INEVITABLE OIL CHANGES

OPEC - Energy at the Crossroads: Seeking New Balance

Keynote Address delivered by HE Mohammad Sanusi Barkindo, OPEC Secretary General, at the 5th International Energy Executive Forum 2018, 13 December 2017, Beijing, People's Republic of China.

I would like to begin by thanking my twin brother, Dr. Sun Xiansheng, Secretary General of the International Energy Forum. Not many people know that we are brothers, but Dr. Sun likes to remind me that there once was only one continent before they split up into our current continents. We all came from there, so this shared origin makes us brothers!

It is a pleasure to share the floor with my professor, Daniel Yergin. Dan has been a great friend over the years.

Mr. Chairman, distinguished delegates, ladies and gentlemen,

It is a distinct honour for me to deliver this keynote address at the International Energy Executive Forum, on its fifth anniversary.

We live in an increasingly interdependent world, driven by the irreversible forces of globalization which will continue to define the global energy transition. The OPEC-non-OPEC landmark, historic Declaration of Cooperation has established a platform to provide the necessary insurance of sustainable stability in the oil market with multiplier effects on the global economy.

Hence the theme of today's forum, "Energy at Crossroads: Seeking New Balance" is both apt and timely.

Today's agenda covers a programme of topics and discussion points that are extremely stimulating and thought-provoking.

In my comments, I would like to touch on subjects relevant to the short, medium and long term perspectives for the oil industry. The complex interplay between these components is crucial in order to truly assess "Energy at Crossroads."

In this regard, my remarks can be divided into four sections:

Firstly, I would like to make a point about the general character of the oil industry, which will contextualize many of my subsequent remarks.

The second section relates to the market's prospects in the short-term, and looming large in this respect is the historic Declaration of Cooperation. I will cover its genesis, impact and successes to date.

Thirdly, with regard to the medium to longer-term, I would like to provide a brief synopsis of the 2017 edition of OPEC's World Oil Outlook to 2040 (WOO), which was launched last month. A delegation from OPEC headed by Dr. Ayed Al-Qahtani, Director of the Research Division, presented an overview of this to CNPC ETRI on Monday, here in Beijing.

And finally, I would like to shed some light on OPEC's views on current discussions on policies aimed at combatting climate change.

In these sections, I would like to make eight points which I believe encapsulate OPEC's views on current conditions in the oil market and perspectives for the future.

My eight points will be:

- Change is an integral aspect of the nature of our industry;

- The historic Declaration of Cooperation is an indelible feature of the new energy landscape;

- The rebalancing of the oil market is currently well and truly underway-the end of this brutal oil cycle is finally in sight;

- Sustainable oil market stability is crucial to attract the level of investment necessary for future demand growth;

- In the longer term, oil will remain a vital and integral part of the energy mix;

- Global energy and oil demand will grow in the long term;

- The future of US tight oil supply is uncertain, with the complex interplay between technology, geology and economics playing a critical role;

- The right of people living in developing countries to access modern energy services should be respected, upheld and enshrined within environmental policies of governments.

Ladies and gentlemen,

My first point is very much related to the topic of Session One, "Balancing the old and new in the world of energy."

Undoubtedly there are major changes afoot in our industry. These have been brought about by a mixture of the emergence of new producers and technological innovation, as well as a new policy framework with regard to measures aimed at combatting climate change.

However, as anyone who has read Dan's masterpiece "The Prize" is aware, in the long history of this industry, since Edwin Drake first struck oil in Titusville, Pennsylvania in 1859, change has been a permanent characteristic of the story of oil.

Nowhere is the tendency for change more apparent than in the history of the oil price. Price cycles have always been part of the market and they always will be. They are integral to its evolving nature and their characteristics correlate with changes in market dynamics and structures.

During the course of our research on price cycles, OPEC has identified six since the early 1970s. This has been an illuminating exercise as it has revealed some interesting similarities among the cycles, as well as some discrepancies.

For example, there have been instances of demand driven cycles, whereas in other cases they have been supply driven. At other times, a combination of supply and demand factors has driven prices.

Moreover, it is apparent that in recent times, non-fundamental factors like speculative financial activities have also had a significant impact on prices.

However, this current price cycle should be considered unique for several reasons. Firstly, it is the most overwhelmingly supply-driven of all the cycles we assessed as part of this exercise. Secondly, the magnitude of the price drop is the highest in real terms. And finally, the recent oil price drop has been considerably sharper than the decline in prices for other commodities, which is in stark contrast to the oil price collapse of 1985-1986, when all commodity prices declined in a similar steep manner, something Dan referred to earlier.

