OPEC & RUSSIA CUTS

BLOOMBERG - OPEC and its allies outside the group agreed to maintain oil production cuts until the end of 2018, extending their campaign to wrest back control of the global market from America's shale industry.

After a day of talks in Vienna, the decision showed the strength of the unprecedented alliance between the world's top two oil producers, Saudi Arabia and Russia, and confounded Wall Street analysts who'd predicted Moscow would be reluctant to keep going. The deal was even beefed up through the inclusion of Nigeria and Libya, two members of the Organization of Petroleum Exporting Countries originally exempted from the curbs.

"We are united, shoulder to shoulder," Saudi Arabian Energy Minister Khalid Al-Falih said sitting next to his Russian counterpart Alexander Novak at a press conference after the meeting. "We are completely aligned."

Since the pact started a year ago, global inventories have fallen and prices rose by more than $20 a barrel, but in a rare display of unanimity at an OPEC meeting ministers agreed the job wasn't yet complete. By keeping the 1.8 million barrels a day of cuts in place for a further nine months, the oil producers aim to return stockpiles to their five-year average without overheating the market and eliciting a new flood of shale oil.

"Fundamentally, the cuts have worked well," Patrick Pouyanne, chief executive officer of French oil major Total SA, said at a press briefing in Antwerp. "I'm not surprised they decided to extend. "

OPEC's evolving view of the oil market supported a full year extension. Until last week, OPEC's internal analysis concluded that stockpiles would be back in line with the five-year average in the third quarter of 2018. At the meeting on Tuesday of the Joint Technical Committee -- officials from OPEC and non-OPEC nations that monitor the cuts -- that key date was pushed back to the end of the third quarter or the start of the fourth, said people familiar with the deliberations.

Libya and Nigeria, previously exempt from cutting production due to internal strife, agreed to a collective cap on their output that exceeds the nations' current production, according to Iranian Oil Minister Bijan Namdar Zanganeh. To accommodate the two new entrants, the existing deal will be reset to run for twelve months from January to December, delegates said.

"The most positive surprise is the inclusion of Libya and Nigeria in the deal and it removes uncertainty about supply in 2018," said Jan Edelmann, an analyst at HSH Nordbank in Hamburg.

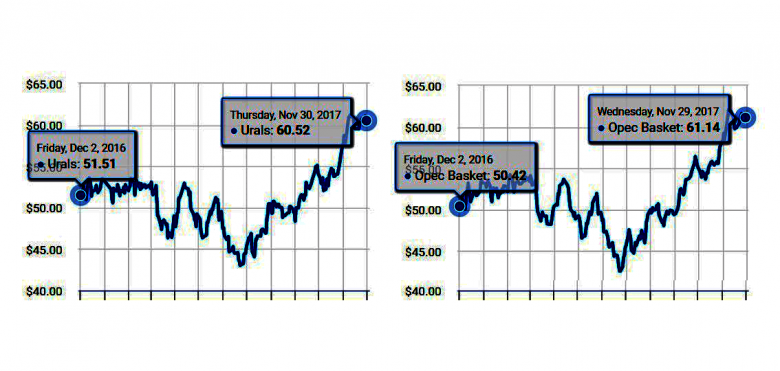

West Texas Intermediate, the U.S. benchmark, was 0.2 percent higher at $57.49 a barrel as of 10:07 a.m. in Singapore. Brent for February settlement climbed 0.4 percent to $62.85 a barrel.

Before the meeting, Russia had sought assurances on how and when the agreement would be phased out, people involved in negotiations said earlier this week. The country needs greater clarity than most OPEC members because its economic policy making is more complex, including a floating exchange rate that fluctuates with the oil price.

Those concerns had prompted some Wall St. banks including Citigroup Inc. and Goldman Sachs Group Inc. to warn the meeting might disappoint oil investors.

Despite the success of today's meeting, OPEC was given an immediate sign of the challenges it still faces. The U.S. government reported a large increase in domestic production in September, bringing the total to 9.48 million barrels a day, the fourth-highest monthly level since the early 1970s. Oil output surged in Texas and New Mexico, home of the prolific Permian shale basin.

