OIL PRICE: NOT ABOVE $65

REUTERS, BLOOMBERG - Oil prices on Friday dipped away from some of their highest levels since 2015, weighed down by rising U.S. output and the expected January re-opening of the Forties pipeline in the North Sea.

Despite this, markets remained well supported by ongoing supply cuts led by the Organization of the Petroleum Exporting Countries (OPEC) and Russia.

Market liquidity was drying up on Friday as traders closed positions ahead of the upcoming Christmas and New Year breaks.

U.S. West Texas Intermediate (WTI) crude futures were at $58.16 a barrel at 0755 GMT, down 20 cents, or 0.3 percent, from their last settlement.

Brent crude futures, the international benchmark for oil prices, were at $64.81 a barrel, down 19 cents, or 0.1 percent.

Brent on Thursday ended at $64.90 a barrel, its highest close since June 2015. WTI has also been touching values not seen since mid-2015 over the past two months.

The dip on Friday was due to an outlook for rising supplies that triggered those holding long positions to sell-out ahead of the year-end holidays, traders said.

Also weighing on the market was the expected return of the 450,000 barrels per day (bpd) Forties pipeline system in the North Sea in January.

The pipeline, which delivers crude underpinning Brent futures, was shut earlier this month due to a crack. Operator Ineos said on Thursday it expected to complete repairs around Christmas and to gradually restart the system in early January.

Longer term, analysts said crude production in the United States that is fast approaching 10 million bpd would also drag on oil prices, and undermine OPEC's effort to tighten the market and prop up prices.

"Supply is expected to grow further, paving the way to an oversupplied market, which can again exercise downward pressure on oil prices," consultancy Rystad Energy said in a note.

Not all analysts expect a return of oversupply, though.

The OPEC-led pact to withhold supplies started in January this year, and the producer group and its allies decided in November to extend the cuts to cover all of 2018, instead of letting them expire next March, as had been planned.

The supply restraint has resulted in significant reductions of oil inventories and helped push up Brent prices by more than 45 percent since June this year.

"OPEC's extension of its production cuts through the end of 2018 is a necessary condition for continued inventory drawdown," U.S. investment bank Jefferies said.

Jefferies said it has raised its 2018 Brent forecast to $63 a barrel from $57, and its WTI forecast to $59 per barrel from $54, on expectations that the market will remain tight.

-----

Earlier:

2017, December, 20, 19:45:00

OIL PRICE: ABOUT $64REUTERS - Brent crude futures, the international benchmark for oil prices, were up 29 cents at $64.09 a barrel by 1438 GMT. U.S. West Texas Intermediate (WTI) crude futures were 26 cents higher at $57.82 a barrel. |

2017, December, 20, 19:35:00

SAUDIS EXPECTS +12%BLOOMBERG - Saudi Arabia expects oil revenue to jump 12 percent next year in a sign the world’s biggest crude exporter expects prices to keep rising in 2018.

|

2017, December, 18, 12:50:00

OIL PRICE: BELOW $64 YETREUTERS - Brent crude futures LCOc1, the international benchmark for oil prices, were at $63.72 a barrel at 0821 GMT, up 49 cents, or 0.8 percent, from their last close. Brent crude futures LCOc1, the international benchmark for oil prices, were at $63.72 a barrel at 0821 GMT, up 49 cents, or 0.8 percent, from their last close. |

2017, December, 18, 12:45:00

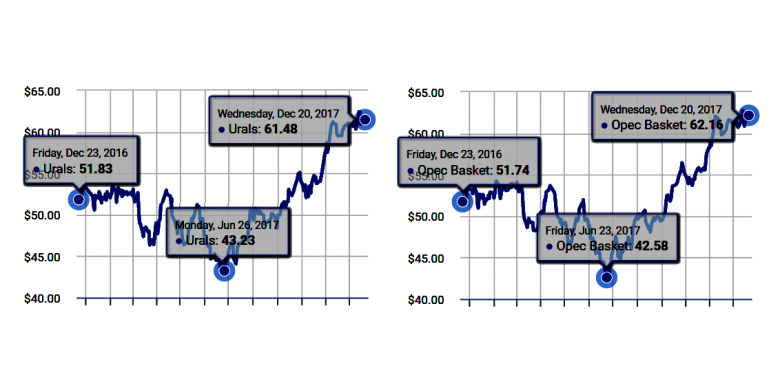

ЦЕНА URALS: $62,53932МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 ноября по 14 декабря 2017 года составила $62,53932 за баррель, или $456,5 за тонну.

|

2017, December, 18, 12:40:00

OPTIMISTIC OIL PRICESBLOOMBERG - OPEC’s Secretary General Mohammad Barkindo said the producer group is close to its goal of rebalancing markets and the International Energy Agency said oil inventories in developed nations have slid to the lowest since July 2015. OPEC upped the implementation of promised cuts in November to 115 percent, the highest rate since the agreement began, according to the IEA.

|

2017, December, 18, 12:35:00

INEVITABLE OIL CHANGESOPEC - Sustainable oil market stability is crucial to attract the level of investment necessary for future demand growth; In the longer term, oil will remain a vital and integral part of the energy mix; Global energy and oil demand will grow in the long term;

|

2017, December, 15, 13:10:00

UNCERTAIN OIL PRICESEIA - The forecast for oil prices remains highly uncertain. WTI futures contracts for March 2018 delivery, traded during the five-day period ending December 7, 2017, averaged $57/b.

|