Between 2008 and 2015, non-OPEC liquids supply growth was 7.9 mb/d, while OPEC liquids production was 1.5 mb/d during the same period. This total of 9.4 mb/d growth in a relatively short period, was phenomenal and epoch defining.

By July 2016, you may recall that OECD commercial stock levels reached a record high of about 386 mb over the five-year average. The OPEC Reference Basket price fell by an extraordinary 80% between June 2014 and January 2016. Investments were choked-off, with exploration and production spending falling by an enormous 27% in both 2015 and 2016. Additionally, nearly one trillion dollars in investments were frozen or discontinued, and many thousands of good quality jobs were lost.

The seriousness of these developments motivated OPEC to embark on extensive consultations throughout 2016 to build consensus about the strategic urgency of rebalancing the global oil market in a collective manner.

This culminated in the historic Declaration of Cooperation, whereby 24 oil producing nations agreed at the first OPEC non-OPEC Ministerial Meeting held on the 10th of December 2016 in Vienna, on a concerted effort to accelerate the stabilization of the global oil market through voluntary adjustments in total production of around 1.8 million barrels per day. The second OPEC non-OPEC Ministerial Meeting, held on the 25th of May 2017, extended the voluntary production adjustments for another nine months commencing on the 1st of July 2017.

Two weeks ago, we saw the ultimate vindication that not only is this partnership holding together: it is thriving.

Following the third OPEC and non-OPEC Ministerial Meeting on the 30th of November 2017, the Declaration of Cooperation was amended to take effect for the whole year of 2018. Six additional countries issued a 'Declaration of Support,' recognising and acclaiming this contribution to oil market stability.

Currently, we are gradually but steadily putting the building blocks in place for institutionalising the Declaration of Cooperation, beyond rebalancing the market:

- The OPEC and non-OPEC Ministerial Meeting is on a firm footing as a policy-making forum. As I previously said, the third edition took place just two weeks ago, continuing an outstanding record of decision making and consensus building.

- A series of OPEC and non-OPEC Technical Meetings have been successfully organised under the umbrella of the Declaration of Cooperation. These have achieved a commendable level of knowledge-exchange much coveted by our industry. We have ceased to operate in silos and realised that we are all on the same boat.

- The organs designed to monitor the implementation of the Declaration of Cooperation as well as developments in the market, namely, the Joint Ministerial Monitoring Committee (JMMC) and the Joint Technical Committee (JTC) have evolved into "jewels in the crown" of OPEC and non-OPEC cooperation. These are thriving, invigorating and dynamic forums, producing high quality market analyses on a monthly basis.

- We have established joint OPEC and non-OPEC technical coordination meetings on environmental issues, under the United Nations Framework Convention on Climate Change (UNFCCC) process. The first meeting was actually held in October at the OPEC Secretariat in Vienna, in preparation for COP 23 in Bonn. Our experts from OPEC and non-OPEC came together to establish a "joint rule book" guiding participating countries in COP negotiations and this will be a permanent feature of cooperation.

- We are designing a framework for a continuity strategy for supply management to help ensure a stable and sustainable oil market.

- Finally, I would stress that there is no ceiling on how many countries can join the forum that is, the Declaration of Cooperation. There is an open invitation for all oil producers to join with us and work responsibly towards market rebalancing in the interests of all.

Therefore, the Declaration of Cooperation and the enhanced relations between its participating countries constitute a fundamental and essential feature of the "new in the world of energy."

I am delighted to say that the consequences of our historic cooperation have exceeded even the most optimistic of predictions. The market rebalancing process is well underway. Commercial oil stocks in the OECD fell further in the month of November and the difference to the latest five-year average has been reduced by around 200 million barrels since the beginning of this year.

This process has clearly been driven by the excellent conformity levels with the production adjustments, which was 116% for October 2017. It is a clear indication of the steely and determined commitment of participating producers to this process.

There are further positive signs for the global oil market. Global economic growth, which Dan referred to earlier, is forecast at 3.7% for both 2017 and 2018. China's GDP growth is forecast at 6.8% in 2017 and 6.5% in 2018. Correspondingly, global oil demand growth has also been on the rise, with the 2017 forecast having been revised up by nearly 400 tb/d since the beginning of the year to now stand at 1.53 million barrels a day. For 2018, the encouraging dynamic is set to continue with a forecast of 1.51 million barrels a day.

My remarks so far have been largely confined to the short-term prospects of the oil industry. I would now like to turn to the longer-term prospects.

