OPTIMISTIC OIL PRICES

BLOOMBERG - Oil's bumpy ride to higher ground this year is winding down with a good dose of optimism that 2018 will be even better.

Hedge funds boosted their bets on rising Brent crude to a record, with bullish wagers on West Texas Intermediate oil near a nine-month high. The optimism is largely fueled by confidence that the extension of OPEC output curbs will tighten up markets next year.

"In general, money managers are ending the year on a high note, certainly a little more optimistic than where they started and where we were at the middle of the year," Ashley Petersen, lead oil analyst at Stratas Advisors in New York, said in a telephone interview. "The U.S. remains kind of a big risk next year in terms of increasing supply, but the international picture is still pretty optimistic and pretty bright with OPEC controlling supply and demand strong."

OPEC's Secretary General Mohammad Barkindo said the producer group is close to its goal of rebalancing markets and the International Energy Agency said oil inventories in developed nations have slid to the lowest since July 2015. OPEC upped the implementation of promised cuts in November to 115 percent, the highest rate since the agreement began, according to the IEA.

"Post-OPEC, you can't be short," Chris Kettenmann, chief energy strategist at Macro Risk Advisors LLC, said by telephone. "OPEC restored a tremendous amount of credibility."

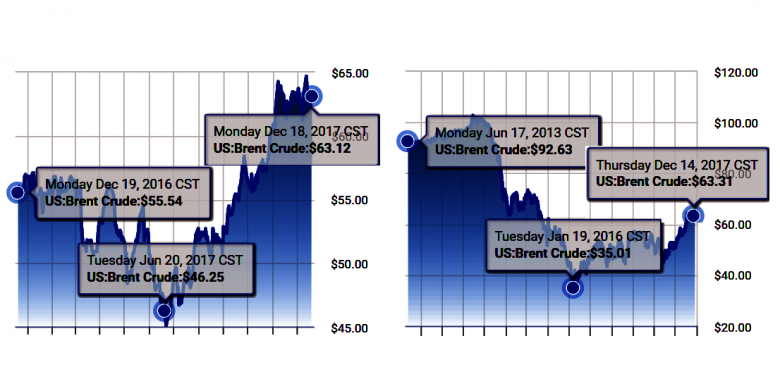

Brent is up about 40 percent since hitting bottom in late June, while WTI has gained about 35 percent.

Bullish Record

The Brent net-long position -- the difference between bets on a price increase and wagers on a drop -- rose 1.8 percent to a record 544,051 contracts, according to data from ICE Futures Europe. Longs increased for a third week, also hitting an all-time high, while shorts slid by 2.2 percent.

Money managers cut their WTI net-long position by 0.4 percent to 390,874 futures and options in the week ended Dec. 12, according to data from the U.S. Commodity Futures Trading Commission on Friday. Longs edged lower by 0.9 percent and shorts fell by 5.1 percent.

During the report week, money managers were also slightly more bullish on Brent than WTI due to the outage on the Ineos Group Ltd.-operated Forties Pipeline System in the North Sea that sent prices surging to two-year highs, according to Rob Haworth, who helps oversee $150 billion in assets at U.S. Bank Wealth Management in Seattle.

'Solid Fundamentals'

The net-short position of swap dealers, an indication of hedging, increased for a ninth week to a fresh record, according to the CFTC data.

In the fuel market, money managers reduced their net-long position on benchmark U.S. gasoline by 9.9 percent. Meanwhile, the net-bullish position on diesel rose by 4.1 percent.

Kuwait's new oil minister, Bakheet Al-Rashidi, said global crude demand will increase at a "healthy" pace next year. JPMorgan Chase & Co. boosted its oil forecasts for 2018, saying prices have remained "broadly stable, reflecting solid fundamentals and tightening balances." Meanwhile, oil options trading shows increasing bets on Brent at $80 a barrel from the middle of next year.

Front-month Brent contracts are trading at a premium to later-dated ones, a market structure known as backwardation that signals strong demand and tighter supply. Brent futures for December 2018 were $2.61 higher than the December 2019 contracts on Friday. Most of the WTI curve is also in backwardation.

Money managers are "certainly very positive," Haworth said. "They continue to really believe in demand growth and OPEC's conviction to take control of this market and drive prices higher."

-----

Earlier:

2017, December, 15, 13:20:00

OIL PRICE: BELOW $64REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.28 a barrel at 0757 GMT, up 26 cents, or 0.5 percent, from their last settlement. Brent crude futures, the international benchmark for oil prices, were at $63.47 a barrel, up 16 cents, or 0.25 percent, from their previous close. |

2017, December, 15, 13:15:00

AFRICA NEEDS GOOD PRICEBLOOMBERG - The region’s median government debt level will probably exceed 50 percent of gross domestic product this year from 34 percent in 2013, while the cost of servicing the liabilities will average almost 10 percent compared with half that four years ago, the International Monetary Fund said.

|

2017, December, 15, 12:50:00

LUKOIL'S PLAN: $50LUKOIL - The plan is based on the conservative $50 per barrel oil price scenario. Sustainable hydrocarbon production growth is planned in the Upstream business segment along with the growth in the share of high-margin projects in the overall production. In the Downstream business segment, the focus is on the improvement of operating efficiency and selective investment projects targeted at the enhancement of product slate. |

2017, December, 13, 12:30:00

OIL PRICE - 2018: $57EIA - North Sea Brent crude oil spot prices averaged $63 per barrel (b) in November, an increase of $5/b from the average in October. EIA forecasts Brent spot prices to average $57/b in 2018, up from an average of $54/b in 2017.

|

2017, December, 6, 12:05:00

GAS PRICES DOWN TO $2.933PLATTS - Colder weather outlooks for major heating regions support the upside, while the recent and impending lackluster pace of storage erosion is keeping downward pressure on the market. At 6:50 am ET (1150 GMT) the contract was 5.2 cents lower at $2.933/MMBtu.

|

2017, December, 4, 23:15:00

СОТРУДНИЧЕСТВО С ОПЕКМИНЭНЕРГО РОССИИ - ОПЕК оставляет в силе решения, принятые 30 ноября 2017 года; в «Декларацию о сотрудничестве» вносится поправка, согласно которой ее срок действия охватывает весь 2018 год с января по декабрь 2018 года, при этом входящие и участвующие в кооперации не входящие в ОПЕК страны обязуются обеспечить полное и своевременное исполнение условий «Декларации о сотрудничестве» и скорректировать объемы добычи в соответствии с достигнутыми на добровольной основе договоренностями.

|

2017, December, 2, 18:54:00

OPEC CONFIRMEDOPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets. |