50 billion from China under a financing arrangement created by late socialist leader Hugo Chavez in 2007, in which a portion of its crude and fuel sales to the world's second-biggest economy are used to pay down loans.

|

2016, April, 20, 17:45:00

BRAZIL & VENEZUELA IN SHOCKSouth America’s two largest oil producing nations face bigger threats from political turmoil than depressed crude prices, but reforms in their national oil companies (NOC) and energy ministries may be essential for their governments to survive.

|

2015, December, 17, 19:35:00

RUSSIA BUYING UP AMERICA“Currently, they have their sights firmly on the Americas, having expressed interest in future gas projects in Mexico, Argentina, Venezuela, and Bolivia, among others.”

|

2015, May, 28, 18:30:00

VENEZUELA & RUSSIA INVESTMENT: $14 BLNVenezuela and Russia's top oil producer, Rosneft, have agreed on around $14 billion in investment in the South American OPEC country's oil and gas sector, President Nicolas Maduro said on Wednesday evening. |