ЦЕНА НЕФТИ: ВЫШЕ $49

РЕЙТЕР , BLOOMBERG - Рубль торгуется в минусе на фоне свежих 3-недельных нефтяных минимумов, достигнутых из-за опасений расширения добычи странами, не подписавшими пакт ОПЕК+ и его 9-месячное продление, которого может не хватить для баланса мирового спроса и предложения.

В фокусе внимания локального валютного рынка также трудовая статистика США, выходящая в 15.30 МСК, и новостная лента с Петербургского экономического форума.

К 13.00 МСК котировки пары доллар/рубль расчетами "завтра" были вблизи 56,80, и рубль дешевеет на 0,7 процента от уровней предыдущего биржевого закрытия.

С начала дня был сформирован торговый диапазон 56,54-56,86, объем биржевых сделок в этой валютной паре - $1,3 миллиарда.

Пара евро/рубль расчетами "завтра" находилась к 13.00 МСК у отметки 63,72 рубля, и здесь рубль дешевеет на 0,8 процента.

"Растем (по валюте) без объемов и идей, непонятно, что будет дальше с нефтью и где выйдут с продажей валюты экспортеры, у которых, по ощущению, валюта "жжет" карман, и просто они дожидаются выгодных уровней", - сказал дилер крупного российского банка.

По его мнению, вынос доллара выше отметки 57 рублей спровоцирует сильная трудовая статистика США и ответный рост валюты США на форексе. "Однако там может появиться и большой экспортный "офер", - предупредил дилер.

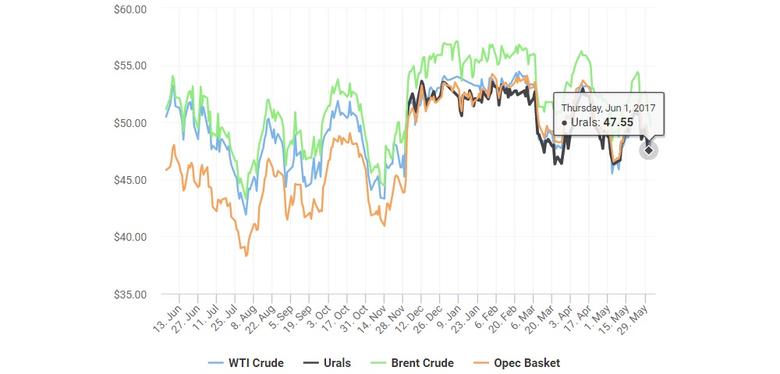

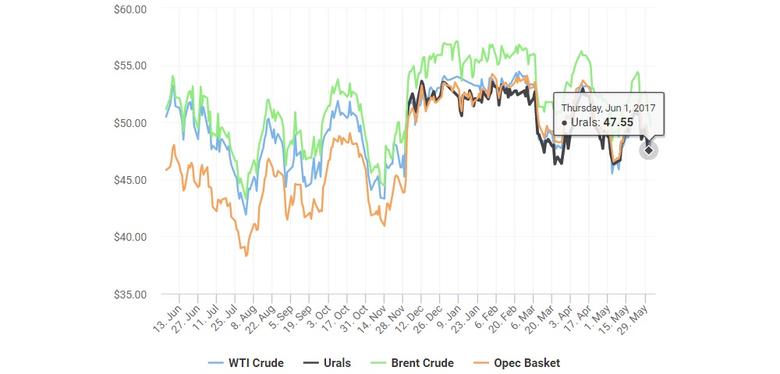

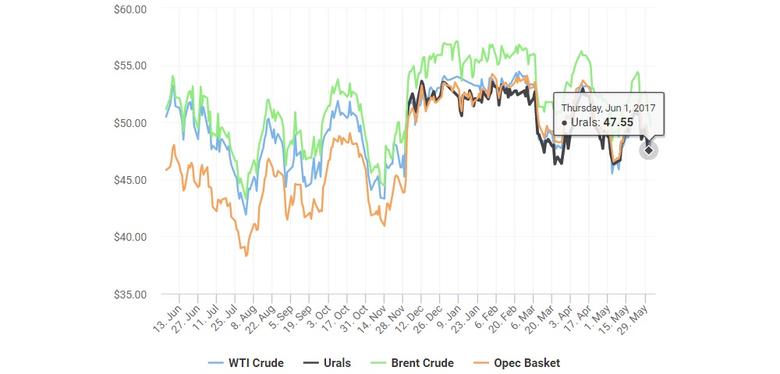

Нефть марки Brent теряет в цене с начала дня почти три процента, и баррель оценивается в $49,12. Ранее была достигнута отметка $49 впервые с 10 мая. Американский сорт WTI отметился сегодня также на минимальном с 10 мая значении $46,83 за баррель, текущие котировки вблизи 47,93 (-3 процента).

Цены на нефть снижаются после решения Дональда Трампа выйти из Парижского климатического пакта, которое может спровоцировать рост буровой активности в США и, как следствие, усугубить избыток предложения на мировом рынке.