Last month, OPEC launched the 2017 version of the WOO. This edition, like previous editions, underscored the importance of Asia, specifically China, as a major centre of economic growth, playing a pivotal role in the future of the energy industry. For example, China's portion of global GDP is expected to increase from 18% to 23% between 2016 and 2040.

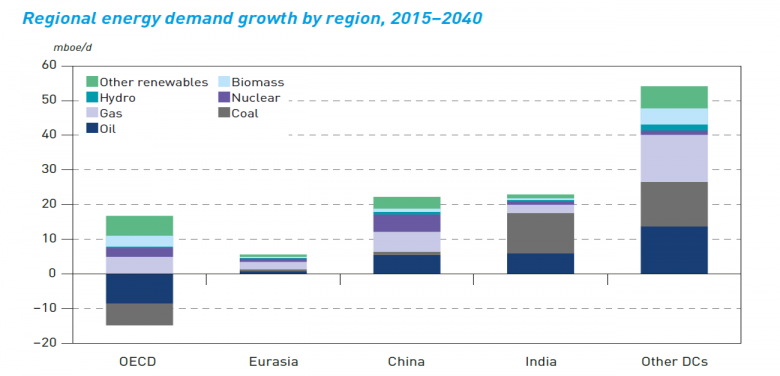

Global energy demand growth is expected to increase by approximately 96 million barrels of oil equivalent per day between 2016 and 2040. Roughly 23% of this increase will come from China.

A similar trend can be observed with regard to oil demand. World oil demand is expected to grow by 16 mb/d, from 94.4 mb/d in 2016 to 111.1 mb/d in 2040. Here also, China will account for a staggering 38% of this growth.

Furthermore, according to our estimates, crude exports from OPEC Member Countries to China will increase by close to 4 mb/d between 2016 and 2040, rising from 4.4 mb/d in 2016 to more than 8 mb/d in 2040, representing around 20 % of the world's total crude oil trade between major regions by 2040.

So it is absolutely clear that for the foreseeable future, China will be one of the most important outlets for OPEC barrels and the Asia-Pacific region will be the backbone of the increase in energy and oil demand.

The importance of China for the future of world energy demand will be underlined by the progress of the Belt and Road Initiative (BRI). As infrastructure expands along the BRI routes across the oceans and the Eurasian continent, this will have a knock-on effect on energy demand. OPEC is determined to be a reliable partner for China, dependable in meeting China's oil needs.

With regard to the composition of the energy mix, fossil fuels are expected to retain a dominant role in the global energy mix, albeit with a declining overall share. Oil and gas together are still expected to provide more than half of the world's energy needs from 2016 to 2040, with their combined share relatively stable between 52–53%.

This means there is no expectation for a peak in oil demand over the forecast period to 2040.

It also important to note that to meet the projected increase in global oil demand, investments worth an estimated $10.5 trillion will be required. This underscores the absolutely necessity of a sustainable and stable oil market, conducive to encouraging the type of long-cycle investments necessary to prevent supply gaps in the future. Once more, this shows how critically important the Declaration of Cooperation is.

In Session One, we will discuss the emergence of the United States as a critical oil and gas producer and exporter. I would like to emphasise that US tight oil has been welcomed as it is, and will continue to be, a key component of the global oil supply mix. Tight crude supply from the US and Canada is expected to increase dramatically from 4.5 mb/d in 2016 to 8.7 mb/d in 2025, according to our outlook.

The are many factors behind this growth in US tight oil supply. Firstly, there was the application of the cutting-edge technology of fracking, that made the transition from the gas to the oil industry.

Secondly, there was the emergence of sophisticated, aggressive, managerial skills of unconventional business models. These were especially potent operating within the framework of the world's most sophisticated financial system. These factors combined to give birth to the tight oil revolution, at a time when there were significant disruptions to supply in key producing countries, including some of our Members.

OPEC recognises the importance of US tight oil, spearheading dialogue with leading stakeholders in the industry and is keen for this to proliferate going forward.

However, there is a great deal of uncertainty with regard to the future of US tight oil supply, with technology, economics and geology playing critical roles.

Notably, there has been a recent, important shift in tight oil investor sentiment, from a "growth at any costs" model to an emphasis on returns on capital, cash generation and fiscal discipline. In the longer term, according to our Outlook, US tight oil growth is expected to decelerate, then plateau and peak just after 2025.

It is also important to remember that in the longer term, there is the question of compensating for natural decline rates, which can be as high as 5% per year. To maintain current production levels, the industry might need to add upwards of 4 mb/d each year.