The Philadelphia Oil Services Index, made up of 15 various drilling and fracking contractors, climbed 1.8 percent in New York, while U.S. shale explorers Pioneer Natural Resources Co. and Continental Resources Inc. each rose more than 2.5 percent on Thursday.

Explorers in the U.S. are likely to be seen as more attractive for investors heading into next year, Leo Mariani, an analyst at Natalliance Securities, wrote Wednesday in a note to investors.

"While there is no doubt that non-OPEC production growth will be robust in 2018, fears are probably a little overblown as I expect global oil inventories to continue to draw down for most of next year," he wrote.

Although Al-Falih said the impact of shale would be muted by production declines in mature fields elsewhere, he made clear OPEC was willing to stay the course.

It would be premature to talk about an exit strategy because OPEC and its allies are relying on oil demand in the third quarter of 2018 to finally eliminate the inventory surplus, Al-Falih said before the meeting. But the kingdom is open to discussions about how the group could wind down the cuts "very gradually" once its goals are achieved, he said.

Although the final communique said OPEC's meeting in June would review the production limits, ministers were keen to say there was no suggestion that they wanted to back off before the end of next year.

"The June meeting is not an exit meeting. It is not an exit review," said Nigerian Oil Minister Emmanuel Kachikwu. "It is simply a commonplace analysis of what the market is trending for and what we need to do to strengthen the bonds we have set up today."

-----

Earlier:

November, 29, 10:00:00

OPEC OIL EXPECTATIONSBLOOMBERG - Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and meetings this week in Vienna, where OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

|

November, 27, 20:15:00

РОССИЯ ПОДДЕРЖИВАЕТ СОКРАЩЕНИЕМИНЭНЕРГО РОССИИ - «Мы видим, что с рынка ушло примерно 50% излишком запасов нефти, мы видим, что цена сбалансировалась и вышла на достаточно приемлемый уровень в районе 60 и выше долларов за баррель марки Brent, инвестиции начали уже в 17-м году расти, а до этого они 15-16-й год падали. Тем не менее, мы не достигли еще до конца цели по балансировке рынка, и сегодня практически все выступают за то, что необходимо продлить сделку дополнительно для того, чтобы достичь окончательных целей. В принципе, Россия тоже поддерживает такие предложения, рассматриваются разные варианты».

|

November, 24, 09:20:00

OPEC WILL REDUCEREUTERS - The Organization of the Petroleum Exporting Countries, non-member Russia and nine other producers agreed to curb oil output by about 1.8 million barrels per day until March 2018. They are expected to extend the deal at a Nov. 30 meeting in Vienna.

|

November, 17, 19:50:00

RUSSIA'S OIL PAUSEFT - The original deal with Opec’s de facto leader Saudi Arabia, brokered by Mr Novak and Russian president Vladimir Putin, reduced oil production from participating countries by 1.8m barrels a day and helped push the price of benchmark Brent Crude above $60 a barrel this week for the first time in more than two years. |

November, 15, 15:20:00

IEA COOLS THE MARKETBLOOMBERG - Prices dropped during the session as the International Energy Agency said the recent recovery in oil prices, coupled with milder-than-normal winter weather, is slowing demand growth. The worsening outlook for consumption dampened some of the enthusiasm that OPEC and its allies will extend supply curbs.

|

November, 3, 12:20:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИПо линии энергетики Министр отметил потенциал сотрудничества по вопросам совместной разработки нефтяных и газовых месторождений на территории России и Саудовской Аравии, производства нефтегазового оборудования, разработки и внедрения современных технологий в области нефтегазодобычи, а также подготовки кадров для топливно-энергетического сектора Саудовской Аравии.

|

October, 27, 19:30:00

СПРОС НА НЕФТЬ ВЫРАСТЕТОтвечая на вопрос о прогнозе мирового потребления нефти, Александр Новак отметил, что спрос на нефть будет расти в ближайшие пару десятилетий, но более низкими темпами, чем рост экономики. «Чуть меньше 1% в период ближайших 15-20 лет», - пояснил Министр. |