Одновременно на рынке остаются опасения, что одной лишь пролонгации пакта ОПЕК+ до конца марта 2018 года может оказаться недостаточно для противостояния растущей добыче в странах, не подписавших это соглашение, во главе с США.

"Закрепление нефти ниже $50 за баррель Brent на долгий период сильно поубавит интерес к рублю и российским активам на фоне перегретости рынка. Как и ранее, мы ожидаем снижение курса рубля до 59-60 за доллар в летние месяцы", - говорится в аналитическом обзоре банка Санкт-Петербург.

По мнению аналитиков банка, рубль остается переоцененным относительно нефтяных котировок.

При этом одной из важных причин отклонения рубля они называют приток капитала нерезидентов в рамках операций carry trade и высокий спрос нерезидентов на рублевый долг, "доходности которого остаются привлекательными на фоне ожиданий по снижению ключевой ставки Банком России в условиях адаптации экономики к низким ценам на нефть и достижению таргета по инфляции".

На форексе пара евро/доллар торгуется вблизи $1,1222 и валюта США теряет здесь 0,1 процента после четвертьпроцентного укрепления накануне.

Инвесторы ждут официальной трудовой статистики США за май. Экономисты, опрошенные Рейтер, прогнозируют, что число рабочих мест в США в мае выросло на 185.000, а уровень безработицы снизился до 4,4 процента.

Данные выше прогнозов могут возродить ожидания о продолжении ужесточения политики ФРС в течение года, при том что большинство участников рынка уверено в повышении ставки до 1,00-1,25 процента годовых по итогам заседания Федрезерва 13-14 июня. От российского Центробанка аналитики ждут снижения ставки на совете директоров 16 июня до 9,00 процентов.

-----

Раньше:

MARGINAL OIL: NOT ENOUGH

OIL COULD BE $50

ЦЕНА НЕФТИ: ВЫШЕ $50

ЭНЕРГОДИАЛОГ РОССИЯ - ОПЕК

ЦЕНА НЕФТИ: ОПЯТЬ ВЫШЕ $51

OPEC & NON-OPEC AGREEMENT

ЦЕНА НЕФТИ: СНОВА ВЫШЕ $54

OIL PRICE: ABOVE $49

REUTERS, BLOOMBERG - Brent crude tumbled below $50 on Friday, heading for a second straight week of losses, on worries that U.S. President Donald Trump's decision to abandon a climate pact could spark more crude drilling in the United States, worsening a global glut.

Benchmark Brent crude futures LCOc1 were off by nearly 3 percent at $49.14 per barrel at 1034 GMT (6:34 a.m. ET), down $1.49 from the previous close.

U.S. West Texas Intermediate crude CLc1 futures fell $1.45 cents to $46.91 per barrel.

Both contracts were on track for weekly losses of more than 5 percent.

The U.S. withdrawal from the landmark 2015 global agreement to fight climate change drew condemnation from Washington's allies - and sparked fears that U.S. oil production could expand even more rapidly.

"I think we will see a United States that is about to go crazy in terms of producing fossil fuels," said Matt Stanley, a fuel broker at Freight Services International in Dubai, adding other producers could do the same. "Why wouldn't they ramp up production when producers like the U.S. have an open invite to do as they please?"

U.S. crude production last week was up by nearly 500,000 barrels per day (bpd) from year-earlier levels, straining OPEC's efforts to reduce global oversupply.

A week ago, the Organization of the Petroleum Exporting Countries and a number of non-OPEC producers met in Vienna to extend a deal to cut 1.8 million bpd from the market until March 2018.

On Friday, Igor Sechin, chief of Russia's largest oil producer, Rosneft, said U.S. oil producers could add up to 1.5 million bpd to world oil output next year.

Oil prices are down some 10 percent since OPEC's May 25 decision to extend the cuts.

Rising output from OPEC members Nigeria and Libya, which are exempt from the output reduction deal, is also undercutting attempts to limit production.

OPEC last week discussed reducing output by a further 1 to 1.5 percent, and could revisit the proposal should inventories remain high, sources told Reuters.

On Friday, demand for bearish puts expiring in March 2018 spiked, indicating traders and investors are already protecting against a more aggressive drop in price once OPEC's joint supply deal expires.

Still, oil markets received some support from official U.S. data which showed crude inventories fell sharply last week as refining and exports surged to record highs.

Crude stockpiles were down by 6.4 million barrels in the week to May 26, compared with analysts' expectations for a fall of 2.5 million barrels.

-----

Earlier:

MARGINAL OIL: NOT ENOUGH

OIL COULD BE $50

OIL PRICE: ABOVE $50

OIL PRICE: ABOVE $51 ANEW

OPEC & NON-OPEC AGREEMENT

OIL PRODUCTION & PRICES

OIL PRICE: ABOVE $54 ANEW

Tags:

РОСНЕФТЬ,

НЕФТЬ,

ЦЕНА,

ROSNEFT,

OIL,

PRICE