Therefore, given the growth in world oil demand which I mentioned earlier, the uncertainties surrounding the tight oil industry, the expected supply peak in 2025 and natural decline rates, it is clear that US tight oil alone cannot meet all of the market's needs in the future.

OPEC is a firm advocate of the necessity of all stakeholders in the energy industry working together to overcome the challenges of our times. Nowhere is this approach more indispensable than in the area of tackling climate change.

Last month in Bonn, I had the privilege of addressing the high-level segment of the UN Climate Change Conference, COP 23. In my remarks, I was able to convey what has been OPEC's consistent position on this global challenge.

OPEC remains fully engaged and supportive of the Paris Agreement. We firmly believe that a global consensus from the multilateral process remains the best and most inclusive way for all nations to collectively counter climate change in a fair and equitable manner.

The fact remains that the world will continue to need all energy sources, especially for the 1.1 billion people in developing countries that suffer from acute energy poverty.

The positive benefits of oil should not be put beyond the reach of millions of the world's poorest and most vulnerable people. It should not be overlooked that our resource has, throughout its history, stimulated economic growth, development, prosperity and social mobility.

The right to have access to modern energy services for the first time, to provide warmth, light and mobility should not be unduly impeded.

I would like to compliment China for accomplishing one of the key pillars in combatting energy poverty, by ensuring the entire Chinese population of nearly 1.4 billion have access to electricity. This example is something other developing countries should aspire to.

Therefore, rather than discriminate against any energy source, it is vital that we collectively develop and adopt technologies that transform the environmental credentials of all energies. In this regard, OPEC welcomes coordinated action between all Parties, with industry and through various research and development platforms.

Ladies and gentlemen,

I have outlined our views at great length because OPEC firmly believes in the fundamental importance of sharing data, information and outlooks. Fostering good relations with all energy stakeholders is of paramount importance. As the old Chinese proverb tells us, "the going is difficult when doing it alone; the going is made easier when doing it with many others."

I am delighted to be in a country which appreciates the vital need for international collaboration based on the principles of fairness, equity and mutual respect. May these sentiments guide our discussions today and our relations going forward.

Thank you for your kind attention and I wish you a fruitful and productive Forum.

Xie-xie.

-----

Earlier:

ENERGY: |

2017, December, 15, 12:55:00

NUCLEAR - 2050: 25%WNN - According to the Foratom statement, World Nuclear Association Director General Agneta Rising said: "By 2050, nuclear energy must account for 25% of energy generation if we are to meet our climate targets. With nuclear making up 11% of generation in 2014, an extra 1000 GWe in nuclear capacity will need to be built by 2050. However, meeting this goal will not be easy."

|

2017, November, 15, 15:15:00

IEA: GLOBAL ENERGY DEMAND UP BY 30%Global energy needs rise more slowly than in the past but still expand by 30% between today and 2040. This is the equivalent of adding another China and India to today’s global demand.

|

2017, November, 9, 14:00:00

OPEC: 2040 GLOBAL ENERGY CHANGESWithin the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

|

2017, November, 9, 13:50:00

EIA: NUCLEAR ENERGY WILL UPEIA projects that global nuclear capacity will grow at an average annual rate of 1.6% from 2016 through 2040, led predominantly by countries outside of the Organization for Economic Cooperation and Development (OECD). EIA expects China to continue leading world nuclear growth, followed by India. This growth is expected to offset declines in nuclear capacity in the United States, Japan, and countries in Europe.

|

2017, November, 1, 13:30:00

SOUTHEAST ASIA NEED ENERGYAccess to modern energy is incomplete. With a total population of nearly 640 million, an estimated 65 million people remain without electricity and 250 million are reliant on solid biomass as a cooking fuel. Investment in upstream oil and gas has been hit by lower prices since 2014 and the region faces a dwindling position as a gas exporter, and a rising dependency on imported oil.

|

2017, September, 15, 08:55:00

WORLD ENERGY CONSUMPTION UP TO 28%The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

|

2017, September, 13, 15:10:00

IMF: SOUTHEAST ASIA'S TRANSFORMATIONIMF - When we think about Asia’s economic future, we know that this future is being built on strong foundations—on the richness and diversity of its cultures, on the incredible energy and ingenuity of the people who have changed the world by transforming their own economies. China and India have been driving the greatest poverty reduction in human history by creating the world’s largest middle classes. In a single generation, Vietnam has moved from being one of the world’s poorest nations to being a middle-income country. |