OIL PRICE: NOT ABOVE $63

REUTERS, BLOOMBERG - Oil prices dipped on Wednesday, as refined product inventories in the United States rose in what the market interpreted as a sign of lacklustre demand.

Brent crude futures LCOc1, the international benchmark for oil prices, were down 6 cents at $62.80 a barrel as of 0751 GMT.

U.S. West Texas Intermediate (WTI) crude futures were at $57.50 a barrel, down 22 cents.

Traders said prices fell after an American Petroleum Institute (API) report late on Tuesday that showed a 9.2 million barrel rise in gasoline stocks in the week ended Dec. 1, and an increase of 4.3 million barrels in distillate inventories, which include motor diesel and heating oil.

The perception that the higher fuel stocks pointed to weak demand outweighed a drop in crude inventories by 5.5 million barrels to 451.8 million barrels, traders said.

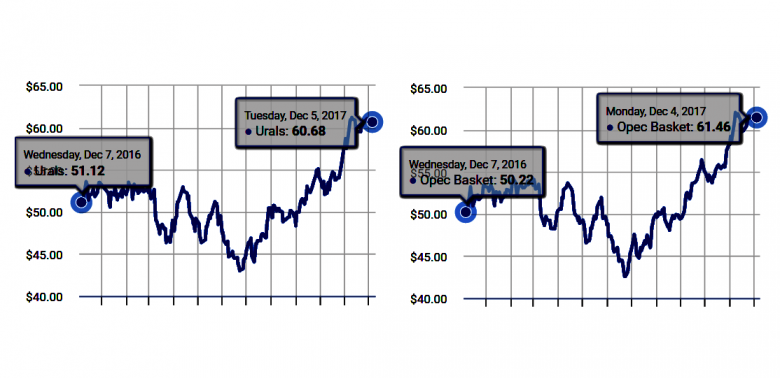

Outside the United States, analysts said supply cuts by the Organization of the Petroleum Exporting Countries (OPEC), Russia and other producers - last week extended to all of next year - have helped lift Brent prices by more than 40 percent since June, and more than 130 percent since early 2016, when they hit their lowest level since 2003.

With the supply cuts likely in place throughout 2018, analysts said crude prices were well supported.

"Robust global demand and tight supplies should see Brent crude oil rise to $70 per barrel by mid-year (2018)," said Bank of America Merrill Lynch in its 2018 outlook.

One factor that could undermine OPEC's and Russia's effort to cut supplies and prop up prices is U.S. oil production C-OUT-T-EIA, which has risen by 15 percent since mid-2016 to 9.68 million barrels per day, close to levels of top producers Russia and Saudi Arabia.

"U.S. shale producers continue to win market share," said Fawad Razaqzada, analyst at futures brokerage Forex.com.

But weaker economic performance and a decline in refinery capacity utilisation in the first quarter could be a drag on oil demand and dampen prices, said Georgi Slavov, head of research at commodity broker Marex Spectron.

"Demand remains firm, which is the main reason for us to still see oil at/above $60 per barrel. This is likely to change as we approach 2018," Slavov said in a note.

"We are starting to pick up weakness in the macro performance of key oil consuming regions. We are also starting to take note of the forthcoming January–February decline in refinery capacity utilisation," he said.

Despite this, some analysts said they expected refining margins to remain healthy into 2018.

"Refining margins will surprise to the upside in 2018 ... (because) we expect petroleum product demand growth of 1.3 million bpd on continued strength in the key light ends: gasoline and distillate," Bernstein Research said in a note to clients on Wednesday.

-----

Earlier:

2017, December, 4, 23:20:00

OIL PRICE: NOT ABOVE $64 YETBLOOMBERG - West Texas Intermediate for January delivery was at $57.93 a barrel on the New York Mercantile Exchange at 2:02 p.m. in Seoul, down 43 cents. The contract gained 96 cents to settle at $58.36 on Friday. Total volume traded was about 21 percent below the 100-day average. Brent for February settlement dropped 36 cents to $63.37 a barrel on the London-based ICE Futures Europe exchange. Prices added $1.10, or 1.8 percent, to close at $63.73 on Friday. The global benchmark crude was at a premium of $5.43 to February WTI.

|

2017, December, 4, 23:15:00

СОТРУДНИЧЕСТВО С ОПЕКМИНЭНЕРГО РОССИИ - ОПЕК оставляет в силе решения, принятые 30 ноября 2017 года; в «Декларацию о сотрудничестве» вносится поправка, согласно которой ее срок действия охватывает весь 2018 год с января по декабрь 2018 года, при этом входящие и участвующие в кооперации не входящие в ОПЕК страны обязуются обеспечить полное и своевременное исполнение условий «Декларации о сотрудничестве» и скорректировать объемы добычи в соответствии с достигнутыми на добровольной основе договоренностями.

|

December, 2, 18:54:00

OPEC CONFIRMEDOPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets.

|

December, 1, 13:05:00

OIL PRICE: NOT ABOVE $64BLOOMBERG - West Texas Intermediate for January delivery was at $57.72 a barrel on the New York Mercantile Exchange, up 32 cents, at 7:50 a.m. in London. Total volume traded was about 16 percent below the 100-day average. Prices rose 10 cents to $57.40 on Thursday, capping a 5.6 percent gain for November. Brent for February settlement climbed 43 cents to $63.06 a barrel on the London-based ICE Futures Europe exchange. The January contract expired Thursday after adding 46 cents, or 0.7 percent, to $63.57. The global benchmark crude was at a premium of $5.32 to February WTI.

|

December, 1, 13:00:00

СОГЛАШЕНИЕ: МЕНЬШЕ НЕФТИМИНЭНЕРГО РОССИИ - «Мы успешно и конструктивно провели переговоры по продлению сделки. Мы удовлетворены результатами балансировки рынка, сокращением излишков нефти и нефтепродуктов, снижением волатильности цен, а также возврату инвестиционной активности в отрасли. В тоже время мы также единодушно подтвердили то, что мы находимся лишь в середине пути, и для того, чтобы достичь окончательной цели по балансировке рынка, нам нужно продолжить совместные усилия».

|

December, 1, 12:50:00

OPEC & RUSSIA CUTSBLOOMBERG - OPEC and its allies outside the group agreed to maintain oil production cuts until the end of 2018, extending their campaign to wrest back control of the global market from America’s shale industry.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|