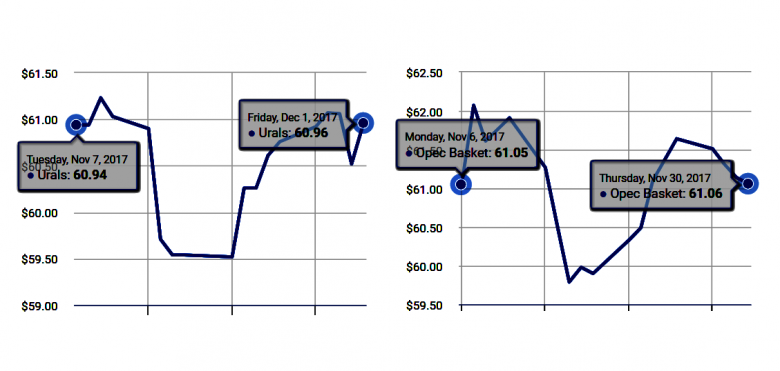

OIL PRICE: NOT ABOVE $64 YET

BLOOMBERG - Oil dropped below $58 a barrel as investors weighed an increase in U.S. oil drilling rigs against OPEC's promise to extend output cuts through the end of next year.

Futures fell as much as 0.9 percent in New York after adding 1.7 percent Friday. OPEC and its allies including Russia last week agreed to keep their supply cuts in place and beefed up the extension with the inclusion of Nigeria and Libya. Executives from three of the biggest independent U.S. drillers said while they won't increase activity just because prices rise after OPEC agreed to prolong curbs, they will continue to grow.

Oil has advanced for three consecutive months through November amid optimism that output cuts by Organization of Petroleum Exporting Countries and its partners are helping to balance the market. Drillers targeting crude in the U.S. added two rigs to 749 last week, the highest level since late September, according to Baker Hughes Inc.

"Even though adding Nigeria and Libya is a positive sign, OPEC has basically played all its cards after deciding to extend production curbs through next year," Will Yun, a commodities analyst at Hyundai Futures Corp., said by phone. "As long as U.S. shale suppliers exist, it will be hard to see further gains in oil prices from now on."

West Texas Intermediate for January delivery was at $57.93 a barrel on the New York Mercantile Exchange at 2:02 p.m. in Seoul, down 43 cents. The contract gained 96 cents to settle at $58.36 on Friday. Total volume traded was about 21 percent below the 100-day average.

Brent for February settlement dropped 36 cents to $63.37 a barrel on the London-based ICE Futures Europe exchange. Prices added $1.10, or 1.8 percent, to close at $63.73 on Friday. The global benchmark crude was at a premium of $5.43 to February WTI.

Pioneer Natural Resources Co., Parsley Energy Inc. and Newfield Exploration Co. said their emphasis will be on maintaining spending discipline and generating profits, rather than just boosting supply on higher oil prices. Pioneer plans to boost output from about 300,000 barrels of oil equivalent a day this quarter to more than 1 million by 2026.

-----

Earlier:

December, 2, 18:54:00

OPEC CONFIRMEDOPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets.

|

December, 1, 13:05:00

OIL PRICE: NOT ABOVE $64BLOOMBERG - West Texas Intermediate for January delivery was at $57.72 a barrel on the New York Mercantile Exchange, up 32 cents, at 7:50 a.m. in London. Total volume traded was about 16 percent below the 100-day average. Prices rose 10 cents to $57.40 on Thursday, capping a 5.6 percent gain for November. Brent for February settlement climbed 43 cents to $63.06 a barrel on the London-based ICE Futures Europe exchange. The January contract expired Thursday after adding 46 cents, or 0.7 percent, to $63.57. The global benchmark crude was at a premium of $5.32 to February WTI.

|

December, 1, 13:00:00

СОГЛАШЕНИЕ: МЕНЬШЕ НЕФТИМИНЭНЕРГО РОССИИ - «Мы успешно и конструктивно провели переговоры по продлению сделки. Мы удовлетворены результатами балансировки рынка, сокращением излишков нефти и нефтепродуктов, снижением волатильности цен, а также возврату инвестиционной активности в отрасли. В тоже время мы также единодушно подтвердили то, что мы находимся лишь в середине пути, и для того, чтобы достичь окончательной цели по балансировке рынка, нам нужно продолжить совместные усилия».

|

December, 1, 12:55:00

SAUDIS & RUSSIA LEADERSHIPPLATTS - Saudi Arabia reasserted its leadership of the oil market Thursday after brokering its desired extension of output cuts with OPEC and non-OPEC partners through to the end of 2018. The deal -- agreed after nearly nine hours of negotiations in Vienna -- kept its new ally Russia onside and prevented a sell-off that many analysts had feared.

|

December, 1, 12:50:00

OPEC & RUSSIA CUTSBLOOMBERG - OPEC and its allies outside the group agreed to maintain oil production cuts until the end of 2018, extending their campaign to wrest back control of the global market from America’s shale industry.

|

November, 29, 10:05:00

OIL PRICE: ABOVE $63 STILLREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.67 a barrel at 0427 GMT, down 32 cents, or 0.6 percent below their last settlement. Brent crude futures, the international benchmark for oil prices, were at $63.14 a barrel, down 47 cents, or 0.7 percent. |

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|