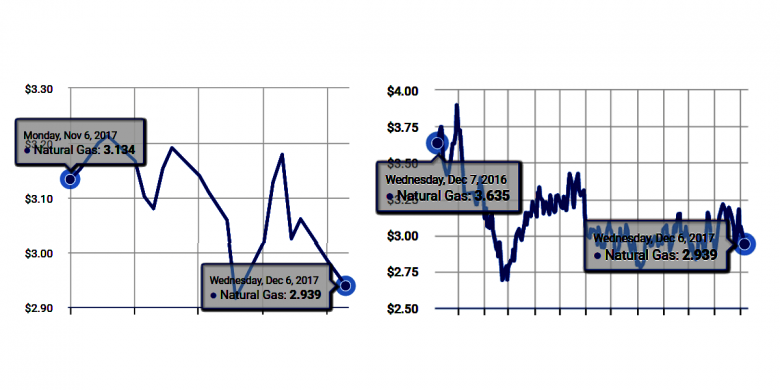

GAS PRICES DOWN TO $2.933

PLATTS - NYMEX January natural gas futures moved higher in US overnight trading before retracing their gains as traders consider supportive weather against bearish supply.

Colder weather outlooks for major heating regions support the upside, while the recent and impending lackluster pace of storage erosion is keeping downward pressure on the market. At 6:50 am ET (1150 GMT) the contract was 5.2 cents lower at $2.933/MMBtu.

Updated National Weather Service projections for the six-to-10-day and eight- to 14-day periods continue to show the US split between below-average temperatures over the entire eastern half and aboveaverage temperatures over the bulk of the West, with a narrow swath of average temperatures over the Central US.

Cold weather in store for the major heat-consuming regions in the East should boost demand and weekly stock withdrawals, but recent mild conditions have meant modest storage withdrawals.

-----

Earlier:

2017, December, 1, 12:40:00

GAS PRICES DOWN TO $3.097/MMBTUPLATTS - Having gained over 5 cents yesterday as the new front month contract, NYMEX January 2018 natural gas futures were lower ahead of Thursday's open and the morning release of the weekly storage data. At 6:45 am ET (1145 GMT), the contract was down 8.2 cents to $3.097/MMBtu.

|

2017, November, 20, 09:20:00

RUSSIA'S GAS FOR EUROPE UPGazprom's natural gas supplies to western Europe edged up by 3% year on year in the third quarter of 2017, according to an S&P Global Platts analysis of Gazprom data, as Russian gas deliveries to its core markets continue to outpace last year's levels.

|

2017, November, 14, 17:30:00

U.S. OIL + 80 TBD, GAS + 779 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 80,000 b/d month-over-month in December to 6.174 million b/d, gas production to increase 779 million cubic feet/day.

|

2017, November, 9, 14:00:00

OPEC: 2040 GLOBAL ENERGY CHANGESWithin the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

|

2017, November, 9, 13:35:00

U.S. - CHINA LNGChina’s top state oil major Sinopec, one of the country’s top banks and its sovereign wealth fund have agreed to help develop Alaska’s liquefied natural gas sector as part of U.S. President Donald Trump’s visit, the U.S. government said on Thursday. The agreement will involve investment of up to $43 billion, create up to 12,000 U.S. jobs during construction, reduce the trade deficit between the United States and Asia by $10 billion a year, and give China clean energy.

|

2017, October, 27, 19:20:00

CHINA'S GAS CONSUMPTION UPEIA - Global natural gas consumption is expected to grow from 340 billion cubic feet per day (Bcf/d) in 2015 to 485 Bcf/d by 2040, primarily in countries in Asia and in the Middle East. China accounts for more than a quarter of all global natural gas consumption growth between 2015 and 2040.

|

2017, October, 23, 11:25:00

AUSTRALIAN LNG UP ANEWAustralia became the world’s second-largest exporter of liquefied natural gas (LNG) in 2015 and is likely to overtake Qatar as the world’s largest LNG exporter by 2019. As Australia’s LNG exports have increased, primarily from LNG projects in eastern Australia, the country has had natural gas supply shortages in eastern and southeastern Australia and an increase in domestic natural gas prices. |